ADT 2006 Annual Report Download - page 198

Download and view the complete annual report

Please find page 198 of the 2006 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

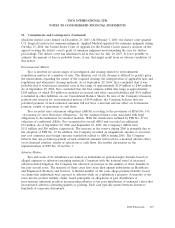

18. Commitments and Contingencies (Continued)

Tyco’s involvement in asbestos cases has been limited because its subsidiaries did not mine or

produce asbestos. Furthermore, in the Company’s experience, a large percentage of these claims were

never substantiated and have been dismissed by the courts. The Company will continue to vigorously

defend these lawsuits and the Company has not suffered an adverse verdict in a trial court proceeding

related to asbestos claims. When appropriate, the Company settles claims; however, the total amount

paid in any year to settle and defend all asbestos claims has been immaterial. As of September 29,

2006, there were approximately 15,500 asbestos liability cases pending against the Company and its

subsidiaries.

The Company estimates its pending asbestos claims and claims that were incurred but not

reported, as well as related insurance and indemnification recoveries. The Company’s estimate of the

liability for pending and future claims is based on claim experience over the past five years and covers

claims expected to be filed over the next seven years. The Company believes that it has adequate

amounts recorded related to these matters. While it is not possible at this time to determine with

certainty the ultimate outcome of these asbestos-related proceedings, the Company believes that the

final outcome of all known and anticipated future claims, after taking into account its substantial

indemnification rights and insurance coverage, will not have a material adverse effect on the Company’s

financial position, results of operations or cash flows.

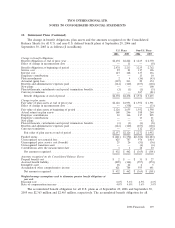

Income Taxes

The Company and its subsidiaries’ income tax returns are periodically examined by various tax

authorities. In connection with such examinations, tax authorities, including the United States Internal

Revenue Service (‘‘IRS’’), have raised issues and proposed tax adjustments. The Company is reviewing

and contesting certain of the proposed tax adjustments. Amounts related to these tax adjustments and

other tax contingencies that management has assessed as probable and estimable have been recorded.

While the timing and ultimate resolution of these matters is uncertain, the Company anticipates that

certain of these matters could be resolved during 2007.

The IRS continues to audit the years 1997 to 2000. In 2004 the Company submitted to the IRS

proposed adjustments to these prior period U.S. federal income tax returns, resulting in a reduction in

the taxable income previously reported. During 2006, the IRS accepted substantially all of the proposed

adjustments. These adjustments did not have a material impact on the financial condition, results of

operations or cash flows of the Company.

During 2006, the Company has developed amendments to U.S. federal income tax returns for

additional periods. On the basis of previously accepted amendments, the Company has determined that

acceptance of these adjustments is probable and accordingly has recorded them in the Consolidated

Financial Statements. Such adjustments did not have a material impact on the Company’s financial

condition, results of operations or cash flows.

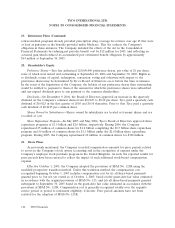

Compliance Matters

Tyco has received and responded to various allegations that certain improper payments were made

by Tyco subsidiaries in recent years. During 2005, Tyco reported to the U.S. Department of Justice

(‘‘DOJ’’) and the SEC the investigative steps and remedial measures that it has taken in response to

the allegations. Tyco also informed the DOJ and the SEC that it has retained outside counsel to

perform a company-wide baseline review of its policies, controls and practices with respect to

compliance with the Foreign Corrupt Practices Act, that it would continue to make periodic progress

136 2006 Financials