ADT 2006 Annual Report Download - page 209

Download and view the complete annual report

Please find page 209 of the 2006 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

21. Share Plans (Continued)

estimated based on voluntary termination behavior, as well as an analysis of actual option forfeitures.

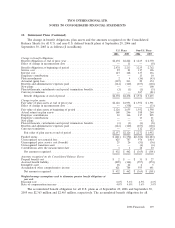

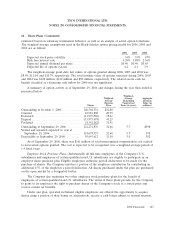

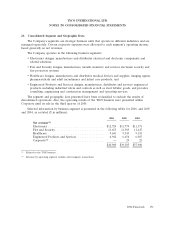

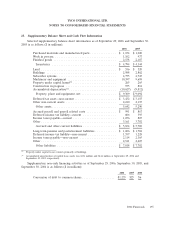

The weighted-average assumptions used in the Black-Scholes option pricing model for 2006, 2005 and

2004 are as follows:

2006 2005 2004

Expected stock price volatility .............................. 34% 35% 47%

Risk free interest rate .................................... 4.28% 3.88% 2.56%

Expected annual dividend per share .......................... $0.40 $0.40 $0.05

Expected life of options (years) ............................. 4.2 4.1 3.9

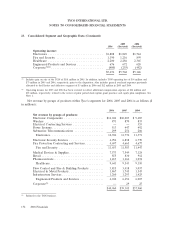

The weighted-average grant-date fair values of options granted during 2006, 2005 and 2004 was

$8.98, $11.04, and $10.79, respectively. The total intrinsic value of options exercised during 2006, 2005

and 2004 was $108 million, $142 million and $89 million, respectively. The related excess cash tax

benefit classified as a financing cash inflow for 2006 was not significant.

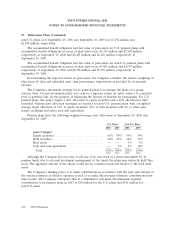

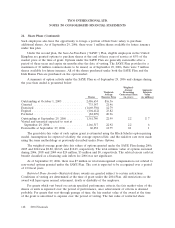

A summary of option activity as of September 29, 2006 and changes during the year then ended is

presented below:

Weighted-

Weighted- Average Aggregate

Average Remaining Intrinsic

Exercise Contractual Value (in

Shares Price Term (in years) millions)

Outstanding at October 1, 2005 ........... 140,502,534 $32.80

Granted ........................... 10,981,808 28.99

Exercised ........................... (11,993,526) 18.61

Expired ............................ (13,873,678) 43.23

Forfeited ........................... (4,342,262) 31.91

Outstanding at September 29, 2006 ........ 121,274,876 32.66 5.7 $398

Vested and unvested expected to vest at

September 29, 2006 .................. 119,678,337 32.68 5.7 398

Exercisable at September 29, 2006 ........ 95,643,612 33.10 5.0 382

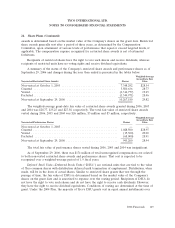

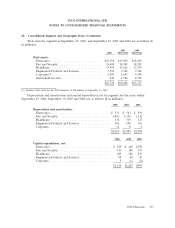

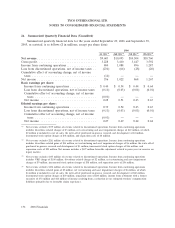

As of September 29, 2006, there was $161 million of total unrecognized compensation cost related

to non-vested options granted. The cost is expected to be recognized over a weighted-average period of

1.4 fiscal years.

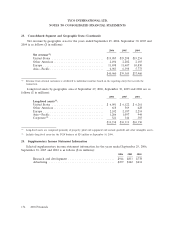

Employee Stock Purchase Plans—Substantially all full-time employees of the Company’s U.S.

subsidiaries and employees of certain qualified non-U.S. subsidiaries are eligible to participate in an

employee share purchase plan. Eligible employees authorize payroll deductions to be made for the

purchase of shares. The Company matches a portion of the employee contribution by contributing an

additional 15% of the employee’s payroll deduction. All shares purchased under the plan are purchased

on the open market by a designated broker.

The Company also maintains two other employee stock purchase plans for the benefit of

employees of certain qualified non-U.S. subsidiaries. The terms of these plans provide for the Company

to grant to its employees the right to purchase shares of the Company’s stock at a stated price and

receive certain tax benefits.

Under one plan, operated in Ireland, eligible employees are offered the opportunity to acquire

shares using a portion of their bonus or, alternatively, receive a cash bonus subject to normal taxation.

2006 Financials 147