ADT 2006 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2006 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

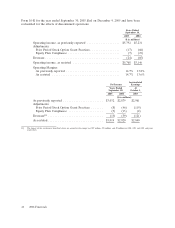

related to the Proposed Separation as well as incremental stock option charges of $35 million required

under SFAS No. 123R.

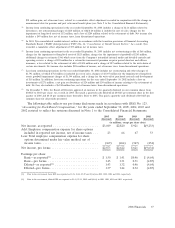

Attrition rates for customers in our Worldwide Electronic Security Services business decreased to

13.8% on a trailing twelve-month basis for 2006, as compared to 14.8% for 2005 and 15.1% in 2004.

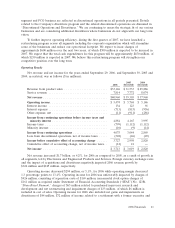

Net revenue for Fire and Security remained relatively level during 2005 as compared to 2004 as

the decrease in product revenue was offset by an increase in service revenue. Revenue from product

sales includes sales and installation of security, fire protection and other systems. Net revenue increased

due to favorable changes in foreign currency exchange rates of $274 million and, to a lesser extent,

increased sales volume of breathing and intrusion products at Tyco Safety Products as well as growth in

our European fire services business. These increases were offset by the impact of divestitures of

$315 million and decreased sales at our security business in Europe.

Operating income increased $317 million in 2005 over the prior year. Results for the current

period included net restructuring, impairment and divestiture charges of $28 million as compared to net

restructuring, impairment and divestiture charges of $264 million in 2004. Operating income for 2005

was also favorably impacted by foreign currency exchange rates of $26 million as well as cost savings

related to operational excellence initiatives and prior year restructuring programs. These cost

reductions were partially offset by increased investment in sales and marketing.

Healthcare

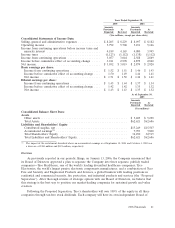

Net revenue, operating income and operating margin for Healthcare for the years ended

September 29, 2006, September 30, 2005 and 2004 were as follows ($ in millions):

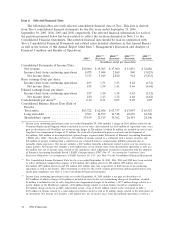

2006 2005 2004

Revenue from product sales ............................. $9,579 $9,477 $9,040

Service revenue ...................................... 62 66 70

Net revenue ........................................ $9,641 $9,543 $9,110

Operating income .................................... $2,200 $2,286 $2,365

Operating margin ..................................... 22.8% 24.0% 26.0%

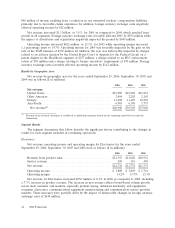

Net revenue for Healthcare increased $98 million or 1.0% in 2006 as compared to 2005. This

increase was largely driven by the International and Surgical divisions within Medical Devices &

Supplies as a result of strong growth across the majority of geographic regions in surgical sales

including laparoscopy, ablation and vessel sealing, and to a lesser extent, sutures. Also contributing to

the revenue increase was volume growth in Bulk Pharmaceuticals (active pharmaceutical ingredients)

and Retail, with growth primarily driven by new product sales and distribution, growth in Latin

America, as well as favorable economic trends and strategic promotional efforts in key markets. These

increases were partially offset by the adverse impact of voluntary product recalls in Imaging and lower

volume sales within Respiratory, in addition to the negative changes in foreign currency exchange rates

of $93 million.

Operating income and operating margin decreased $86 million and 1.2 percentage points,

respectively, as compared to 2005. The increased volume in Medical Devices & Supplies, discussed

above, was more than offset by unfavorable manufacturing performance primarily in Respiratory and

Imaging, as a result of lower volumes and higher expenses primarily associated with voluntary product

recalls, as well as weakness in Retail of $40 million. Also contributing to the decrease in operating

income, although to a lesser extent, was additional investments in research and development and selling

expenses. Operating income was adversely impacted by a charge of $63 million related to purchased

in-process research and development, incremental stock option charges required under SFAS No. 123R

of $37 million, $2 million of charges related to the Proposed Separation and a $31 million negative

46 2006 Financials