ADT 2006 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2006 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

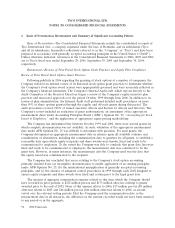

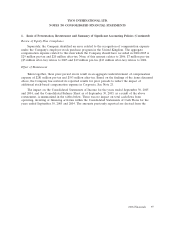

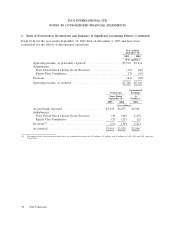

1. Basis of Presentation, Restatement and Summary of Significant Accounting Policies

Basis of Presentation—The Consolidated Financial Statements include the consolidated accounts of

Tyco International Ltd., a company organized under the laws of Bermuda, and its subsidiaries (Tyco

and all its subsidiaries, hereinafter collectively referred to as the ‘‘Company’’ or ‘‘Tyco’’) and have been

prepared in accordance with generally accepted accounting principles in the United States (‘‘GAAP’’).

Unless otherwise indicated, references in the Consolidated Financial Statements to 2006, 2005 and 2004

are to Tyco’s fiscal year ended September 29, 2006, September 30, 2005 and September 30, 2004,

respectively.

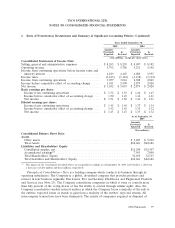

Restatement—Reviews of Prior Period Stock Option Grant Practices and Equity Plan Compliance

Review of Prior Period Stock Option Grant Practices

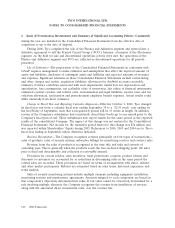

Following publicity in 2006 regarding the granting of stock options at a number of companies, the

Company initiated an internal review of its historical stock option grant practices to determine whether

the Company’s stock option award actions were appropriately governed and were accurately reflected in

the Company’s financial statements. The Company’s Internal Audit staff, which reports directly to the

Audit Committee of the Board of Directors, began a review of the Company’s equity incentive plan

practices and associated approvals over the period October 1999 through June 2006. In addition to its

review of plan administration, the Internal Audit staff performed detailed audit procedures on more

than 95% of share options granted through the regular and off-cycle grants during this period. The

audit procedures covered 100% of named executive officers and Section 16 officers and directors. The

Company’s review included an evaluation of grant authorizations, an assessment of the appropriate

measurement dates under Accounting Principles Board (‘‘APB’’) Opinion No. 25, ‘‘Accounting for Stock

Issued to Employees,’’ and the application of appropriate equity pricing methodology.

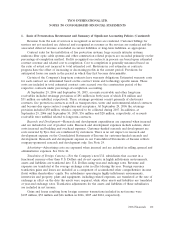

The Company has determined that between October 1999 and 2002, there were several grants for

which complete documentation was not available. As such, validation of the appropriate measurement

date under APB Opinion No. 25 was difficult to determine with precision. For such grants, the

Company determined an appropriate measurement date in reliance upon all available evidence and

consideration of alternatives, including the communication date to grantees for all grants, to establish a

reasonable date upon which equity recipients and share awards were known, fixed and ready to be

communicated to employees. To the extent the Company was able to conclude that grant date lists were

fixed and ready to be communicated to employees, the measurement date was considered to be the

grant date. However, in many instances, the measurement date the Company used was the date that

the equity award was communicated to the recipient.

The Company has concluded that errors relating to the Company’s stock option accounting

primarily resulted from: (a) incomplete documentation to enable application of accounting principles

under APB Opinion No. 25; (b) the unintentional misapplication of generally accepted accounting

principles; and (c) the absence of adequate control procedures in 1999 through early 2002 designed to

ensure equity recipients and share awards were fixed and certain prior to the legal grant date.

The amount of aggregate compensation expense related to this item, which the Company should

have recorded in prior periods, is $252 million pre-tax and $173 million after-tax, relating to grants

awarded prior to the end of 2002. None of this amount relates to 2006, $17 million pre-tax ($8 million

after-tax) relates to 2005 and $66 million pre-tax ($46 million after-tax) relates to 2004, as awards

vested over the relevant vesting periods. Had the Company used the communication date as the

measurement date in all instances, the difference in the amount recorded would not have been material

to any period or in the aggregate.

96 2006 Financials