ADT 2006 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2006 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

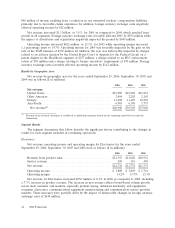

segment and PCG business are reflected as discontinued operations in all periods presented. Details

related to the Company’s divestiture program and the related discontinued operations are discussed in

‘‘Discontinued Operations and Divestitures.’’ We are continuing to assess the strategic fit of our various

businesses and are considering additional divestitures where businesses do not align with our long term

vision.

To further improve operating efficiency, during the first quarter of 2007, we have launched a

restructuring program across all segments including the corporate organization which will streamline

some of the businesses and reduce our operational footprint. We expect to incur charges of

approximately $600 million over the next two years, of which $500 million is expected to be incurred in

2007. We expect that the total cash expenditures for this program will be approximately $450 million, of

which $250 million is expected in 2007. We believe this restructuring program will strengthen our

competitive position over the long term.

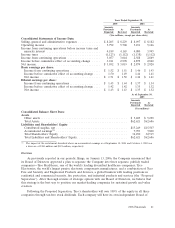

Operating Results

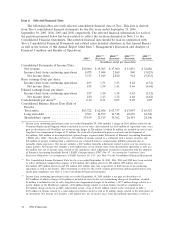

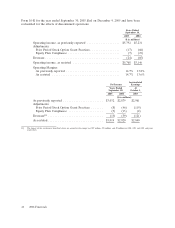

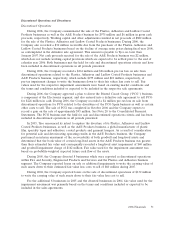

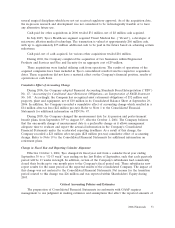

Net revenue and net income for the years ended September 29, 2006, and September 30, 2005 and

2004, as restated, was as follows ($ in millions):

2005 2004

2006 (Restated) (Restated)

Revenue from product sales ......................... $33,146 $ 31,533 $ 29,886

Service revenue .................................. 7,814 7,772 8,074

Net revenue ..................................... $40,960 $ 39,305 $ 37,960

Operating income ................................. $ 5,474 $ 5,768 $ 5,146

Interest income .................................. 134 123 91

Interest expense .................................. (713) (815) (956)

Other expense, net ................................ (11) (911) (286)

Income from continuing operations before income taxes and

minority interest ................................ 4,884 4,165 3,995

Income taxes .................................... (799) (1,112) (1,112)

Minority interest ................................. (10) (9) (14)

Income from continuing operations .................... 4,075 3,044 2,869

Loss from discontinued operations, net of income taxes ..... (348) (46) (49)

Income before cumulative effect of accounting change ...... 3,727 2,998 2,820

Cumulative effect of accounting change, net of income taxes . . (14) 21 —

Net income ..................................... $ 3,713 $ 3,019 $ 2,820

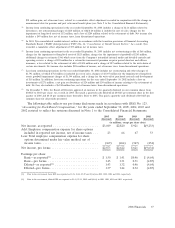

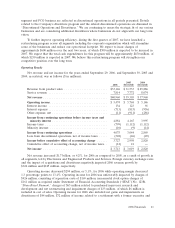

Net revenue increased $1.7 billion, or 4.2%, for 2006 as compared to 2005, as a result of growth in

all segments, led by Electronics and Engineered Products and Services. Foreign currency exchange rates

and the impact of acquisitions and divestitures negatively impacted 2006 revenue growth by

$326 million and $125 million, respectively.

Operating income decreased $294 million, or 5.1%, for 2006 while operating margin decreased

1.3 percentage points to 13.4%. Operating income for 2006 was unfavorably impacted by charges of

$426 million, consisting of separation costs of $169 million; incremental stock option charges of

$161 million as required under Statement of Financial Accounting Standards (‘‘SFAS’’) No. 123R,

‘‘Share-Based Payment,’’ charges of $63 million related to purchased in-process research and

development and net restructuring and impairment charges of $33 million, of which $6 million is

included in cost of sales. Operating income for 2006 also included net gains and impairments on

divestitures of $44 million, $72 million of income related to a settlement with a former executive and

2006 Financials 43