ADT 2006 Annual Report Download - page 180

Download and view the complete annual report

Please find page 180 of the 2006 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

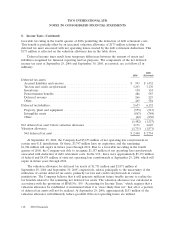

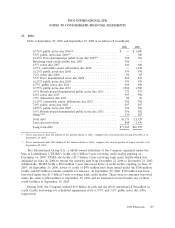

8. Income Taxes (Continued)

favorable tax ruling in the fourth quarter of 2006 permitting the deduction of debt retirement costs.

This benefit is partially offset by an increased valuation allowance of $173 million relating to the

deferred tax asset associated with net operating losses created by the debt retirement deductions. This

$173 million is reflected on the valuation allowance line in the table above.

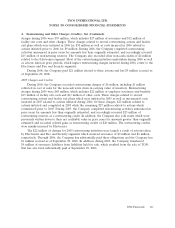

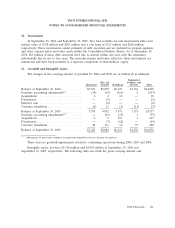

Deferred income taxes result from temporary differences between the amount of assets and

liabilities recognized for financial reporting and tax purposes. The components of the net deferred

income tax asset at September 29, 2006 and September 30, 2005, as restated, are as follows ($ in

millions):

2005

2006 (Restated)

Deferred tax assets:

Accrued liabilities and reserves .................................... $ 993 $1,432

Tax loss and credit carryforwards ................................... 3,293 3,170

Inventories ................................................... 150 154

Postretirement benefits .......................................... 486 587

Deferred revenue .............................................. 266 225

Other ....................................................... 465 584

Deferred tax liabilities: 5,653 6,152

Property, plant and equipment ..................................... (555) (513)

Intangibles assets .............................................. (867) (784)

Other ....................................................... (60) (230)

(1,482) (1,527)

Net deferred tax asset before valuation allowance ........................ 4,171 4,625

Valuation allowance .............................................. (1,731) (1,871)

Net deferred tax asset ........................................... $2,440 $ 2,754

At September 29, 2006, the Company had $5,673 million of net operating loss carryforwards in

certain non-U.S. jurisdictions. Of these, $3,747 million have no expiration, and the remaining

$1,926 million will expire in future years through 2016. Due to a favorable tax ruling in the fourth

quarter of 2006, the Company was able to recognize $1,157 million of net operating loss carryforwards

associated with deduction of debt retirement costs. In the U.S., there were approximately $5,133 million

of federal and $4,675 million of state net operating loss carryforwards at September 29, 2006, which will

expire in future years through 2026.

The valuation allowance for deferred tax assets of $1,731 million and $1,871 million at

September 29, 2006 and September 30, 2005, respectively, relates principally to the uncertainty of the

utilization of certain deferred tax assets, primarily tax loss and credit carryforwards in various

jurisdictions. The Company believes that it will generate sufficient future taxable income to realize the

tax benefits related to the remaining net deferred tax assets. The valuation allowance was calculated in

accordance with the provisions of SFAS No. 109, ‘‘Accounting for Income Taxes,’’ which requires that a

valuation allowance be established or maintained when it is ‘‘more likely than not’’ that all or a portion

of deferred tax assets will not be realized. At September 29, 2006, approximately $153 million of the

valuation allowance will ultimately reduce goodwill if the net operating losses are utilized.

118 2006 Financials