Wells Fargo 2013 Annual Report Download - page 178

Download and view the complete annual report

Please find page 178 of the 2013 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

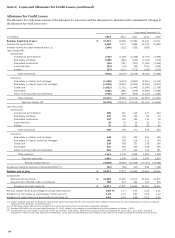

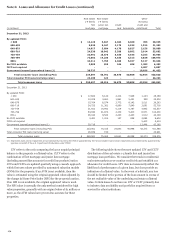

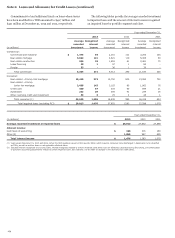

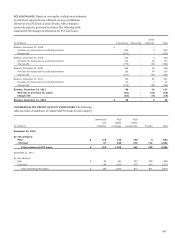

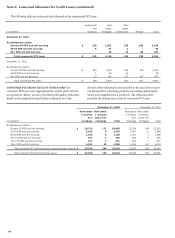

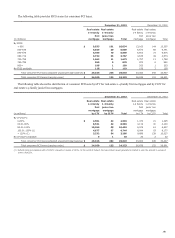

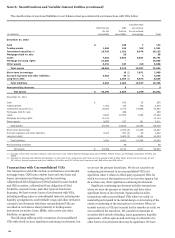

Note 6: Loans and Allowance for Credit Losses (continued)

Primary modification type (1) Financial effects of modifications

(in millions) Principal (2)

Interest

rate

reduction

Other

concessions (3) Total

Charge-

offs (4)

Weighted

average

interest

rate

reduction

Recorded

investment

related to

interest rate

reduction (5)

Year ended December 31, 2013

Commercial:

Commercial and industrial $ 4 176 1,081 1,261 17 4.71 % $ 176

Real estate mortgage 33 307 1,391 1,731 8 1.66 308

Real estate construction - 12 381 393 4 1.07 12

Lease financing - - - - - - -

Foreign 15 1 - 16 - - 1

Total commercial 52 496 2,853 3,401 29 2.72 497

Consumer:

Real estate 1-4 family first mortgage 1,143 1,170 3,681 5,994 233 2.64 2,019

Real estate 1-4 family junior lien mortgage 103 181 472 756 42 3.33 276

Credit card - 182 - 182 - 10.38 182

Automobile 3 12 97 112 34 7.66 12

Other revolving credit and installment - 10 12 22 - 4.87 10

Trial modifications (6) - - 50 50 - - -

Total consumer 1,249 1,555 4,312 7,116 309 3.31 2,499

Total $ 1,301 2,051 7,165 10,517 338 3.21 % $ 2,996

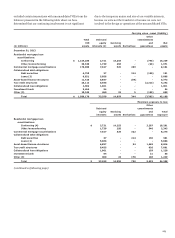

Year ended December 31, 2012

Commercial:

Commercial and industrial $ 11 35 1,370 1,416 40 1.60 % $ 38

Real estate mortgage 47 219 1,907 2,173 12 1.57 226

Real estate construction 12 19 531 562 10 1.69 19

Lease financing - - 4 4 - - -

Foreign - - 19 19 - - -

Total commercial 70 273 3,831 4,174 62 1.58 283

Consumer:

Real estate 1-4 family first mortgage 1,371 1,302 5,822 8,495 547 3.00 2,379

Real estate 1-4 family junior lien mortgage 79 244 756 1,079 512 3.70 313

Credit card - 241 - 241 - 10.85 241

Automobile 5 54 265 324 50 6.90 56

Other revolving credit and installment - 1 22 23 5 4.29 2

Trial modifications (6) -- 666 666 - - -

Total consumer 1,455 1,842 7,531 10,828 1,114 3.78 2,991

Total $ 1,525 2,115 11,362 15,002 1,176 3.59 % $ 3,274

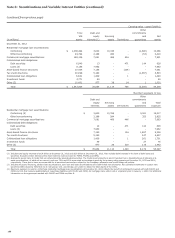

Year ended December 31, 2011

Commercial:

Commercial and industrial $ 166 64 2,412 2,642 84 3.13 % $ 69

Real estate mortgage 113 146 1,894 2,153 24 1.46 160

Real estate construction 29 114 421 564 26 0.81 125

Lease financing - - 57 57 - - -

Foreign - - 22 22 - - -

Total commercial 308 324 4,806 5,438 134 1.55 354

Consumer:

Real estate 1-4 family first mortgage 1,629 1,908 934 4,471 293 3.27 3,322

Real estate 1-4 family junior lien mortgage 98 559 197 854 28 4.34 654

Credit card - 336 - 336 2 10.77 260

Automobile 73 115 3 191 23 6.39 177

Other revolving credit and installment 1 4 4 9 1 5.00 4

Trial modifications (6) -- 651 651 - - -

Total consumer 1,801 2,922 1,789 6,512 347 4.00 4,417

Total $ 2,109 3,246 6,595 11,950 481 3.82 % $ 4,771

(1) Amounts represent the recorded investment in loans after recognizing the effects of the TDR, if any. TDRs may have multiple types of concessions, but are presented only

once in the first modification type based on the order presented in the table above. The reported amounts include loans remodified of $3.1 billion, $3.9 billion and

$496 million, for the years ended December 31, 2013, 2012 and 2011, respectively, which reflect the impact of the prospective adoption of the OCC guidance issued in 2012.

(2) Principal modifications include principal forgiveness at the time of the modification, contingent principal forgiveness granted over the life of the loan based on borrower

performance, and principal that has been legally separated and deferred to the end of the loan, with a zero percent contractual interest rate.

(3) Other concessions include loan renewals, term extensions and other interest and noninterest adjustments, but exclude modifications that also forgive principal and/or reduce

the interest rate. Years ended December 2013 and 2012 includes $4.0 billion and $5.2 billion of consumer loans discharged in bankruptcy, respectively, as a result of the

OCC guidance implementation. The OCC guidance issued in third quarter 2012 required consumer loans discharged in bankruptcy to be classified as TDRs, as well as written

down to net realizable collateral value.

(4) Charge-offs include write-downs of the investment in the loan in the period it is contractually modified. The amount of charge-off will differ from the modification terms if the

loan has been charged down prior to the modification based on our policies. In addition, there may be cases where we have a charge-off/down with no legal principal

modification. Modifications resulted in legally forgiving principal (actual, contingent or deferred) of $393 million, $495 million and $577 million for the years ended

December 31, 2013, 2012 and 2011, respectively.

(5) Reflects the effect of reduced interest rates on loans with principal or interest rate reduction primary modification type.

(6) Trial modifications are granted a delay in payments due under the original terms during the trial payment period. However, these loans continue to advance through

delinquency status and accrue interest according to their original terms. Any subsequent permanent modification generally includes interest rate related concessions;

however, the exact concession type and resulting financial effect are usually not known until the loan is permanently modified. Trial modifications for the period are

presented net of previously reported trial modifications that became permanent in the current period.

176