ADT 2006 Annual Report Download - page 110

Download and view the complete annual report

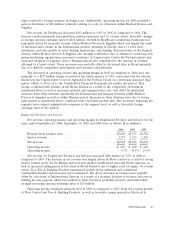

Please find page 110 of the 2006 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Metal Products and higher margin projects at Infrastructure Services contributed positively to operating

income in 2006. Offsetting this growth was a $100 million charge relating to the Voluntary Replacement

Program for certain sprinkler heads (see Note 16 to the Consolidated Financial Statements) and

incremental stock option charges of $17 million required under SFAS No. 123R.

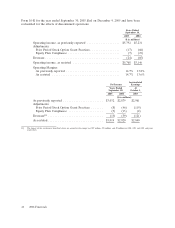

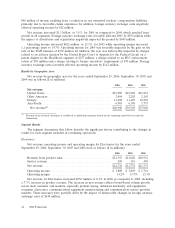

Net revenue for Engineered Products and Services increased $449 million or 7.5% in 2005 as

compared to 2004. The increase in net revenue was largely driven by increased selling prices in

Electrical & Metal Products due to higher costs of steel and other raw materials. In addition, Flow

Control and, to a lesser extent, Tyco Fire & Building Products experienced growth in the industrial and

commercial construction markets. Favorable changes in foreign currency exchange rates of $167 million

also contributed to the increase in revenue. The above increases in revenue were partially offset by a

decrease at Infrastructure Services as a result of a strategic decision to be more selective in bidding for

new projects, which has resulted in fewer but more profitable projects.

The increases in operating income and operating margin in 2005 as compared to 2004 were due

primarily to increased volume and demand within the industrial and commercial markets, along with

the impact of operational excellence initiatives, cost reductions from prior period restructuring

programs and favorable changes in foreign currency exchange rates of $21 million. These increases

more than offset the impact of higher raw material costs. Additionally, 2005 operating income includes

$4 million of net restructuring, impairment and divestiture charges as compared to the $62 million of

net restructuring, impairment and divestiture charges in 2004.

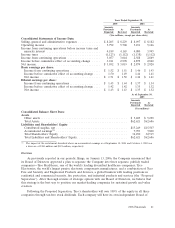

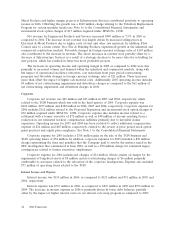

Corporate

Corporate net revenue was $29 million and $25 million in 2005 and 2004, respectively, which

related to the TGN business which was sold in the third quarter of 2005. Corporate expense was

$400 million, $255 million and $482 million in 2006, 2005 and 2004, respectively. Corporate expense for

2006 includes $162 million related to the Proposed Separation and incremental stock option charges of

$32 million required under SFAS No. 123R. Corporate expense also includes income related to a

settlement with a former executive of $72 million as well as $48 million of income resulting from a

reduction in our estimated workers’ compensation liabilities primarily due to favorable claims

experience. Operating income for 2005 and 2004 has been restated to reflect additional compensation

expense of $24 million and $85 million, respectively, related to the review of prior period stock option

grant practices and equity plan compliance. See Note 1 to the Consolidated Financial Statements.

Corporate expense for 2005 includes a $301 million gain on the sale of the TGN business and

TGN operating losses of $54 million. In addition, corporate expenses for 2005 included a $50 million

charge representing the fines and penalties that the Company paid to resolve the matters raised in the

SEC investigation that commenced in June 2002, as well as a $70 million charge for estimated legacy

contingencies related to former executives’ employment.

Corporate expense for 2004 includes net charges of $14 million, which consists of charges for the

impairment of long-lived assets of $8 million and net restructuring charges of $6 million primarily

attributable to severance related to the relocation of the corporate headquarters. Expense also included

$73 million of operating losses related to the TGN.

Interest Income and Expense

Interest income was $134 million in 2006, as compared to $123 million and $91 million in 2005 and

2004, respectively.

Interest expense was $713 million in 2006, as compared to $815 million in 2005 and $956 million in

2004. The decrease in interest expense in 2006 is primarily driven by lower debt balances, partially

offset by the impact of higher interest rates on our interest rate swap program as compared to 2005.

48 2006 Financials