ADT 2006 Annual Report Download - page 218

Download and view the complete annual report

Please find page 218 of the 2006 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

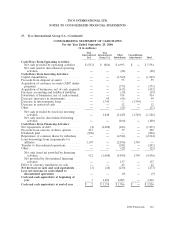

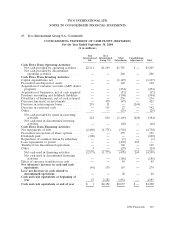

TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

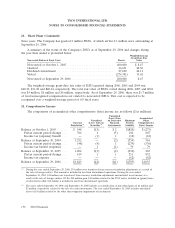

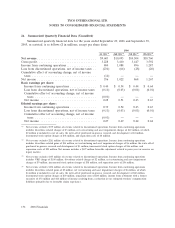

26. Summarized Quarterly Financial Data (Unaudited)

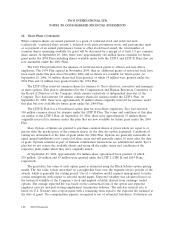

Summarized quarterly financial data for the years ended September 29, 2006 and September 30,

2005, as restated, is as follows ($ in millions, except per share data):

2006

1st Qtr.(1) 2nd Qtr.(2) 3rd Qtr.(3) 4th Qtr.(4)

Net revenue .................................. $9,603 $10,093 $10,504 $10,760

Gross profit .................................. 3,228 3,410 3,447 3,592

Income from continuing operations ................. 804 1,088 896 1,287

Loss from discontinued operations, net of income taxes . . (234) (66) (28) (20)

Cumulative effect of accounting change, net of income

taxes ..................................... (14) — — —

Net income .................................. 556 1,022 868 1,267

Basic earnings per share:

Income from continuing operations ............... $ 0.40 $ 0.54 $ 0.44 $ 0.64

Loss from discontinued operations, net of income taxes (0.11) (0.03) (0.01) (0.01)

Cumulative effect of accounting change, net of income

taxes ................................... (0.01) — — —

Net income ................................ 0.28 0.51 0.43 0.63

Diluted earnings per share:

Income from continuing operations ............... 0.39 0.52 0.43 0.63

Loss from discontinued operations, net of income taxes (0.11) (0.03) (0.01) (0.01)

Cumulative effect of accounting change, net of income

taxes ................................... (0.01) — — —

Net income ................................ 0.27 0.49 0.42 0.62

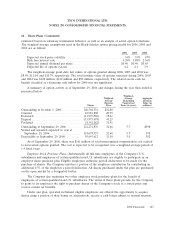

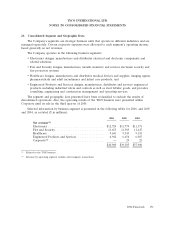

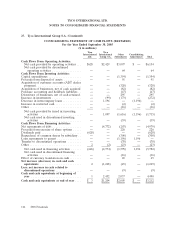

(1) Net revenue excludes $579 million of revenue related to discontinued operations. Income from continuing operations

includes divestiture-related charges of $3 million, net restructuring and asset impairment charges of $12 million, of which

$2 million is included in cost of sales, the write-off of purchased in-process research and development of $2 million,

incremental stock option charges of $48 million, and separation costs of $8 million.

(2) Net revenue excludes $281 million of revenue related to discontinued operations. Income from continuing operations

includes divestiture-related gains of $44 million, net restructuring and asset impairment charges of $6 million, the write-off of

purchased in-process research and development of $1 million, incremental stock option charges of $46 million, and

separation costs of $25 million. Net income includes a $127 million favorable adjustment related to prior year tax reserves on

legacy matters.

(3) Net revenue excludes $145 million of revenue related to discontinued operations. Income from continuing operations

includes VRP charge of $100 million, divestiture-related charges of $2 million, net restructuring and asset impairment

charges of $9 million, incremental stock option charges of $38 million, and separation costs of $56 million.

(4) Net revenue excludes $106 million of revenue related to discontinued operations. Income from continuing operations

includes divestiture-related gains of $5 million, net restructuring and asset impairment charges of $6 million, of which

$4 million is included in cost of sales, the write-off of purchased in-process research and development of $60 million,

incremental stock option charges of $29 million, separation costs of $80 million, income from settlement with a former

executive of $72 million and $48 million of income resulting from a reduction in our estimated workers’ compensation

liabilities primarily due to favorable claims experience.

156 2006 Financials