ADT 2006 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2006 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

consideration of alternatives, including the communication date to grantees for all grants, to establish a

reasonable date upon which equity recipients and share awards were known, fixed and ready to be

communicated to employees. To the extent the Company was able to conclude that grant date lists were

fixed and ready to be communicated to employees, the measurement date was considered to be the

grant date. However, in many instances, the measurement date the Company used was the date that

the equity award was communicated to the recipient.

The Company has concluded that errors relating to the Company’s stock option accounting

primarily resulted from: (a) incomplete documentation to enable application of accounting principles

under APB Opinion No. 25; (b) the unintentional misapplication of generally accepted accounting

principles; and (c) the absence of adequate control procedures in 1999 through early 2002 designed to

ensure equity recipients and share awards were fixed and certain prior to the legal grant date.

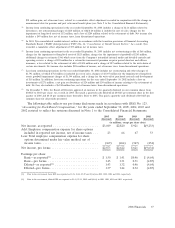

The amount of aggregate compensation expense related to this item, which the Company should

have recorded in prior periods, is $252 million pre-tax and $173 million after-tax, relating to grants

awarded prior to the end of 2002. None of this amount relates to 2006, $17 million pre-tax ($8 million

after-tax) relates to 2005 and $66 million pre-tax ($46 million after-tax) relates to 2004, as awards

vested over the relevant vesting periods. Had the Company used the communication date as the

measurement date in all instances, the difference in the amount recorded would not have been material

to any period or in the aggregate.

Review of Equity Plan Compliance

Separately, the Company identified an error related to the recognition of compensation expense

under the Company’s employee stock purchase program in the United Kingdom. The aggregate

compensation expense related to this item which the Company should have recorded in 2002-2005 is

$29 million pre-tax and $20 million after-tax. None of this amount relates to 2006, $7 million pre-tax

($5 million after-tax) relates to 2005 and $19 million pre-tax ($13 million after-tax) relates to 2004.

Effect of Restatement

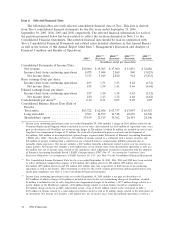

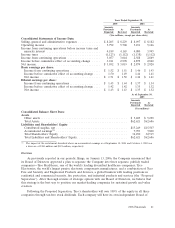

Taken together, these prior period errors result in an aggregate understatement of compensation

expense of $281 million pre-tax and $193 million after-tax. Based on the findings of the items discussed

above, the Company has restated its reported results for prior periods to reflect the impact of

additional stock-based compensation expense in Corporate. The impact by year is as follows ($ in

millions):

2001

and

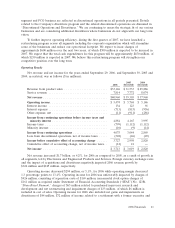

2006 2005 2004 2003 2002 Prior Total

Pre-tax impact ................................ — $24 $85 $84 $75 $13 $281

After-tax impact .............................. — $13 $59 $59 $53 $ 9 $193

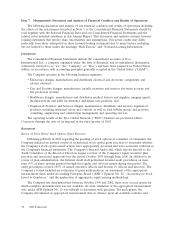

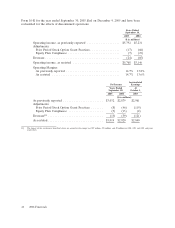

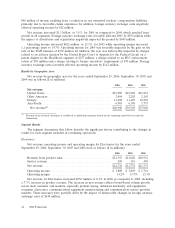

The impact on the Consolidated Statements of Income for the years ended September 30, 2005

and 2004, and the Consolidated Balance Sheet as of September 30, 2005, as a result of the above

restatement, is summarized in the tables below. There was no impact on total cash flows from

operating, investing or financing activities within the Consolidated Statements of Cash Flows for the

years ended September 30, 2005 and 2004. The amounts previously reported are derived from the

2006 Financials 39