ADT 2006 Annual Report Download - page 211

Download and view the complete annual report

Please find page 211 of the 2006 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

21. Share Plans (Continued)

awards is determined based on the market value of the Company’s shares on the grant date. Restricted

share awards generally vest after a period of three years, as determined by the Compensation

Committee, upon attainment of various levels of performance that equal or exceed targeted levels, if

applicable. The compensation expense recognized for restricted share awards is net of estimated

forfeitures.

Recipients of restricted shares have the right to vote such shares and receive dividends, whereas

recipients of restricted units have no voting rights and receive dividend equivalents.

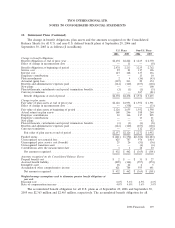

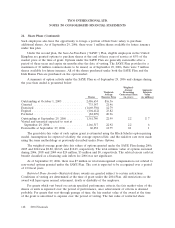

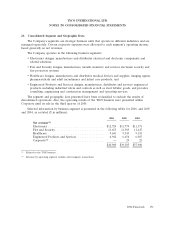

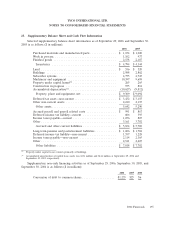

A summary of the status of the Company’s restricted share awards and performance shares as of

September 29, 2006 and changes during the year then ended is presented in the tables below:

Weighted-Average

Grant-Date Fair

Non-vested Restricted Share Awards Shares Value

Non-vested at October 1, 2005 ............................... 7,348,292 $28.54

Granted ............................................... 5,580,636 28.77

Vested ................................................. (1,316,777) 19.45

Forfeited ............................................... (1,344,971) 28.46

Non-vested at September 29, 2006 ............................ 10,267,180 29.82

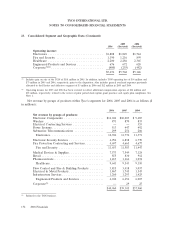

The weighted-average grant-date fair value of restricted share awards granted during 2006, 2005

and 2004 was $28.77, $35.25 and $27.38, respectively. The total fair value of restricted share awards

vested during 2006, 2005 and 2004 was $26 million, $3 million and $5 million, respectively.

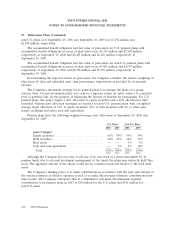

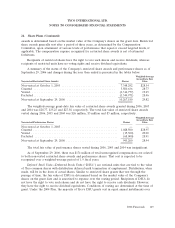

Weighted-Average

Grant-Date Fair

Non-vested Performance Shares Shares Value

Non-vested at October 1, 2005 ................................. — —

Granted ................................................. 1,028,500 $28.95

Vested .................................................. (15,300) 29.00

Forfeited ................................................ (68,000) 28.91

Non-vested at September 29, 2006 .............................. 945,200 28.94

The total fair value of performance shares vested during 2006, 2005 and 2004 was insignificant.

As of September 29, 2006, there was $174 million of total unrecognized compensation cost related

to both non-vested restricted share awards and performance shares. That cost is expected to be

recognized over a weighted-average period of 1.9 fiscal years.

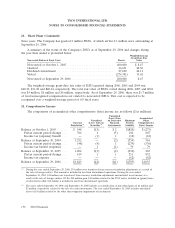

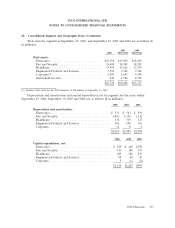

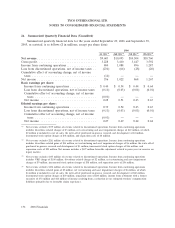

Deferred Stock Units—Deferred Stock Units (‘‘DSUs’’) are notional units that are tied to the value

of Tyco common shares with distribution deferred until termination of employment. Distribution, when

made, will be in the form of actual shares. Similar to restricted share grants that vest through the

passage of time, the fair value of DSUs is determined based on the market value of the Company’s

shares on the grant date and is amortized to expense over the vesting period. Recipients of DSUs do

not have the right to vote such shares and do not have the right to receive cash dividends. However,

they have the right to receive dividend equivalents. Conditions of vesting are determined at the time of

grant. Under the 2004 Plan, the majority of Tyco’s DSU grants vest in equal annual installments over

2006 Financials 149