ADT 2006 Annual Report Download - page 164

Download and view the complete annual report

Please find page 164 of the 2006 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TYCO INTERNATIONAL LTD.

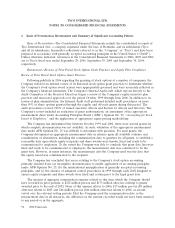

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. Basis of Presentation, Restatement and Summary of Significant Accounting Policies (Continued)

Cash and Cash Equivalents—All highly liquid investments purchased with maturity of three months

or less from the time of purchase are considered to be cash equivalents.

On occasion, the Company is required to post cash collateral to secure obligations in respect of

various construction projects, contractual obligations related to acquisitions or divestitures or other

legal obligations. The amount of restricted cash in collateral was $77 million (of which $39 million is

included in current assets and $38 million is included in long-term assets) and $86 million (of which

$44 million is included in current assets and $42 million is included in long-term assets) at

September 29, 2006 and September 30, 2005, respectively.

Allowance for Doubtful Accounts—The allowance for doubtful accounts receivable reflects the best

estimate of probable losses inherent in Tyco’s receivable portfolio determined on the basis of historical

experience, specific allowances for known troubled accounts and other currently available evidence.

Inventories—Inventories are recorded at the lower of cost (primarily first-in, first-out) or market

value.

Property, Plant and Equipment, Net—Property, plant and equipment, net is recorded at cost less

accumulated depreciation. Depreciation expense for 2006, 2005 and 2004 was $1,415 million,

$1,431 million and $1,407 million, respectively. Maintenance and repair expenditures are charged to

expense when incurred. Depreciation is calculated using the straight-line method over the estimated

useful lives of the related assets as follows:

Buildings and related improvements .... 5 to 50 years

Leasehold improvements ............ Lesser of remaining term of the lease or

economic useful life

Subscriber systems ................. 10 to 14 years

Other machinery, equipment and

furniture and fixtures ............. 2 to 20 years

The Company generally considers its electronic security assets in three asset pools: internally

generated residential systems, internally generated commercial systems and customer accounts acquired

through the ADT dealer program. Subscriber systems represent internally generated residential systems

and internally generated commercial systems (customer accounts acquired through the ADT dealer

program are recorded as intangible assets). The internally generated residential and commercial

account pools are generally amortized using the straight-line method over a ten-year period (a

fourteen-year period is used for national commercial accounts and a fourteen-year period with write-off

of specific accounts upon discontinuance is used for residential and commercial accounts in certain

non-U.S. locations).

Long-Lived Assets—Tyco reviews long-lived assets, including amortizable intangible assets, for

impairment whenever events or changes in business circumstances indicate that the carrying amount of

the asset may not be fully recoverable. Tyco performs undiscounted operating cash flow analyses to

determine if impairment exists. For purposes of recognition and measurement of an impairment for

assets held for use, Tyco groups assets and liabilities at the lowest level for which cash flows are

separately identified. If an impairment is determined to exist, any related impairment loss is calculated

based on fair value. Impairment losses on assets to be disposed of, if any, are based on the estimated

proceeds to be received, less costs of disposal.

102 2006 Financials