Wells Fargo 2013 Annual Report Download - page 208

Download and view the complete annual report

Please find page 208 of the 2013 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Note 15: Legal Actions (continued)

filed. The complaint alleges that Wells Fargo and others violated

the Maryland Finder’s Fee Act in the closing of mortgage loans in

Maryland. On March 13, 2013, the Court held the plaintiff class

did not have sufficient evidence to proceed to trial, which was

previously set for March 18, 2013. On June 20, 2013, the Court

entered judgment in favor of the defendants. The plaintiffs have

appealed.

MORTGAGE RELATED REGULATORY INVESTIGATIONS

Government agencies continue investigations or examinations of

certain mortgage related practices of Wells Fargo and

predecessor institutions. Wells Fargo, for itself and for

predecessor institutions, has responded, and continues to

respond, to requests from government agencies seeking

information regarding the origination, underwriting and

securitization of residential mortgages, including sub-prime

mortgages.

ORDER OF POSTING LITIGATION A series of putative class

actions have been filed against Wachovia Bank, N.A. and Wells

Fargo Bank, N.A., as well as many other banks, challenging the

high to low order in which the banks post debit card transactions

to consumer deposit accounts. There are currently several such

cases pending against Wells Fargo Bank (including the Wachovia

Bank cases to which Wells Fargo succeeded), most of which have

been consolidated in multi-district litigation proceedings in the

U.S. District Court for the Southern District of Florida. The bank

defendants moved to compel these cases to arbitration under

recent Supreme Court authority. On November 22, 2011, the

Judge denied the motion. The bank defendants appealed the

decision to the U.S. Court of Appeals for the Eleventh Circuit. On

October 26, 2012, the Eleventh Circuit affirmed the District

Court’s denial of the motion. Wells Fargo renewed its motion to

compel arbitration with respect to the unnamed putative class

members. On April 8, 2013, the District Court denied the

motion. Wells Fargo has appealed the decision to the Eleventh

Circuit.

On August 10, 2010, the U.S. District Court for the Northern

District of California issued an order in Gutierrez v. Wells Fargo

Bank, N.A., a case that was not consolidated in the multi-district

proceedings, enjoining the bank’s use of the high to low posting

method for debit card transactions with respect to the plaintiff

class of California depositors, directing the bank to establish a

different posting methodology and ordering remediation of

approximately $203 million. On October 26, 2010, a final

judgment was entered in Gutierrez. On October 28, 2010, Wells

Fargo appealed to the U.S. Court of Appeals for the Ninth

Circuit. On December 26, 2012, the Ninth Circuit reversed the

order requiring Wells Fargo to change its order of posting and

vacated the portion of the order granting remediation of

approximately $203 million on the grounds of federal

preemption. The Ninth Circuit affirmed the District Court’s

finding that Wells Fargo violated a California state law

prohibition on fraudulent representations and remanded the

case to the District Court for further proceedings. On

August 5, 2013, the District Court entered a judgment against

Wells Fargo in the approximate amount of $203 million,

together with post-judgment interest thereon from

October 25, 2010, and, effective as of July 15, 2013, enjoined

Wells Fargo from making or disseminating additional

misrepresentations about its order of posting of transactions. On

August 7, 2013, Wells Fargo appealed the judgment to the Ninth

Circuit.

SECURITIES LENDING LITIGATION Wells Fargo Bank, N.A. is

involved in five separate pending actions brought by securities

lending customers of Wells Fargo and Wachovia Bank in various

courts. In general, each of the cases alleges that Wells Fargo

violated fiduciary and contractual duties by investing collateral

for loaned securities in investments that suffered losses. One of

the cases, filed on March 27, 2012, is composed of a class of

Wells Fargo securities lending customers in a case captioned

City of Farmington Hills Employees Retirement System v. Wells

Fargo Bank, N.A. The class action is pending in the U.S. District

Court for the District of Minnesota.

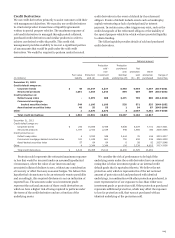

OUTLOOK When establishing a liability for contingent litigation

losses, the Company determines a range of potential losses for

each matter that is both probable and estimable, and records the

amount it considers to be the best estimate within the range. The

high end of the range of reasonably possible potential litigation

losses in excess of the Company’s liability for probable and

estimable losses was $951 million as of December 31, 2013. For

these matters and others where an unfavorable outcome is

reasonably possible but not probable, there may be a range of

possible losses in excess of the established liability that cannot

be estimated. Based on information currently available, advice of

counsel, available insurance coverage and established reserves,

Wells Fargo believes that the eventual outcome of the actions

against Wells Fargo and/or its subsidiaries, including the

matters described above, will not, individually or in the

aggregate, have a material adverse effect on Wells Fargo’s

consolidated financial position. However, in the event of

unexpected future developments, it is possible that the ultimate

resolution of those matters, if unfavorable, may be material to

Wells Fargo’s results of operations for any particular period.

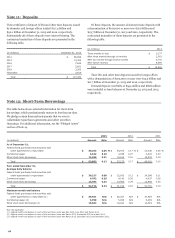

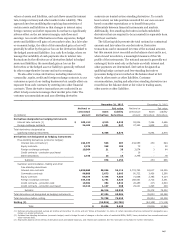

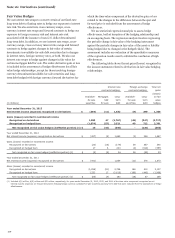

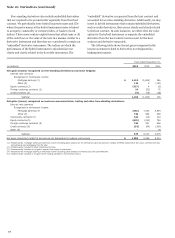

Note 16: Derivatives

We primarily use derivatives to manage exposure to market risk,

including interest rate risk, credit risk and foreign currency risk,

and to assist customers with their risk management objectives.

We designate derivatives either as hedging instruments in a

qualifying hedge accounting relationship (fair value or cash flow

hedge) or as free-standing derivatives. Free-standing derivatives

include economic hedges that do not qualify for hedge

accounting and derivatives held for customer accommodation or

other trading purposes.

Our asset/liability management approach to interest rate,

foreign currency and certain other risks includes the use of

derivatives. Such derivatives are typically designated as fair

value or cash flow hedges, or economic hedges. This helps

minimize significant, unplanned fluctuations in earnings, fair

206