ADT 2006 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2006 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

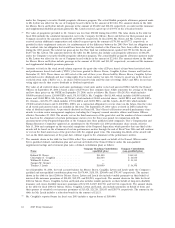

under the Company’s executive flexible perquisite allowance program. The actual flexible perquisite allowance payment made

to Mr. Lytton was offset for the use of Company leased vehicles in the amount of $23,416. The amounts shown in the table

for Messrs. Breen and Lytton include gross-ups in the amount of $54,602 and $40,436 respectively, on universal life insurance

and supplemental disability premium payments. Mr. Lynch received a gross-up of $53,974 on his relocation benefit.

(5) The value of perquisites provided to Dr. Gromer was less than $50,000 during fiscal 2004. The value shown in the table for

fiscal 2004 includes the calculated incremental cost to the Company for Messrs. Breen and Lytton for their personal use of

Company aircraft in the amounts of $122,500 and $94,830, respectively. In fiscal 2004, Mr. Breen and Mr. Lytton each

received certain additional compensation and related tax gross-ups in the amount of $70,300 and $9,773, respectively, as

provided in their employment contracts, for reimbursement of the difference between the 2003 New York tax obligation and

the resident state tax obligation that would have been due had they worked at the Princeton, New Jersey office location

during the 2003 period. The related tax gross-up for this New York tax reimbursement equaled $44,795 for Mr. Breen and

$6,677 for Mr. Lytton. The amounts shown in the table for Mr. Lytton also include cash perquisite allowances of $66,250,

under the Company’s executive flexible perquisite allowance program. The actual flexible perquisite allowance payment made

to Mr. Lytton was offset for the use of Company leased vehicles in the amount of $23,416. The amounts shown in the table

for Messrs. Breen and Lytton include gross-ups in the amount of $34,341 and $33,507 respectively, on universal life insurance

and supplemental disability premium payments.

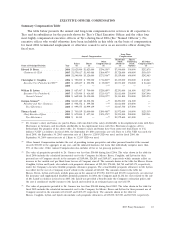

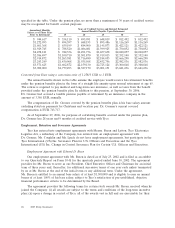

(6) Amounts set forth in the stock award column represent the grant-date value ($29 per share) of time-based restricted stock

and performance based stock units (‘‘PSUs’’) that were granted to Messrs. Breen, Coughlin, Lytton, Gromer and Lynch on

November 22, 2005. These shares are cliff vested at the end of three years. Shares held by Messrs. Breen, Coughlin, Lytton

and Lynch receive dividends and have voting rights. Due to local country tax laws, Dr. Gromer’s award was in the form of

restricted stock units (‘‘RSUs’’) (i.e., no shares will be issued to him until the date of vesting). RSUs and PSUs do not have

voting rights nor do they receive dividends or dividend equivalents.

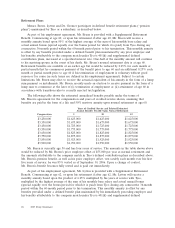

The value of all restricted shares and units, performance stock units and/or vested and unvested DSUs held by the Named

Officers on September 29, 2006 is based a price of $27.96 per Tyco common share, which represents the average of the high

and low share prices on the NYSE on September 29, 2006, and is as follows: Mr. Breen—$56,243,916, which includes

500,000 restricted shares, 120,000 PSUs and 1,391,585 DSUs; Mr. Coughlin—$6,011,400, which includes 160,000 restricted

shares and 55,000 PSUs; Mr. Lytton—$8,908,615, which includes 128,000 restricted shares, 36,000 PSUs and 154,620 DSUs;

Dr. Gromer—$13,291,177, which includes 439,364 RSUs and 36,000 PSUs; and Mr. Lynch—$6,235,080, which includes

192,000 restricted shares and 31,000 PSUs. DSUs are a contractual obligation to receive shares in the future, thus the value

of all vested and unvested units are included in this total. The September 29, 2006 values set forth in DSUs include the

value of dividend equivalents. As previously disclosed on Form 8-K, Tyco’s Board of Directors awarded performance share

awards to certain senior management employees, including the Company’s named executive officers and Senior Officers,

effective November 22, 2005. The awards vest on the third anniversary of the grant date and the number of shares awarded

are based on the attainment of certain performance metrics over the three-year period. In conjunction with the

announcement of the Proposed Separation of the Company into three publicly-traded companies, Tyco’s Compensation and

Human Resources Committee approved an amendment to the November 22, 2005 performance share awards, effective

July 13, 2006 and contingent on the successful completion of the Proposed Separation, which provides that one-third of the

awards will be based on the attainment of certain performance metrics through the end of Fiscal Year 2006 and will continue

to vest on the third anniversary of the grant date with the original grant term. The remaining two-thirds of the awards will

vest on the third anniversary of the grant date, without regard to the attainment of the performance metrics.

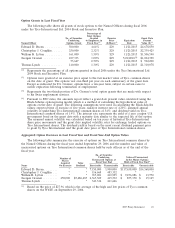

(7) The amounts shown in the table for fiscal 2006 reflect Tyco contributions made on behalf of the Named Officers under

Tyco’s qualified defined contribution plan and accruals on behalf of the Named Officers under the non-qualified

supplemental savings and retirement plan (also a defined contribution plan) as follows:

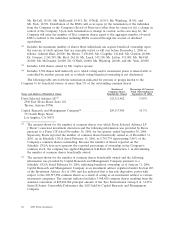

Company Matching Contribution Company Contribution

Name (qualified plan) (non-qualified plan)

Edward D. Breen .................... $11,000 $144,515

Christopher J. Coughlin ................ $11,000 $ 46,030

William B. Lytton .................... — $54,115

Juergen W. Gromer .................. — —

Thomas J. Lynch .................... $10,000 $ 56,398

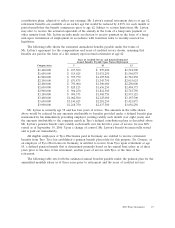

As of September 30, 2006, the total account balance for Messrs. Breen, Coughlin, Lytton and Lynch under the Company’s

qualified and non-qualified contribution plans was $1,070,404, $138,330, $240,696 and $793,457 respectively. The amount

shown in the table for fiscal 2006 for Messrs. Breen, Lytton and Lynch also includes taxable payments on their behalf of

universal life insurance premiums of $50,405, $32,279, and $24,918, respectively. The amount shown in the table for fiscal

2006 for Messrs. Breen, Coughlin, Lytton and Lynch also includes taxable payments on their behalf of long-term disability

insurance and excess disability insurance premiums of $31,522, $1,807, $20,350, and $11,916 respectively. The amount shown

in the table for fiscal 2006 for Messrs. Breen, Coughlin, Lytton and Lynch, also includes payments on behalf of them and

their spouses of extended care insurance premiums of $15,428, $21,210, $20,855 and $20,974, respectively. The amount in the

table for Mr. Lynch includes a relocation benefit in the amount of $1,133.

(8) Mr. Coughlin’s reported bonus for fiscal year 2005 includes a sign-on bonus of $100,000.

24 2007 Proxy Statement