ADT 2006 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2006 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

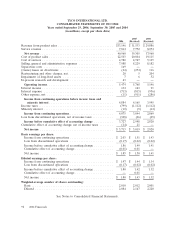

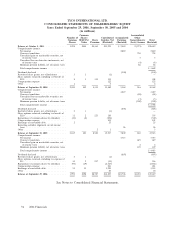

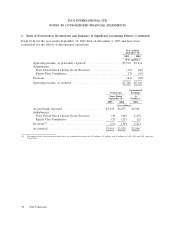

TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

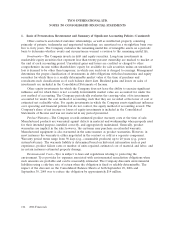

1. Basis of Presentation, Restatement and Summary of Significant Accounting Policies (Continued)

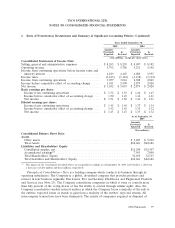

Years Ended September 30,

2005 2004

Amounts Amounts

Previously As Previously As

Reported Restated Reported Restated

($ in millions, except per share data)

Consolidated Statements of Income Data:

Selling, general and administrative expenses ............. $ 8,205 $ 8,229 $ 8,097 $ 8,182

Operating income ................................ 5,792 5,768 5,231 5,146

Income from continuing operations before income taxes and

minority interest ............................... 4,189 4,165 4,080 3,995

Income taxes ................................... (1,123) (1,112) (1,138) (1,112)

Income from continuing operations ................... 3,057 3,044 2,928 2,869

Income before cumulative effect of accounting change ..... 3,011 2,998 2,879 2,820

Net income ..................................... $ 3,032 $ 3,019 $ 2,879 $ 2,820

Basic earnings per share:

Income from continuing operations .................. $ 1.52 $ 1.51 $ 1.46 $ 1.43

Income before cumulative effect of accounting change .... 1.50 1.49 1.44 1.41

Net income ................................... $ 1.51 $ 1.50 $ 1.44 $ 1.41

Diluted earnings per share:

Income from continuing operations .................. $ 1.45 $ 1.44 $ 1.37 $ 1.34

Income before cumulative effect of accounting change .... 1.42 1.42 1.35 1.32

Net income ................................... $ 1.43 $ 1.43 $ 1.35 $ 1.32

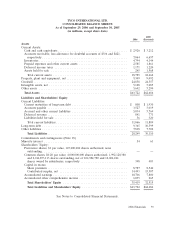

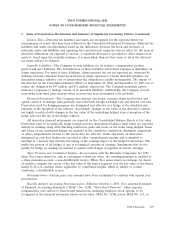

As of September 30,

2005

Amounts

Previously As

Reported Restated

($ in millions)

Consolidated Balance Sheet Data:

Assets

Other assets .................................................. $ 5,225 $ 5,290

Total Assets .................................................. $62,621 $62,686

Liabilities and Shareholders’ Equity

Contributed surplus, net ......................................... $15,249 $15,507

Accumulated earnings(1) ......................................... 7,993 7,800

Total Shareholders’ Equity ....................................... 32,450 32,515

Total Liabilities and Shareholders’ Equity ............................. $62,621 $62,686

(1) The impact of the restatement described above on accumulated earnings as of September 30, 2004 and October 1, 2003 was

a decrease of $180 million and $121 million, respectively.

Principles of Consolidation—Tyco is a holding company which conducts its business through its

operating subsidiaries. The Company is a global, diversified company that provides products and

services in four business segments: Electronics, Fire and Security, Healthcare and Engineered Products

and Services (see Note 23). The Company consolidates companies in which it owns or controls more

than fifty percent of the voting shares or has the ability to control through similar rights. Also, the

Company consolidates variable interest entities in which the Company bears a majority of the risk to

the entities’ expected losses or stands to gain from a majority of the entities’ expected returns. All

intercompany transactions have been eliminated. The results of companies acquired or disposed of

99

2006 Financials