ADT 2006 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2006 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

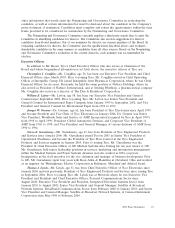

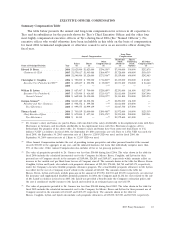

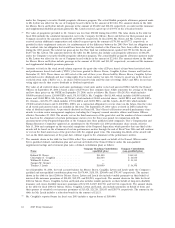

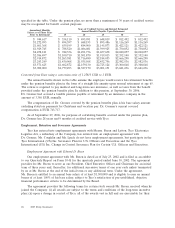

EXECUTIVE OFFICER COMPENSATION

Summary Compensation Table

The table below presents the annual and long-term compensation for services in all capacities to

Tyco and its subsidiaries for the periods shown for Tyco’s Chief Executive Officer and the other four

most highly compensated executive officers of Tyco during fiscal 2006 (the ‘‘Named Officers’’). No

executive officer who would otherwise have been includable in this table on the basis of compensation

for fiscal 2006 terminated employment or otherwise ceased to serve as an executive officer during the

fiscal year.

Long Term

Annual Compensation Compensation

Restricted Shares

Other Stock Underlying All Other

Salary Bonus Compensation(2) Awards(6) Stock Compensation(7)

Name & Principal Position Year ($) ($) ($) ($) Options ($)

Edward D. Breen ............... 2006 $1,625,000 $1,625,000 $296,558(3) $7,540,000 500,000 $252,870

Chairman & CEO 2005 $1,570,617 $1,485,088 $186,407(4) $5,728,000 600,000 $336,339

2004 $1,540,000 $3,120,000 $271,936(5) $5,559,000 600,000 $242,483

Christopher J. Coughlin .......... 2006 $ 750,000 $ 950,000 $ 96,203(3) $3,335,000 250,000 $ 80,047

Executive Vice President & CFO(8) 2005 $ 429,807 $ 490,598 $ 35,000(4) $3,573,200 350,000 $ 24,160

2004 —— —

(5) —— —

William B. Lytton .............. 2006 $ 687,487 $ 700,000 $220,889(3) $2,291,000 161,000 $127,599

Executive Vice President & 2005 $ 675,000 $ 616,883 $213,413(4) $1,611,000 250,000 $167,046

General Counsel 2004 $ 662,500 $1,350,000 $211,037(5) $1,111,800 250,000 $123,274

Juergen Gromer(1) .............. 2006 $1,067,480 $1,308,304 —(3) $2,291,000 161,000 —

President and Vice Chairman 2005 $ 998,372 $ 399,588 —(4) $1,611,000 250,000 —

Tyco Electronics 2004 $ 999,575 $1,999,149 —(5) $1,667,700 275,000 —

Thomas Lynch ................ 2006 $ 703,039 $1,000,000 $100,488(3) $1,972,000 140,000 $125,339

Chief Executive Officer 2005 $ 675,000 $ 697,343 $121,474(4) $1,253,000 200,000 $109,231

Tyco Electronics 2004 $ 10,345 — —(5) $3,579,600 415,000 —

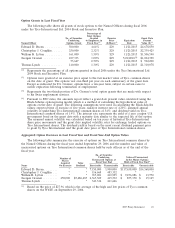

(1) Dr. Gromer’s salary and bonus are paid in Euros, with one-third of his salary attributable to his employment status with Tyco

Electronics in Germany, and two-thirds attributable to his employment status with Tyco Electronics Logistics AG in

Switzerland. For purposes of the above table, Dr. Gromer’s salary and bonus have been converted from Euros to U.S.

dollars (‘‘USD’’) as follows: for fiscal 2006, the September 29, 2006 conversion rate of 1 Euro to 1.2711 USD was used; for

fiscal 2005, the September 30, 2005 conversion rate of 1 Euro to 1.2058 USD was used; and for fiscal 2004, the

September 30, 2004 conversion rate of 1 Euro to 1.2319 USD was used.

(2) Other Annual Compensation includes the cost of providing various perquisites and other personal benefits if the amount

exceeds $50,000 in the aggregate in any year, and the indicated footnotes list items that individually comprise more than

25% of this value. Other Annual Compensation also includes all tax or tax gross-up payments.

(3) The value of perquisites provided to Dr. Gromer was less than $50,000 during fiscal 2006. The value shown in the table for

fiscal 2006 includes the calculated incremental cost to the Company for Messrs. Breen, Coughlin, and Lytton for their

personal use of Company aircraft in the amounts of $189,000, $26,203 and $109,837; respectively which amounts reflect an

increase in the variable cost per block hour for use of Company aircraft. The amounts shown in the table for Messrs. Breen,

Coughlin, Lytton and Lynch, also include cash perquisite allowances of $52,500, $70,000, $68,748 and $69,375, respectively,

under the Company’s executive flexible perquisite allowance program. The actual flexible perquisite allowance to Mr. Lytton

was offset for the use of a Company leased vehicle in the amount of $10,260. The amounts shown in the table for

Messrs. Breen, Lytton and Lynch, include gross-ups in the amount of $55,058, $42,304 and $30,354 respectively, on universal

life insurance and supplemental disability premium payments. In 2006, the Company paid $1,132 for costs related to the sale

of Mr. Lynch’s residence in fiscal year 2005. Mr. Lynch was provided a benefit under the Company’s relocation policy and

the cost is considered taxable income to Mr. Lynch and resulted in an estimated gross up cost of $759.

(4) The value of perquisites provided to Dr. Gromer was less than $50,000 during fiscal 2005. The value shown in the table for

fiscal 2005 includes the calculated incremental cost to the Company for Messrs. Breen and Lytton for their personal use of

Company aircraft in the amounts of $131,805 and $105,477 respectively. The amounts shown in the table for

Messrs. Coughlin, Lytton and Lynch also include cash perquisite allowances of $35,000, $67,500 and $67,500, respectively,

2007 Proxy Statement 23