ADT 2006 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2006 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

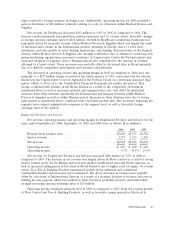

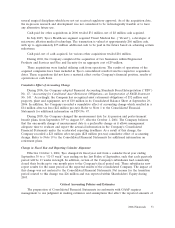

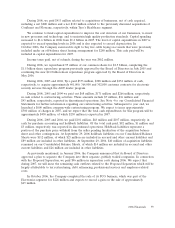

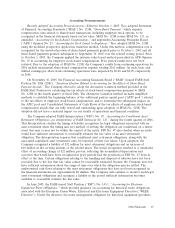

Liquidity and Capital Resources

The sources of our cash flow from operating activities and the use of a portion of that cash in our

operations for the years ended September 29, 2006, and September 30, 2005 and 2004, as restated,

were as follows ($ in millions):

2005 2004

2006 (Restated) (Restated)

Cash flows from operating activities:

Operating income .................................... $5,474 $ 5,768 $ 5,146

Non-cash restructuring and asset impairment charges (credits), net 9 (13) 16

(Gains) losses on divestitures ........................... (44) (271) 111

In-process research and development ...................... 63 — —

Depreciation and amortization(1) ......................... 2,065 2,084 2,098

Non-cash compensation expense ......................... 275 99 121

Deferred income taxes ................................ 72 (28) 167

Provision for losses on accounts receivable and inventory ....... 174 232 317

Other, net(2) ........................................ (47) 148 79

Net increase in working capital .......................... (1,069) (61) (873)

Interest income ..................................... 134 123 91

Interest expense ..................................... (713) (815) (956)

Income tax expense .................................. (799) (1,112) (1,112)

Net cash provided by operating activities ................... $5,594 $ 6,154 $ 5,205

Other cash flow items:

Capital expenditures, net(3) ............................. $(1,514) $(1,263) $ (987)

Decrease in sale of accounts receivable .................... 9 18 929

Acquisition of customer accounts (ADT dealer program) ....... (373) (328) (254)

Purchase accounting and holdback liabilities ................. (19) (47) (104)

Voluntary pension contributions ......................... 2 115 567

(1) Includes depreciation expense of $1,415 million, $1,431 million and $1,407 million in 2006, 2005 and 2004, respectively and

amortization of intangible assets of $650 million, $653 million and $691 million in 2006, 2005 and 2004, respectively.

(2) Includes the add-back of losses on the retirement of debt of $2 million, $1,013 million and $284 million in 2006, 2005 and

2004, respectively.

(3) Includes net proceeds of $55 million, $91 million and $140 million received for the sale/disposition of property, plant and

equipment in 2006, 2005 and 2004, respectively.

The net change in total working capital was a cash decrease of $1,069 million in 2006. The

components of this change are set forth in the Consolidated Statements of Cash Flows. The change in

working capital included an increase of $680 million in inventories and a $332 million decrease in

accrued and other liabilities, primarily related to decreased accrued legal and audit fees, partially offset

by an increase in annual employee bonus compensation.

The provision for losses on accounts receivable and inventory decreased from $232 million during

the year ended September 30, 2005 to $174 million for the current period. This decrease was driven by

improvements across all segments, particularly due to improved accounts receivable aging, an overall

improved credit profile of the customer base, and better collections. Consequently, our allowance for

doubtful accounts decreased from $421 million at September 30, 2005 to $336 million at September 29,

2006.

2006 Financials 57