ADT 2006 Annual Report Download - page 207

Download and view the complete annual report

Please find page 207 of the 2006 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

21. Share Plans (Continued)

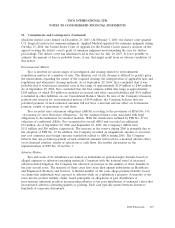

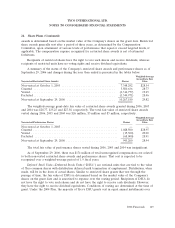

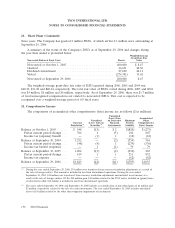

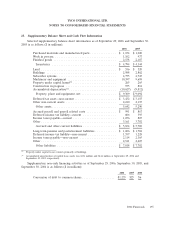

As a result of the adoption of SFAS No. 123R, the Company’s results for the year ended

September 29, 2006 include incremental share-based compensation expense of $161 million. The total

share-based compensation cost during 2006, 2005 (restated) and 2004 (restated) of $282 million,

$105 million and $126 million, respectively, has been included in the Consolidated Statements of

Income within selling, general and administrative expenses. The Company has recognized a related tax

benefit associated with its share-based compensation arrangements during 2006, 2005 (restated) and

2004 (restated) of $85 million, $36 million and $37 million, respectively.

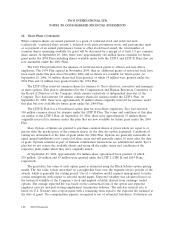

Prior to October 1, 2005, the Company accounted for stock-based compensation plans in

accordance with the provisions of APB Opinion No. 25, as permitted by SFAS No. 123, and accordingly

did not recognize compensation expense for the issuance of options with an exercise price equal to or

greater than the market price of the stock at the date of grant. Had the fair value based method as

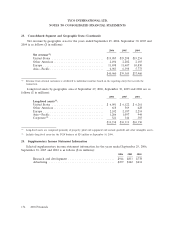

prescribed by SFAS No. 123 been applied by Tyco, the effect on net income and earnings per share for

2005 and 2004 would have been as follows ($ in millions, except per share data):

2005 2004

(Restated) (Restated)

Net income, as reported ................................... $3,019 $ 2,820

Add: Employee compensation expense for share options included in

reported net income, net of income taxes ..................... 23 66

Less: Total employee compensation expense for share options

determined under fair value method, net of income taxes .......... (169) (264)

Net income, pro forma .................................... $2,873 $ 2,622

Earnings per share:

Basic—as reported ...................................... $ 1.50 $ 1.41

Basic—pro forma ....................................... 1.43 1.31

Diluted—as reported .................................... 1.43 1.32

Diluted—pro forma ..................................... 1.37 1.24

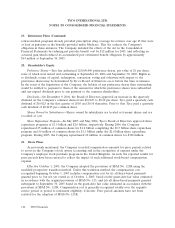

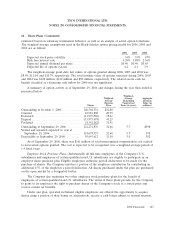

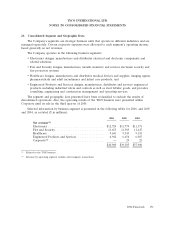

During 2004, the Tyco International Ltd. 2004 Stock and Incentive Plan (the ‘‘2004 Plan’’)

effectively replaced the Tyco International Ltd. Long Term Incentive Plan, as amended as of May 12,

1999 (the ‘‘LTIP I Plan’’), the Tyco International Ltd. Long Term Incentive Plan II (the ‘‘LTIP II

Plan’’), as well as the Tyco International Ltd. 1994 Restricted Stock Ownership Plan for Key Employees

(the ‘‘1994 Plan’’) for all awards effective on and after March 25, 2004. The 2004 Plan provides for the

award of stock options, stock appreciation rights, annual performance bonuses, long term performance

awards, restricted units, restricted stock, deferred stock units, promissory stock and other stock-based

awards (collectively, ‘‘Awards’’).

The 2004 Plan provides for a maximum of 160 million common shares to be issued as Awards,

subject to adjustment as provided under the terms of the 2004 Plan. In addition, any common shares

that have been approved by the Company’s shareholders for issuance under the LTIP Plans but which

have not been awarded thereunder as of January 1, 2004, reduced by the number of common shares

related to Awards made under the LTIP Plans between January 1, 2004 and March 25, 2004, the date

the 2004 Plan was approved by shareholders, (or which have been awarded but will not be issued,

owing to expiration, forfeiture, cancellation, return to the Company or settlement in cash in lieu of

common shares on or after January 1, 2004) and which are no longer available for any reason

(including the termination of the LTIP Plans) will also be available for issuance under the 2004 Plan.

2006 Financials 145