Wells Fargo 2013 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2013 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Risk Management – Credit Risk Management (continued)

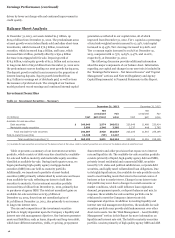

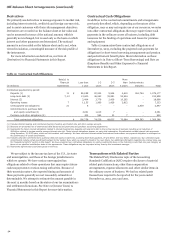

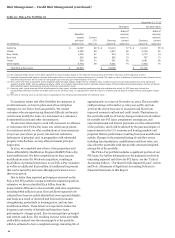

PURCHASED CREDIT-IMPAIRED (PCI) LOANS Loans

acquired with evidence of credit deterioration since their

origination and where it is probable that we will not collect all

contractually required principal and interest payments are PCI

loans. Substantially all of our PCI loans were acquired in the

Wachovia acquisition on December 31, 2008. PCI loans are

recorded at fair value at the date of acquisition, and the

historical allowance for credit losses related to these loans is not

carried over. The carrying value of PCI loans totaled

$26.7 billion at December 31, 2013, down from $31.0 billion and

$58.8 billion at December 31, 2012 and 2008, respectively. Such

loans are considered to be accruing due to the existence of the

accretable yield and not based on consideration given to

contractual interest payments. The accretable yield at

December 31, 2013, was $17.4 billion, which reflects a revision

from the $19.1 billion reported in our earnings release, filed

January 14, 2014, on Form 8-K. This revision primarily reflects a

correction of our projected cash flow estimates for our Pick-a-

Pay portfolio related to the anticipated volume of future

modifications and defaults on modified loans. As a result, the

estimated weighted-average life of our projected cash flow

estimates for our Pick-a-Pay portfolio declined from 14.0 years

to 12.7 years.

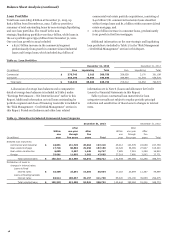

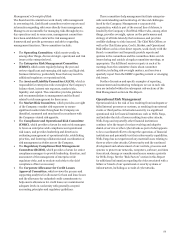

A nonaccretable difference is established for PCI loans to

absorb losses expected on those loans at the date of acquisition.

Amounts absorbed by the nonaccretable difference do not affect

the income statement or the allowance for credit losses.

Substantially all commercial and industrial, CRE and foreign

PCI loans are accounted for as individual loans. Conversely,

Pick-a-Pay and other consumer PCI loans have been aggregated

into pools based on common risk characteristics. Each pool is

accounted for as a single asset with a single composite interest

rate and an aggregate expectation of cash flows.

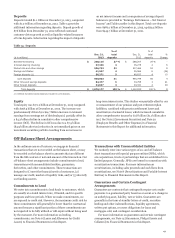

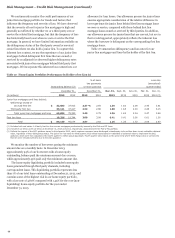

Resolutions of loans may include sales to third parties,

receipt of payments in settlement with the borrower, or

foreclosure of the collateral. Our policy is to remove an

individual PCI loan from a pool based on comparing the amount

received from its resolution with its contractual amount. Any

difference between these amounts is absorbed by the

nonaccretable difference. This removal method assumes that the

amount received from resolution approximates pool

performance expectations. The accretable yield percentage is

unaffected by the resolution and any changes in the effective

yield for the remaining loans in the pool are addressed by our

quarterly cash flow evaluation process for each pool. For loans

that are resolved by payment in full, there is no release of the

nonaccretable difference for the pool because there is no

difference between the amount received at resolution and the

contractual amount of the loan. Modified PCI loans are not

removed from a pool even if those loans would otherwise be

deemed TDRs. Modified PCI loans that are accounted for

individually are TDRs, and removed from PCI accounting, if

there has been a concession granted in excess of the original

nonaccretable difference. We include these TDRs in our

impaired loans.

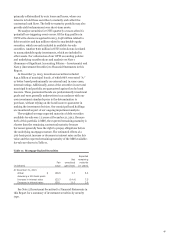

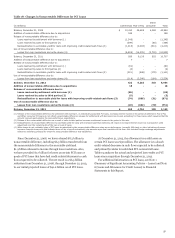

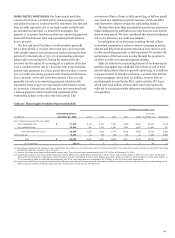

During 2013, we recognized as income $91 million released

from the nonaccretable difference related to commercial PCI

loans due to payoffs and other resolutions. We also transferred

$971 million from the nonaccretable difference to the accretable

yield for PCI loans with improving credit-related cash flows and

absorbed $751 million of losses in the nonaccretable difference

from loan resolutions and write-downs. Our cash flows expected

to be collected have been favorably affected by lower than

expected defaults and losses as a result of observed economic

strengthening, particularly in housing prices, and by our loan

modification efforts. See the “Real Estate 1-4 Family First and

Junior Lien Mortgage Loans” section in this Report for

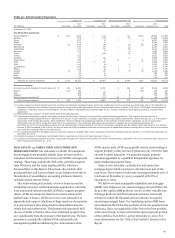

additional information. Table 18 provides an analysis of changes

in the nonaccretable difference.

56