ADT 2006 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2006 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

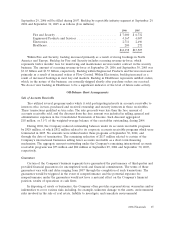

September 29, 2006 will be filled during 2007. Backlog by reportable industry segment at September 29,

2006 and September 30, 2005 is as follows ($ in millions):

2006 2005

Fire and Security ................................... $ 7,000 $ 6,732

Engineered Products and Services ....................... 4,167 4,007

Electronics ........................................ 2,711 2,496

Healthcare ........................................ 280 272

$14,158 $13,507

Within Fire and Security, backlog increased primarily as a result of strong bookings in North

America and Europe. Backlog for Fire and Security includes recurring revenue-in-force, which

represents twelve months’ fees for monitoring and maintenance services under contract in the security

business. The amount of recurring revenue-in-force at September 29, 2006 and September 30, 2005 was

$3.65 billion and $3.55 billion, respectively. Backlog within Engineered Products and Services increased

primarily as a result of increased orders at Flow Control. Within Electronics, backlog increased as a

result of increased bookings in most key end markets. Backlog in Healthcare represents unfilled orders,

which, in the nature of the business, are normally shipped shortly after purchase orders are received.

We do not view backlog in Healthcare to be a significant indicator of the level of future sales activity.

Off-Balance Sheet Arrangements

Sale of Accounts Receivable

Tyco utilized several programs under which it sold participating interests in accounts receivable to

investors who, in turn, purchased and received ownership and security interests in those receivables.

These transactions qualified as true sales. The sale proceeds were less than the face amount of

accounts receivable sold, and the discount from the face amount was included in selling, general and

administrative expenses in the Consolidated Statements of Income. Such discount aggregated

$18 million, or 3.1% of the weighted-average balance of the receivables outstanding, during 2004.

During 2004, the Company reduced outstanding balances under its accounts receivable programs

by $929 million, of which $812 million related to its corporate accounts receivable programs which were

terminated in 2005. No amounts were utilized under these programs at September 30, 2004, and

through the date of termination. The remaining reduction of $117 million related to certain of the

Company’s international businesses selling fewer accounts receivable as a short-term financing

mechanism. The aggregate amount outstanding under the Company’s remaining international accounts

receivable programs was $75 million and $80 million at September 29, 2006 and September 30, 2005,

respectively.

Guarantees

Certain of the Company’s business segments have guaranteed the performance of third-parties and

provided financial guarantees for uncompleted work and financial commitments. The terms of these

guarantees vary with end dates ranging from 2007 through the completion of such transactions. The

guarantees would be triggered in the event of nonperformance and the potential exposure for

nonperformance under the guarantees would not have a material effect on the Company’s financial

position, results of operations or cash flows.

In disposing of assets or businesses, the Company often provides representations, warranties and/or

indemnities to cover various risks including, for example, unknown damage to the assets, environmental

risks involved in the sale of real estate, liability to investigate and remediate environmental

2006 Financials 65