ADT 2006 Annual Report Download - page 187

Download and view the complete annual report

Please find page 187 of the 2006 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

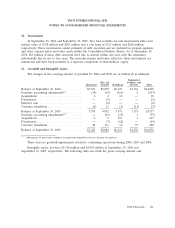

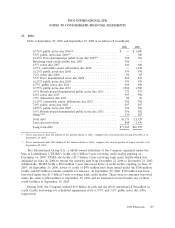

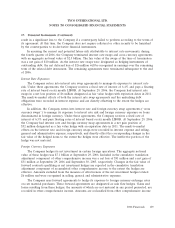

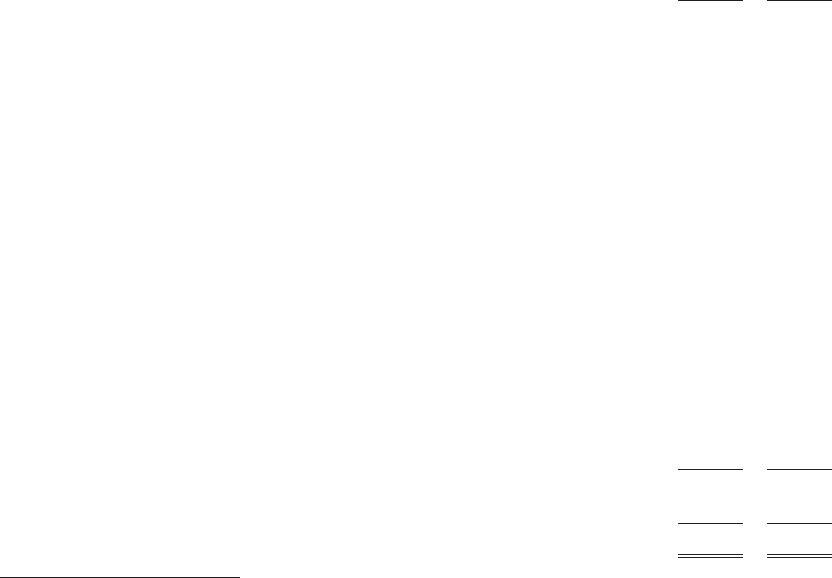

15. Debt

Debt at September 29, 2006 and September 30, 2005 is as follows ($ in millions):

2006 2005

6.375% public notes due 2006(2) ........................ $ — $ 1,000

5.8% public notes due 2006(2) .......................... — 700

6.125% Euro denominated public notes due 2007(1) .......... 762 721

Revolving bank credit facility due 2007 ................... 700 —

6.5% notes due 2007 ................................ 100 100

2.75% convertible senior debentures due 2018 .............. — 1,242

6.125% public notes due 2008 .......................... 399 399

7.2% notes due 2008 ................................ 86 85

5.5% Euro denominated notes due 2008 .................. 869 823

6.125% public notes due 2009 .......................... 399 399

6.75% public notes due 2011 ........................... 999 999

6.375% public notes due 2011 .......................... 1,500 1,500

6.5% British pound denominated public notes due 2011 ....... 373 353

6.0% notes due 2013 ................................ 997 996

7.0% debentures due 2013 ............................ 86 86

3.125% convertible senior debentures due 2023 ............. 750 750

7.0% public notes due 2028 ........................... 497 497

6.875% public notes due 2029 .......................... 790 790

6.5% British pound denominated public notes due 2031 ....... 536 502

Other(1)(2) ......................................... 330 587

Total debt ........................................ 10,173 12,529

Less current portion ................................. 808 1,930

Long-term debt .................................... $ 9,365 $10,599

(1) These instruments, plus $46 million of the amount shown as other, comprise the current portion of long-term debt as of

September 29, 2006.

(2) These instruments, plus $230 million of the amount shown as other, comprise the current portion of long-term debt as of

September 29, 2005.

Tyco International Group S.A., a wholly-owned subsidiary of the Company organized under the

laws of Luxembourg (‘‘TIGSA’’), holds a $1.0 billion 5-year revolving credit facility expiring on

December 16, 2009. TIGSA also holds a $1.5 billion 3-year revolving bank credit facility which was

amended on June 28, 2006 to extend the maturity date from December 22, 2006 to December 21, 2007.

Additionally, TIGSA holds a $500 million 3-year unsecured letter of credit facility expiring on June 15,

2007. At September 29, 2006, letters of credit of $475 million have been issued under the $500 million

facility and $25 million remains available for issuance. At September 29, 2006, $700 million has been

borrowed under the $1.5 billion 3-year revolving bank credit facility. There were no amounts borrowed

under the other credit facilities at September 29, 2006 and no amounts borrowed under any of these

credit facilities at September 30, 2005.

During 2006, the Company utilized $1.0 billion in cash and the above mentioned $700 million in

credit facility borrowings for scheduled repayments of its 6.375% and 5.8% public notes due 2006,

respectively.

2006 Financials 125