ADT 2006 Annual Report Download - page 210

Download and view the complete annual report

Please find page 210 of the 2006 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

21. Share Plans (Continued)

Such employees also have the opportunity to forego a portion of their basic salary to purchase

additional shares. As of September 29, 2006, there were 1 million shares available for future issuance

under this plan.

Under the second plan, the Save-As-You-Earn (‘‘SAYE’’) Plan, eligible employees in the United

Kingdom are granted options to purchase shares at the end of three years of service at 85% of the

market price at the time of grant. Options under the SAYE Plan are generally exercisable after a

period of three years and expire six months after the date of vesting. The SAYE Plan provides for a

maximum of 10 million common shares to be issued; as of September 29, 2006, there were 7 million

shares available for future issuance. All of the shares purchased under both the SAYE Plan and the

Irish Bonus Plan are purchased on the open market.

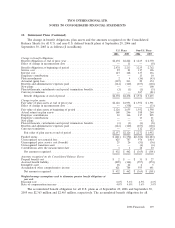

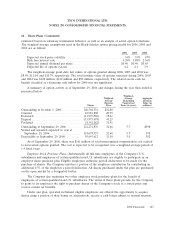

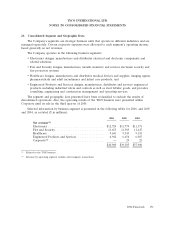

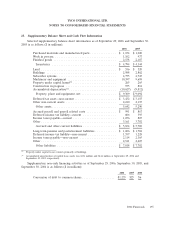

A summary of option activity under the SAYE Plan as of September 29, 2006 and changes during

the year then ended is presented below:

Weighted-

Average Aggregate

Weighted- Remaining Intrinsic

Average Contractual Term Value

Shares Exercise Price (in years) (in millions)

Outstanding at October 1, 2005 ........... 2,486,634 $16.56

Granted ............................ 733,347 21.46

Exercised ........................... (1,669,530) 12.79

Expired ............................. (104,412) 23.82

Forfeited ............................ (84,299) 20.96

Outstanding at September 29, 2006 ......... 1,361,740 22.99 2.2 $ 7

Vested and unvested expected to vest at

September 29, 2006 .................. 1,166,517 22.92 2.2 6

Exercisable at September 29, 2006 ......... 60,252 12.75 0.1 1

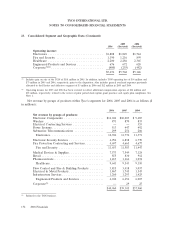

The grant-date-fair value of each option grant is estimated using the Black-Scholes option pricing

model. Assumptions for expected volatility, the average expected life, and the risk-free rate were made

using the same methodology as previously described under Share Options.

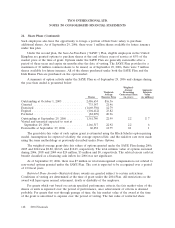

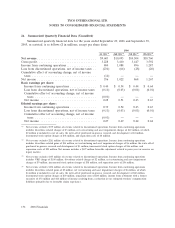

The weighted-average grant-date fair values of options granted under the SAYE Plan during 2006,

2005 and 2004 was $8.80, $12.65, and $12.09, respectively. The total intrinsic value of options exercised

during 2006, 2005 and 2004 was $24 million, $3 million and $0, respectively. The related excess cash tax

benefit classified as a financing cash inflow for 2006 was not significant.

As of September 29, 2006, there was $7 million in total unrecognized compensation cost related to

non-vested options granted under the SAYE Plan. The cost is expected to be recognized over a period

of 2.0 fiscal years.

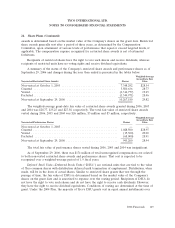

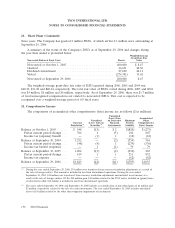

Restricted Share Awards—Restricted share awards are granted subject to certain restrictions.

Conditions of vesting are determined at the time of grant under the 2004 Plan. All restrictions on the

award will lapse upon normal retirement, death or disability of the employee.

For grants which vest based on certain specified performance criteria, the fair market value of the

shares or units is expensed over the period of performance, once achievement of criteria is deemed

probable. For grants that vest through passage of time, the fair market value of the award at the time

of the grant is amortized to expense over the period of vesting. The fair value of restricted share

148 2006 Financials