ADT 2006 Annual Report Download - page 175

Download and view the complete annual report

Please find page 175 of the 2006 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

4. Restructuring and Other Charges (Credits), Net (Continued)

carrying value of inventory. Additionally, during 2004, Electronics sold certain cable-laying sea vessels

and other assets that were impaired in prior years for amounts greater than originally anticipated and

recorded the related gain as a restructuring credit of $34 million. Electronics also completed certain

restructuring activities for amounts less than originally estimated, and accordingly reversed $16 million

of restructuring reserves as a restructuring credit.

During 2004 Healthcare recorded restructuring charges of $13 million related to 2004 restructuring

plans. Additionally, Healthcare completed restructuring activities announced in prior years for amounts

less than originally anticipated, and accordingly reversed $2 million of restructuring reserves as a credit.

During 2004, Engineered Products and Services recorded restructuring charges of $55 million

related to 2004 restructuring plans including $1 million reflected in cost of sales for the non-cash

write-down in carrying value of inventory. Additionally, Engineered Products and Services completed

certain restructuring activities for amounts less than originally anticipated, and accordingly reflected

$2 million as a restructuring credit during 2004.

During 2004, Corporate recorded restructuring charges of $17 million related to the 2004

restructuring plans. In addition, Corporate completed certain restructuring activities announced in prior

years for amounts less than originally anticipated, and accordingly reversed $7 million of restructuring

reserves as a restructuring credit. In addition, during 2004, Corporate sold certain TGN assets that

were written down to their expected net realizable value in prior years for amounts greater than

originally anticipated and recorded the related gain as a restructuring credit of $4 million.

2003 and Prior Charges and Credits

The Company continues to maintain restructuring reserves related to actions initiated prior to

2004. The total amount of these reserves are $69 million and $82 million at September 29, 2006 and

September 30, 2005, respectively. These balances primarily include facility exit costs for long-term

non-cancelable lease obligations within the Electronics segment, with expiration dates which range from

2008 to 2022.

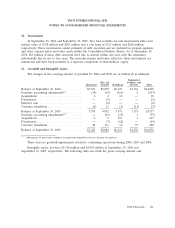

Total Restructuring Reserves

Restructuring reserves by segment at September 29, 2006 and September 30, 2005 are as follows ($

in millions): 2006 2005

Electronics ......................................................... $ 71 $ 81

Fire and Security ..................................................... 28 45

Healthcare ......................................................... — 1

Engineered Products and Services ........................................ 5 9

Corporate .......................................................... 3 3

Restructuring reserves ................................................. $107 $139

At September 29, 2006 and September 30, 2005, restructuring reserves were included in the

Company’s Consolidated Balance Sheets as follows ($ in millions):

2006 2005

Accrued and other current liabilities ................................ $ 33 $ 52

Other liabilities ............................................... 74 87

Restructuring reserves .......................................... $107 $139

2006 Financials 113