ADT 2006 Annual Report Download - page 206

Download and view the complete annual report

Please find page 206 of the 2006 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

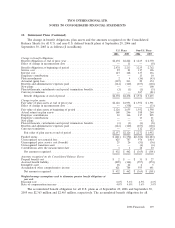

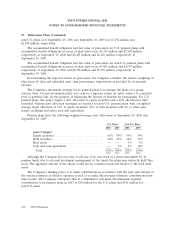

19. Retirement Plans (Continued)

retiree medical programs already provided prescription drug coverage for retirees over age 65 that were

at least as generous as the benefits provided under Medicare. This Act reduces the Company’s

obligation in these instances. The Company included the effects of the Act in the Consolidated

Financial Statements by reducing net periodic benefit cost by $12 million for 2005, and reflecting an

actuarial gain which reduced its accumulated post retirement benefit obligation by approximately

$64 million at September 30, 2005.

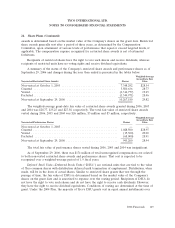

20. Shareholder’s Equity

Preference Shares—Tyco has authorized 125,000,000 preference shares, par value of $1 per share,

none of which were issued and outstanding at September 29, 2006 and September 30, 2005. Rights as

to dividends, return of capital, redemption, conversion, voting and otherwise with respect to the

preference shares may be determined by Tyco’s Board of Directors on or before the time of issuance.

In the event of the liquidation of the Company, the holders of any preference shares then outstanding

would be entitled to payment to them of the amount for which the preference shares were subscribed

and any unpaid dividends prior to any payment to the common shareholders.

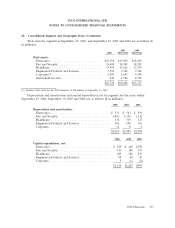

Dividends—On December 9, 2004, the Board of Directors approved an increase in the quarterly

dividend on the Company’s common shares from $0.0125 to $0.10 per share. Tyco paid a quarterly cash

dividend of $0.0125 in the first quarter of 2005 and $0.10 thereafter. Prior to that, Tyco paid a quarterly

cash dividend of $0.0125 per common share.

Shares Owned by Subsidiaries—Shares owned by subsidiaries are treated as treasury shares and are

recorded at cost.

Share Repurchase Program—In July 2005 and May 2006, Tyco’s Board of Directors approved share

repurchase programs of $1.5 billion and $2.0 billion, respectively. During 2006, the Company

repurchased 45 million of common shares for $1.2 billion completing the $1.5 billion share repurchase

program and 50 million of common shares for $1.3 billion under the $2.0 billion share repurchase

program. During 2005, the Company repurchased 10 million of common shares for $300 million.

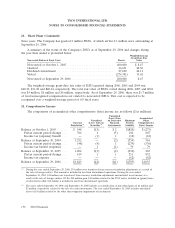

21. Share Plans

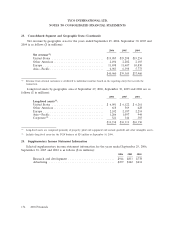

As previously mentioned, the Company recorded compensation amounts for prior periods related

to errors in the Company’s stock option accounting and in the recognition of expense under the

Company’s employee stock purchase program in the United Kingdom. As such, the reported results for

prior periods have been restated to reflect the impact of such additional stock-based compensation

expense.

Effective October 1, 2005, the Company adopted the provisions of SFAS No. 123R using the

modified prospective transition method. Under this transition method, the compensation cost

recognized beginning October 1, 2005 includes compensation cost for (i) all share-based payments

granted prior to, but not yet vested as of October 1, 2005, based on the grant-date fair value estimated

in accordance with the original provisions of SFAS No. 123, and (ii) all share-based payments granted

subsequent to September 30, 2005 based on the grant-date fair value estimated in accordance with the

provisions of SFAS No. 123R. Compensation cost is generally recognized ratably over the requisite

service period or period to retirement eligibility, if shorter. Prior period amounts have not been

restated for the adoption of SFAS No. 123R.

144 2006 Financials