Wells Fargo 2013 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2013 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.management’s estimate of losses for loans for which we could

have a repurchase obligation, whether or not we currently service

those loans, based on a combination of factors. Such factors

include default expectations, expected investor repurchase

demands (influenced by current and expected mortgage loan file

requests and mortgage insurance rescission notices, as well as

estimated levels of origination defects) and appeals success rates

(where the investor rescinds the demand based on a cure of the

defect or acknowledges that the loan satisfies the investor’s

applicable representations and warranties), reimbursement by

correspondent and other third party originators, and projected

loss severity. We establish a liability at the time loans are sold

and continually update our liability estimate during the

remaining life of such loans. Although activity can vary by

investor, investors may demand repurchase at any time and

there is often a lag from the date of default to the time we receive

a repurchase demand. The majority of repurchase demands are

on loans that default in the first 24 to 36 months following

origination of the mortgage loan. The most significant portion of

our repurchases under our representation and warranty

provisions are attributable to borrower misrepresentations and

loan underwriting issues.

To date, repurchase demands from private label MBS have

been more limited than GSE-guaranteed securities; however, it is

possible that requests to repurchase mortgage loans in private

label securitizations may increase in frequency as investors

explore every possible avenue to recover losses on their

securities. We evaluate the validity and materiality of any claim

of breach of representations and warranties in private label MBS

that is brought to our attention and work with securitization

trustees to resolve any repurchase requests. Nevertheless, we

may be subject to legal and other expenses if private label

securitization trustees or investors choose to commence legal

proceedings in the event of disagreements.

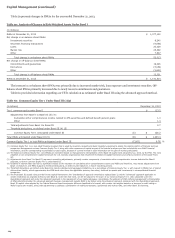

The mortgage loan repurchase liability at December 31, 2013,

represents our best estimate of the probable loss that we may

incur for various representations and warranties in the

contractual provisions of our sales of mortgage loans. Because

the level of mortgage loan repurchase losses is dependent on

economic factors, investor demand strategies and other external

conditions that may change over the life of the underlying loans,

the level of the liability for mortgage loan repurchase losses is

difficult to estimate and requires considerable management

judgment. We maintain regular contact with the GSEs and other

significant investors to monitor and address their repurchase

demand practices and concerns. For additional information on

our repurchase liability, including an adverse impact analysis,

see the “Risk Management – Credit Risk Management – Liability

for Mortgage Loan Repurchase Losses” section and Note 9

(Mortgage Banking Activities) to Financial Statements in this

Report.

Fair Value of Financial Instruments

We use fair value measurements to record fair value adjustments

to certain financial instruments and to determine fair value

disclosures. Trading assets, securities available for sale,

derivatives, substantially all residential MHFS, certain loans held

for investment, certain nonmarketable equity investments,

securities sold but not yet purchased (short sale liabilities) and

certain long-term debt instruments are recorded at fair value on

a recurring basis. Additionally, from time to time, we may be

required to record at fair value other assets on a nonrecurring

basis, such as certain MHFS and LHFS, loans held for

investment and certain other assets. These nonrecurring fair

value adjustments typically involve application of lower-of-cost-

or-market accounting or write-downs of individual assets.

Additionally, for certain financial instruments not recorded at

fair value we disclose the estimate of their fair value.

Fair value represents the price that would be received to sell

the financial asset or paid to transfer the financial liability in an

orderly transaction between market participants at the

measurement date.

The accounting provisions for fair value measurements

include a three-level hierarchy for disclosure of assets and

liabilities recorded at fair value. The classification of assets and

liabilities within the hierarchy is based on whether the inputs to

the valuation methodology used for measurement are observable

or unobservable. Observable inputs reflect market-derived or

market-based information obtained from independent sources,

while unobservable inputs reflect our estimates about market

data. For additional information on fair value levels, see Note 17

(Fair Values of Assets and Liabilities) to Financial Statements in

this Report.

When developing fair value measurements, we maximize the

use of observable inputs and minimize the use of unobservable

inputs. When available, we use quoted prices in active markets to

measure fair value. If quoted prices in active markets are not

available, fair value measurement is based upon models that use

primarily market-based or independently sourced market

parameters, including interest rate yield curves, prepayment

speeds, option volatilities and currency rates. However, in

certain cases, when market observable inputs for model-based

valuation techniques are not readily available, we are required to

make judgments about assumptions market participants would

use to estimate fair value.

The degree of management judgment involved in

determining the fair value of a financial instrument is dependent

upon the availability of quoted prices in active markets or

observable market parameters. For financial instruments with

quoted market prices or observable market parameters in active

markets, there is minimal subjectivity involved in measuring fair

value. When quoted prices and observable data in active markets

are not fully available, management judgment is necessary to

estimate fair value. Changes in the market conditions, such as

reduced liquidity in the capital markets or changes in secondary

market activities, may reduce the availability and reliability of

quoted prices or observable data used to determine fair value.

When significant adjustments are required to price quotes or

inputs, it may be appropriate to utilize an estimate based

primarily on unobservable inputs. When an active market for a

financial instrument does not exist, the use of management

estimates that incorporate current market participant

expectations of future cash flows, adjusted for an appropriate

risk premium, is acceptable.

We may use third party pricing services and brokers

(collectively, “pricing vendors”) to obtain fair values (“vendor

111