ADT 2006 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2006 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Also, following the Proposed Separation, it is anticipated that all three companies will be

capitalized to provide financial flexibility to take advantage of future growth opportunities. They are

expected to have financial policies, balance sheet and credit metrics that are commensurate with solid

investment grade ratings. Tyco will continue to follow financial policies that are consistent with its

current credit ratings until the planned transactions take place. The Company’s existing debt is

expected to be allocated among the three companies or refinanced. Any existing or potential liabilities

that cannot be associated with a particular entity will be allocated appropriately to each of the

businesses, and a sharing agreement among the three companies will be established.

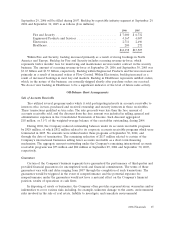

The following table details our debt ratings at September 29, 2006 and September 30, 2005:

Short Term Long Term

Moody’s ....................................... Prime-3 Baa 3

Standard & Poor’s ................................ A2 BBB+

Fitch .......................................... F2 BBB+

The security ratings set forth above are not a recommendation to buy, sell or hold securities and

may be subject to revision or withdrawal by the assigning rating organization. Each rating should be

evaluated independently of any other rating.

Commitments and Contingencies

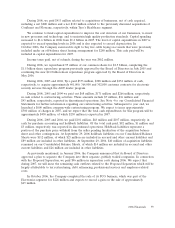

Contractual Obligations

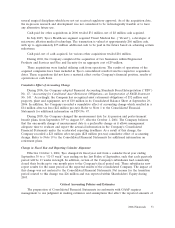

Contractual obligations and commitments for debt, minimum lease payment obligations under

non-cancelable operating leases and other obligations at September 29, 2006 is as follows ($ in

millions):

2007 2008 2009 2010 2011 Thereafter Total

Debt(1) ........................ $ 782 $ 820 $2,555 $ 14 $1,002 $4,833 $10,006

Capital leases ................... 26 27 22 9 7 76 167

Operating leases ................. 516 405 302 214 158 499 2,094

Purchase obligations(2) ............. 222 24 10 10 7 24 297

Total contractual cash obligations(3) . . . $1,546 $1,276 $2,889 $247 $1,174 $5,432 $12,564

(1) Excludes interest.

(2) Purchase obligations consist of commitments for purchases of good and services.

(3) Other long-term liabilities primarily consist of the following: pension and postretirement costs, income taxes, warranty and

environmental liabilities and are excluded from this table. We are unable to estimate the timing of payment for these items

due to the inherent uncertainties of obligations of this type. The minimum required contributions to our pension plans are

expected to be approximately $151 million in 2007 and we expect to pay $26 million in 2007 related to postretirement benefit

plans.

At September 29, 2006, the Company had outstanding letters of credit and bank guarantees in the

amount of $1.3 billion.

At September 29, 2006, TIGSA had unsecured credit facilities of $1.5 billion due December 21,

2007, and $1.0 billion due December 16, 2009, of which $1.8 billion was undrawn and available (see

Note 15 to the Consolidated Financial Statements). In addition, certain of the Company’s operating

subsidiaries have uncommitted overdraft and similar types of facilities, which total $624 million, of

which $606 million was undrawn and available at September 29, 2006. These facilities expire at various

2006 Financials 61