ADT 2006 Annual Report Download - page 128

Download and view the complete annual report

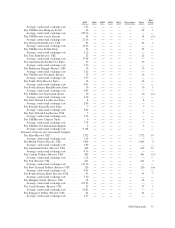

Please find page 128 of the 2006 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.contamination at waste disposal sites and manufacturing facilities, and unidentified tax liabilities and

legal fees related to periods prior to disposition. The Company does not have the ability to estimate

the potential liability from such indemnities because they relate to unknown conditions. However, the

Company has no reason to believe that these uncertainties would have a material adverse effect on the

Company’s financial position, results of operations or cash flows.

The Company has recorded liabilities for known indemnifications included as part of

environmental liabilities. See Item I. Business—Environmental Matters for a discussion of these

liabilities.

The Company had an off-balance sheet leasing arrangement for five cable laying sea vessels. Upon

expiration of this lease in October 2006, a subsidiary of the Company has the option to buy these

vessels for approximately $280 million, or return the vessels to the lessor and, under a residual

guarantee, pay any shortfall in sales proceeds to the lessor from a third party in an amount not to

exceed $235 million. As of September 29, 2006, the Company expected this obligation to be

$54 million, which is recorded in the accompanying Consolidated Balance Sheets, based on an estimate

of the fair value of the vessels performed by management with the assistance of a third-party valuation.

In October 2006, the Company exercised its option to buy these vessels for $280 million. See Note 28

to the Consolidated Financial Statements.

In the normal course of business, the Company is liable for contract completion and product

performance. In the opinion of management, such obligations will not significantly affect the

Company’s financial position, results of operations or cash flows.

The Company records estimated product warranty costs at the time of sale. For further

information on estimated product warranty, see Notes 1 and 16 to the Consolidated Financial

Statements.

In 2001, Engineered Products and Services initiated a Voluntary Replacement Program (‘‘VRP’’)

associated with the acquisition of Central Sprinkler. The VRP relates to the replacement of certain

Model GB fire sprinkler heads which were originally manufactured by Central Sprinkler prior to Tyco’s

acquisition. Under this program, the sprinkler heads are being replaced over a 5-7 year period free of

charge to property owners. In the third quarter of 2006, the Company completed a comprehensive

review of reported claims, recent claim rates and cost trends and further assessed the future of the

program. The Company determined that an additional liability was necessary in order to satisfy the

Company’s obligation under the VRP. As a result, the Company recorded a $100 million charge which

was reflected in cost of sales. Settlements during 2006 include cash expenditures of $37 million related

to the VRP.

66 2006 Financials