ADT 2006 Annual Report Download - page 192

Download and view the complete annual report

Please find page 192 of the 2006 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

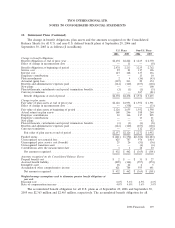

17. Financial Instruments (Continued)

to earnings and recorded as an adjustment to cost of sales when the underlying transaction impacts

earnings.

Tyco uses various options, swaps, and forwards not designated as hedging instruments, to manage

foreign currency exposures on accounts and notes receivable, accounts payable, intercompany loans and

forecasted transactions denominated in certain foreign currencies. For derivatives not designated as

hedging instruments, the Company records changes in fair value through earnings in the period of

change. The fair value of these instruments totaled $23 million at September 29, 2006.

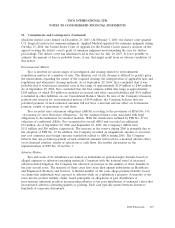

18. Commitments and Contingencies

The Company has facility, vehicle and equipment leases that expire at various dates through the

year 2052. Rental expense under these leases was $717 million, $764 million, and $764 million for 2006,

2005 and 2004, respectively. The Company also has facility and equipment commitments under capital

leases.

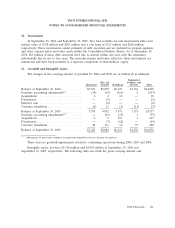

Following is a schedule of minimum lease payments for non-cancelable leases as of September 29,

2006 (in millions):

Operating Capital

Leases Leases(1)

2007 .................................................. $ 516 $ 26

2008 .................................................. 405 27

2009 .................................................. 302 22

2010 .................................................. 214 9

2011 .................................................. 158 7

Thereafter .............................................. 499 76

Total minimum lease payments .............................. $2,094 $167

(1) Excludes the impact of interest.

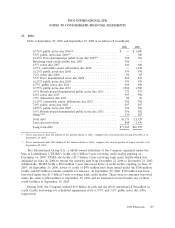

The Company also has purchase obligations related to commitments to purchase certain goods and

services. At September 29, 2006, such obligations were as follows: $222 million in 2007, $24 million in

2008, $10 million in 2009, $10 million in 2010, $7 million in 2011, and an aggregate of $24 million in

2012 and thereafter.

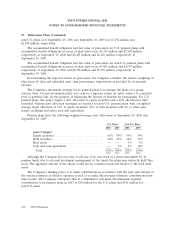

At September 29, 2006, the Company had an off-balance sheet leasing arrangement for five cable

laying sea vessels. Upon expiration of this lease in October 2006, a subsidiary of the Company has the

option to buy these vessels for approximately $280 million, or return the vessels to the lessor and,

under a residual guarantee, pay any shortfall in sales proceeds to the lessor from a third party in an

amount not to exceed $235 million. As of September 29, 2006, the Company expected this obligation to

be $54 million, which is recorded in the accompanying Consolidated Balance Sheets, based on an

estimate of the fair value of the vessels performed by management with the assistance of a third-party

valuation. During 2006, 2005 and 2004, the Company incurred expenses of $14 million in each year

related to this expected obligation. See Note 28—Subsequent Events.

At September 29, 2006, the Company had a contingent purchase price liability of $80 million

related to the 2001 acquisition of Com-Net by Electronics. This represents the maximum amount

payable to the former shareholders of Com-Net only after the construction and installation of a

130 2006 Financials