ADT 2006 Annual Report Download - page 174

Download and view the complete annual report

Please find page 174 of the 2006 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

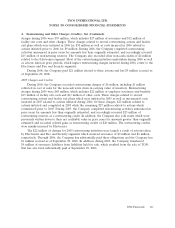

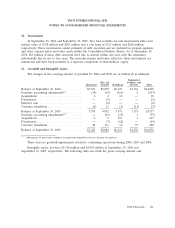

4. Restructuring and Other Charges (Credits), Net (Continued)

2004 Charges and Credits

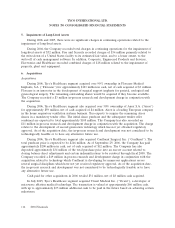

Activity in the Company’s 2004 restructuring reserves is summarized as follows ($ in millions):

Employee Facilities

Severance and Exit Non-cash

Benefits Costs Other Charges Total

Charges ........................... $196 $ 60 $ 22 $ 6 $ 284

Utilization ......................... (88) (15) (19) (6) (128)

Credits ............................ (8) — — — (8)

Currency translation .................. 1 1 — — 2

Balance at September 30, 2004 .......... 101 46 3 — 150

Charges ........................... 6 7 6 — 19

Utilization ......................... (77) (21) (7) — (105)

Credits ............................ (13) — — — (13)

Currency translation .................. 1 — — — 1

Balance at September 30, 2005 .......... 18 32 2 — 52

Charges ........................... — 1 — 1

Utilization ......................... (11) (7) (1) — (19)

Credits ............................ (3) (1) — — (4)

Reclass/transfers ..................... — (1) (1) — (2)

Balance at September 29, 2006 .......... $ 4 $24 $— $— $ 28

During 2004, the Company approved and announced to employees various plans to exit 181

facilities primarily in the United States. These plans included the termination of approximately 8,616

employees resulting in restructuring charges totaling $284 million, including $6 million reflected in cost

of sales for the non-cash write-down in carrying value of inventory, $196 million for employee

severance and benefits, $60 million for facility exit costs and $22 million for other related cost. Through

September 29, 2006, a total of $176 million, $43 million and $27 million related to employee severance

and benefits, facilities exit costs and other, respectively, had been expended related to these plans.

Through September 29, 2006, the Company completed certain activities related to these plans for

amounts less than originally estimated, and accordingly the Company reversed $25 million of

restructuring reserves as a restructuring credit.

During 2004, the Company also sold certain cable-laying sea vessels and other assets that were

written down to their expected net realizable value in prior years for amounts greater than originally

estimated and recorded related gains as restructuring credits of $40 million. During 2004, the Company

also completed certain restructuring activities announced in prior years for amounts less than originally

estimated, and accordingly the Company reversed $34 million of restructuring reserves as a

restructuring credit.

Restructuring and other charges (credits), net recorded by each segment were as follows:

During 2004, Fire and Security recorded restructuring charges of $184 million related to 2004

restructuring plans, including $4 million reflected in cost of sales for the non-cash write down in

carrying value of inventory. Additionally, Fire and Security completed certain restructuring activities

announced in prior years for amounts less than originally estimated, and accordingly reversed

$9 million of restructuring reserves as a restructuring credit.

During 2004, Electronics recorded restructuring charges of $15 million related to 2004

restructuring plans, including $1 million reflected in cost of sales for the non-cash write-down in

112 2006 Financials