ADT 2006 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2006 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

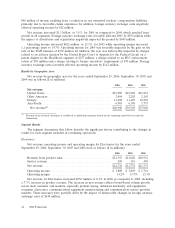

impact related to foreign currency exchange rates. Additionally, operating income for 2006 included a

gain on divestiture of $48 million, primarily relating to a sale of a business within Medical Devices and

Supplies.

Net revenue for Healthcare increased $433 million or 4.8% in 2005 as compared to 2004. This

increase resulted primarily from growth in existing businesses and, to a lesser extent, favorable changes

in foreign currency exchange rates of $141 million. Growth in Healthcare’s underlying businesses was

principally driven by increased revenue within Medical Devices & Supplies which was largely the result

of increased sales volume in the International division, primarily in Europe, due to a sales force

investment and sales growth in vessel sealing, laparoscopy, and stapling. Increased sales at the Surgical

division within Medical Devices & Supplies also strongly contributed, due to enhanced contracting with

group purchasing organizations, increased acceptance of Laparoscopic Gastric By-Pass procedures and

increased adoption of LigaSure device. Pharmaceuticals also contributed to the increase in revenue,

although to a lesser extent. These increases were partially offset by decreased sales in Retail primarily

due to a difficult competitive environment and customer consolidations.

The decreases in operating income and operating margin in 2005 as compared to 2004 were due

primarily to a $277 million charge recorded in the fourth quarter of 2005, associated with the adverse

decision by the United States Court of Appeals for the Federal Circuit on a previously disclosed legal

matter. (Refer to Note 18 to the Consolidated Financial Statements for further discussion.) This

charge, combined with declines in the Retail division as a result of the competitive environment

mentioned above as well as increased material and transportation costs, was offset by substantial

increases from other divisions, specifically the International and Surgical divisions within Medical

Devices & Supplies as well as within Pharmaceutical. Increases in these divisions were due to strong

sales growth as mentioned above, combined with a favorable product mix. Also positively impacting the

segment were reduced administrative expenses at the segment level, as well as favorable foreign

exchange rates of $41 million.

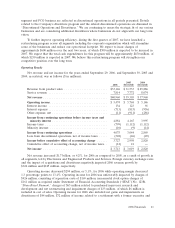

Engineered Products and Services

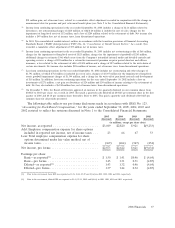

Net revenue, operating income and operating margin for Engineered Products and Services for the

years ended September 29, 2006, September 30, 2005 and 2004 were as follows ($ in millions):

2006 2005 2004

Revenue from product sales ............................. $5,625 $5,137 $4,582

Service revenue ...................................... 1,317 1,319 1,425

Net revenue ........................................ $6,942 $6,456 $6,007

Operating income .................................... $ 676 $ 672 $ 620

Operating margin ..................................... 9.7% 10.4% 10.3%

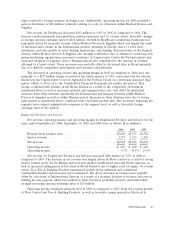

Net revenue for Engineered Products and Services increased $486 million or 7.5% in 2006 as

compared to 2005. The increase in net revenue was largely driven by Flow Control as a result of strong

project volume in the Pacific Region and favorable market conditions in Asia and North America, as

well as increased selling prices in Electrical & Metal Products due to higher costs of copper. To a lesser

extent, Tyco Fire & Building Products experienced growth in the industrial and commercial

construction markets and increased price realization. The above increases in revenue were partially

offset by a decrease at Infrastructure Services as a result of a strategic decision to be more selective in

bidding for new projects, which has resulted in fewer but more profitable projects, and unfavorable

changes in foreign currency exchange rates of $25 million.

Operating income remained relatively level in 2006 as compared to 2005. Both the revenue growth

at Flow Control and Fire & Building Products, as well as favorable copper spreads in Electrical &

2006 Financials 47