ADT 2006 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2006 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

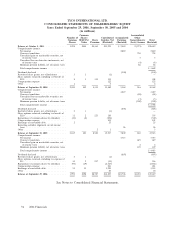

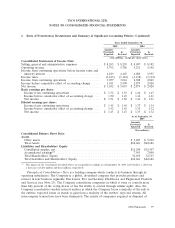

TYCO INTERNATIONAL LTD.

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

Years Ended September 29, 2006, September 30, 2005 and 2004

(in millions)

Common Accumulated

Number of Shares Contributed Accumulated Other

Common $0.20 Par Share Surplus, Net Earnings Comprehensive Total

Shares Value Premium (Restated) (Restated) (Loss) Income (Restated)

Balance at October 1, 2003 .............. 1,998 $400 $8,161 $15,291 $ 2,840 $ (273) $26,419

Comprehensive income:

Net income ...................... 2,820 2,820

Currency translation ................ 704 704

Unrealized gain on marketable securities, net

of income taxes .................. 33

Unrealized loss on derivative instruments, net

of income taxes .................. (4) (4)

Minimum pension liability, net of income taxes 86 86

Total comprehensive income ............ $ 3,609

Dividends declared ................... (100) (100)

Restricted share grants, net of forfeitures ..... 3 1 (1) —

Share options exercised, including tax benefit of

$153 .......................... 8 1 154 153 308

Compensation expense ................ 122 122

Other ........................... 1 4 4

Balance at September 30, 2004 ........... 2,010 402 8,315 15,569 5,560 516 30,362

Comprehensive income:

Net income ...................... 3,019 3,019

Currency translation ................ (48) (48)

Unrealized loss on marketable securities, net

of income taxes .................. (3) (3)

Minimum pension liability, net of income taxes (200) (200)

Total comprehensive income ............ $ 2,768

Dividends declared ................... (805) (805)

Restricted share grants, net of forfeitures ..... 2 1 (1) —

Share options exercised, including tax benefit of

$110 .......................... 11 2 223 110 335

Repurchase of common shares by subsidiary . . . (10) (2) (298) (300)

Compensation expense ................ 101 101

Exchange of convertible debt ............. 2 25 25

Reporting calendar alignment, net of income

taxes .......................... 26 26

Other ........................... 2 1 3

Balance at September 30, 2005 ........... 2,015 403 8,540 15,507 7,800 265 32,515

Comprehensive income:

Net income ...................... 3,713 3,713

Currency translation ................ 619 619

Unrealized gain on marketable securities, net

of income taxes .................. 22

Minimum pension liability, net of income taxes 149 149

Total comprehensive income ............ $ 4,483

Dividends declared ................... (807) (807)

Restricted share grants, net of forfeitures ..... 4 1 (1) —

Share options exercised, including tax expense of

$13........................... 14 2 247 (13) 236

Repurchase of common shares by subsidiary . . . (95) (19) (2,525) (2,544)

Compensation expense ................ 281 281

Exchange of convertible debt ............. 54 11 1,224 1,235

Other ........................... 20 20

Balance at September 29, 2006 ........... 1,992 $398 $8,787 $14,493 $10,706 $1,035 $35,419

See Notes to Consolidated Financial Statements.

94 2006 Financials