Wells Fargo 2013 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2013 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Risk Management – Asset/Liability Management (continued)

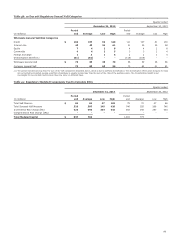

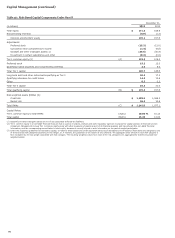

Table 47: Market Risk Regulatory Capital and RWA

December 31, 2013

(in millions)

Risk-

based

capital

Risk-

weighted

assets

Total VaR Measure $ 252 3,149

Total Stressed VaR Measure 921 11,512

Incremental Risk Charge (IRC) 393 4,913

Total Modeled Capital (1) 1,566 19,574

Comprehensive Risk Charge (CRC) - -

Standard Specific Risk Charge:

Securitized Charge 633 7,913

Non-securitized Charge 583 7,289

Total Standard Specific Risk Charge 1,216 15,202

De minimus Charges 125 1,563

Total $ 2,907 36,339

(1) Includes the capital multiplier.

Composition of Material Portfolio of Covered Positions The

Basel 2.5 market risk capital rule substantially modified the

determination of market RWA, and implemented a more risk

sensitive methodology for the risks inherent in certain “covered”

trading positions. The positions that are “covered” by the market

risk capital rule are generally a subset of our trading assets and

trading liabilities, specifically those held by the Company for the

purpose of short-term resale or with the intent of benefiting

from actual or expected short-term price movements, or to lock

in arbitrage profits.

The material portfolio of the Company’s “covered” positions

is predominantly concentrated in the trading assets and trading

liabilities managed within Wholesale Banking, which is the

predominant contributor to the Company’s overall VaR.

Wholesale Banking engages in the fixed income, traded credit,

foreign exchange, equities, and commodities markets businesses.

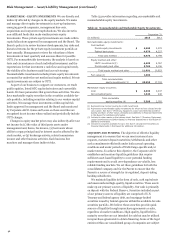

Regulatory Market Risk Capital Components The Company’s

“covered’ positions are subject to the market risk capital

requirements, which are based on internally developed models

or standardized specific risk charges. The market risk regulatory

capital models are subject to internal model risk management

and validation. The models are continuously monitored and

enhanced in response to changes in market conditions,

improvements in system capabilities, and changes in the

Company’s market risk exposure. The Company is required to

obtain and has received prior written approval from its

regulators before using its internally developed models to

calculate the market risk capital charge.

Basel 2.5 prescribes various VaR measures (e.g., Total VaR

Measure) in the determination of regulatory capital and risk-

weighted assets. The Company uses the same VaR models for

both market risk management purposes as well as regulatory

capital calculations.

Regulatory VaR The Regulatory VaR measures include:

Total VaR Measure – is composed of General VaR and

Specific Risk VaR and uses the previous 12 months of

historical market data to comply with regulatory

requirements.

General VaR

Measures the risk of broad market movements

such as changes in the level of interest rates, credit

spreads, equity prices, foreign exchange rates, and

commodity prices.

Uses historical simulation analysis based on 99%

confidence level and a 10-day time horizon.

Specific Risk VaR

Measures the risk of loss that could result from

factors other than broad market movement or

name specific market risk.

Uses Monte Carlo simulation analysis based on a

99% confidence level and a 10-day time horizon.

Total Stressed VaR Measure – uses a historical period of

significant financial stress over a continuous 12 month

period using historically available market data and is

composed of General Stressed VaR and Specific Risk

Stressed VaR. Stressed VaR uses the same methodology and

models as the Total VaR measure.

Incremental Risk Charge An Incremental Risk model, according

to the market risk capital rule, must capture losses due to both

issuer default and migration risk at the 99.9% confidence level

over the one-year capital horizon under the assumption of

constant level of risk or a constant position assumption. The

model covers all credit-sensitive non-securitized products.

The Company calculates Incremental Risk by generating a

portfolio loss distribution utilizing Monte Carlo simulation,

which assumes numerous scenarios, where an assumption is

made that the portfolio’s composition remains constant for a

one-year time horizon. That is, the model will utilize a constant

positions assumption. Individual issuer credit grade migration

and issuer default risk is modeled through generation of the

issuer’s credit rating transition based upon statistical modeling.

Correlation between credit grade migration and default is

captured by a multifactor proprietary model which takes into

account industry classifications as well as regional effects.

Additionally, the impact of market and issuer specific

concentrations is reflected in the modeling framework by

assignment of a higher charge for portfolios that have increasing

concentrations in particular issuers or sectors. Lastly, the model

captures product basis risk; that is, it reflects the material

disparity between a position and its hedge.

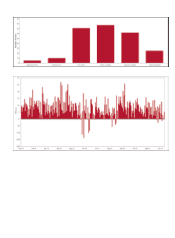

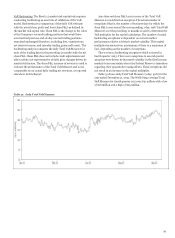

Table 48 shows the General VaR measure categorized by

major risk categories. Table 49 shows the results of the

Company’s modeled components for regulatory capital

calculations. As presented in Table 48, average 10-day General

VaR was $80 million for the quarter ended December 31, 2013,

compared with $64 million for the quarter ended

September 30, 2013. The increase was primarily driven by

changes in portfolio composition.

x

x

o

o

92