ADT 2006 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2006 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

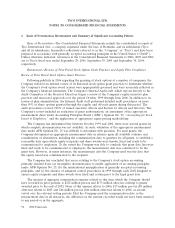

1. Basis of Presentation, Restatement and Summary of Significant Accounting Policies (Continued)

Goodwill and Intangible Assets—Goodwill and indefinite-lived intangible assets are assessed for

impairment annually and more frequently if a triggering event occurs. In making this assessment,

management relies on a number of factors including operating results, business plans, economic

projections, anticipated future cash flows, and transactions and market place data. There are inherent

uncertainties related to these factors and judgment in applying them to the analysis of goodwill

impairment. The Company performed its annual impairment test in the fourth quarter of 2006 and no

impairment occurred.

When testing for goodwill impairment, first, the Company performs a step I goodwill impairment

test to identify a potential impairment. In doing so, the Company compares the fair value of a

reporting unit with its carrying amount. If the carrying amount of a reporting unit exceeds its fair value,

goodwill is considered impaired and a step II goodwill impairment test is performed to measure the

amount of impairment loss. In the step II goodwill impairment test, the Company compares the implied

fair value of reporting unit goodwill with the carrying amount of that goodwill. If the carrying amount

of reporting unit goodwill exceeds the implied fair value of that goodwill, an impairment loss is

recognized in an amount equal to that excess. The implied fair value of goodwill is determined in the

same manner that the amount of goodwill recognized in a business combination is determined. The

Company allocates the fair value of a reporting unit to all of the assets and liabilities of that unit,

including intangible assets, as if the reporting unit had been acquired in a business combination. Any

excess of the value of a reporting unit over the amounts assigned to its assets and liabilities is the

implied fair value of goodwill.

Amortizable Intangible Assets, Net—Intangible assets primarily include contracts and related

customer relationships, and intellectual property. Certain contracts and related customer relationships

result from purchasing residential security monitoring contracts from an external network of

independent dealers who operate under the ADT dealer program. Acquired contracts and related

customer relationships are recorded at their contractually determined purchase price. The Company

incurs costs associated with maintaining and operating its ADT dealer program, including brand

advertising and due diligence, which are expensed as incurred.

During the first six months (twelve months in certain circumstances) after the purchase of the

customer contract, any cancellation of monitoring service, including those that result from customer

payment delinquencies, results in a chargeback by the Company to the dealer for the full amount of

the contract purchase price. The Company records the amount charged back to the dealer as a

reduction of the previously recorded intangible asset.

Intangible assets arising from the ADT dealer program described above are amortized in pools

determined by the month of contract acquisition on an accelerated basis over the period and pattern of

economic benefit that is expected to be obtained from the customer relationship. Based upon analyses

of the period and pattern of economic benefit associated with the intangibles, which utilize information

contained in attrition studies of the ADT dealer program customer base, conducted by a third party

appraiser, the Company believes that the accelerated method that presently best achieves the matching

objective above is the double-declining balance method based on a ten-year life for the first eight years

of the estimated life of the customer relationship, converting to the straight-line method of

amortization for the remaining four years of the estimated relationship period. Actual attrition data is

regularly reviewed in order to assess the continued appropriateness of the accelerated method of

amortization described above.

103

2006 Financials