ADT 2006 Annual Report Download - page 113

Download and view the complete annual report

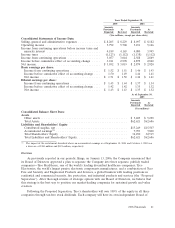

Please find page 113 of the 2006 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Discontinued Operations and Divestitures

Discontinued Operations

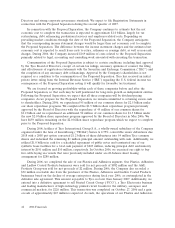

During 2006, the Company consummated the sale of the Plastics, Adhesives and Ludlow Coated

Products businesses as well as the A&E Product business for $975 million and $6 million in gross cash

proceeds, respectively. Working capital and other adjustments resulted in net proceeds of $882 million

for the sale of the Plastics, Adhesives and Ludlow Coated Products businesses. During 2006, the

Company also recorded a $30 million receivable due from the purchaser of the Plastics, Adhesives and

Ludlow Coated Products businesses based on the decline of average resin prices during fiscal year 2006,

as contemplated in the definitive sale agreement. This amount is payable to Tyco no later than

January 2007. Net cash proceeds received for the sale of the A&E Products business was $2 million,

which does not include working capital provisions which are expected to be settled prior to the end of

calendar year 2006. Both businesses met the held for sale and discontinued operations criteria and have

been included in discontinued operations in all periods presented.

During 2006, the Company recorded a $261 million and $26 million pre-tax loss on sale from

discontinued operations related to the Plastics, Adhesives and Ludlow Coated Products businesses and

A&E Products business, respectively, which include $275 million and $22 million, respectively, of

pre-tax impairment charges to write the businesses down to their fair values less costs to sell. Fair

values used for the respective impairment assessments were based on existing market conditions and

the terms and conditions included or expected to be included in the respective sale agreements.

During 2006, the Company approved a plan to divest the Printed Circuit Group (‘‘PCG’’) business,

a component of the Electronics segment, and also entered into a definitive sale agreement to sell PCG

for $226 million in cash. During 2006, the Company recorded a $4 million pre-tax loss on sale from

discontinued operations for PCG related to the divestiture of the PCG Spain business as well as certain

other costs to sell. The sale of PCG was completed in October 2006 and the Company expects to

record a gain on the sale of approximately $45 million. See Note 28 to the Consolidated Financial

Statements. The PCG business met the held for sale and discontinued operations criteria and has been

included in discontinued operations in all periods presented.

In 2005, Tyco announced its intent to explore the divesture of its Plastics, Adhesives and Ludlow

Coated Products businesses, as well as the A&E Products business, a global manufacturer of plastic

film, specialty tapes and adhesives, coated products and garment hangers. As a result of consideration

for potential sale and deteriorating operating results in the A&E Products business, the Company

performed an interim assessment of the recoverability of both goodwill and long-lived assets and

determined that the book value of certain long-lived assets in the A&E Products business was greater

than their estimated fair value and consequently recorded a long-lived asset impairment of $40 million

and goodwill impairment charge of $162 million. Fair value used for the impairment assessment was

based on probability-weighted expected future cash flow of the assets.

During 2005, the Company divested 8 businesses which were reported as discontinued operations

within Fire and Security, Engineered Products and Services and the Plastics and Adhesives business

segment. The Company reported losses on sale or additional impairments to write the carrying value of

such assets down to their estimated fair value less costs to sell of $60 million during 2005.

During 2004, the Company reported losses on the sale of discontinued operations of $132 million

to write the carrying value of such assets down to their fair value less cost to sell.

For the additional 8 businesses in 2005 and the divested businesses in 2004, fair value used for the

impairment assessment was primarily based on the terms and conditions included or expected to be

included in the sales agreements.

2006 Financials 51