ADT 2006 Annual Report Download - page 219

Download and view the complete annual report

Please find page 219 of the 2006 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

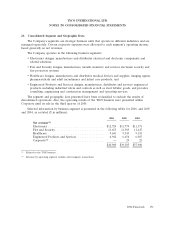

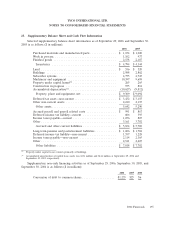

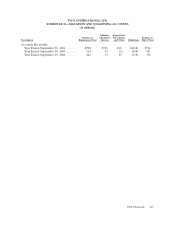

26. Summarized Quarterly Financial Data (Unaudited) (Continued)

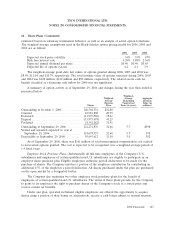

2005

1st Qtr.(1) 2nd Qtr.(2) 3rd Qtr.(3) 4th Qtr.(4)

Amounts Amounts Amounts Amounts

Previously As Previously As Previously As Previously As

Reported Restated Reported Restated Reported Restated Reported Restated

Net revenue .................. $9,497 $9,497 $9,876 $9,876 $9,997 $9,997 $9,935 $9,935

Gross profit .................. 3,350 3,350 3,477 3,477 3,527 3,527 3,380 3,380

Income from continuing operations . 721 713 393 391 1,076 1,074 867 866

(Loss) income from discontinued

operations, net of income taxes . . (12) (12) (201) (201) 117 117 50 50

Cumulative effect of accounting

change, net of income taxes ..... 21 21——————

Net income .................. 730 722 192 190 1,193 1,191 917 916

Basic earnings per share:

Income from continuing

operations ................ $ 0.36 $ 0.36 $ 0.20 $ 0.19 $ 0.53 $ 0.53 $ 0.43 $ 0.43

(Loss) income from discontinued

operations, net of income taxes (0.01) (0.01) (0.10) (0.10) 0.06 0.06 0.02 0.02

Cumulative effect of accounting

change, net of income taxes . . . 0.01 0.01 ——————

Net income ................ 0.36 0.36 0.10 0.09 0.59 0.59 0.45 0.45

Diluted earnings per share:

Income from continuing

operations ................ 0.34 0.33 0.19 0.19 0.51 0.51 0.41 0.41

(Loss) income from discontinued

operations, net of income taxes (0.01) — (0.09) (0.09) 0.05 0.05 0.03 0.03

Cumulative effect of accounting

change, net of income taxes . . . 0.01 0.01 ——————

Net income ................ 0.34 0.34 0.10 0.10 0.56 0.56 0.44 0.44

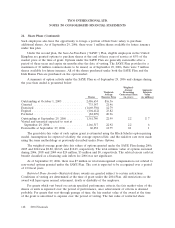

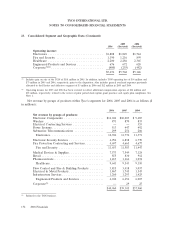

(1) Net revenue excludes $568 million of revenue related to discontinued operations. Income from continuing operations

includes divestiture-related charges of $18 million, including $3 million in cost of sales, net restructuring charges of $6

million, a loss of $156 million related to the retirement of debt and a charge of $4 million related to the write-down of an

investment.

(2) Net revenue excludes $580 million of revenue related to discontinued operations. Income from continuing operations

includes losses and impairments on divestitures of $2 million, net restructuring and other charges of $5 million, of which

$1 million is included in cost of sales, a $50 million charge related to an SEC enforcement action, and a loss of $573 million

related to the retirement of debt.

(3) Net revenue excludes $565 million of revenue related to discontinued operations. Income from continuing operations

includes a net restructuring credit of $3 million, charges for the impairment of long-lived assets of $3 million, net gain on the

sale of TGN of $307 million along with $6 million of divestiture-related charges, and a loss of $179 million related to the

retirement of debt.

(4) Net revenue excludes $560 million of revenue related to discontinued operations. Income from continuing operations

includes divestiture-related charges of $10 million, net restructuring and asset impairment charges of $1 million, a

$277 million charge related to a patent dispute in the Healthcare segment, a $70 million charge related to certain former

executives’ employment, a loss of $105 million related to the retirement of debt and a $109 million court-ordered restitution

award.

2006 Financials 157