Wells Fargo 2013 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2013 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272

|

|

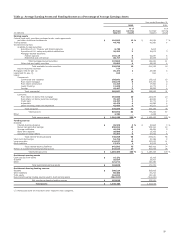

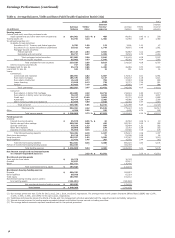

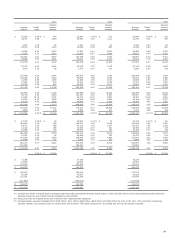

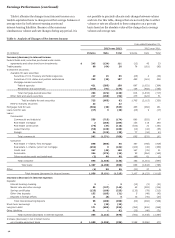

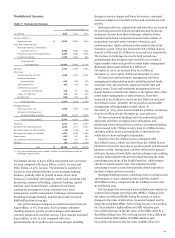

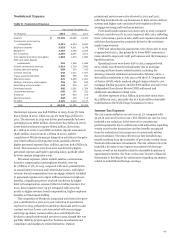

Table 4: Average Earning Assets and Funding Sources as a Percentage of Average Earnings Assets

Year ended December 31,

2013 2012

(in millions)

Average

balance

% of

earning

assets

Averag

balance

% of

e earning

assets

Earning assets

Federal funds sold, securities purchased under resale agreements

and other short-term investments $ 154,902 12 % $ 84,081 7 %

Trading assets 44,745 4 41,950 4

Investment securities:

Available-for-sale securities:

Securities of U.S. Treasury and federal agencies 6,750 1 3,604 -

Securities of U.S. states and political subdivisions

Mortgage-backed securities:

39,922 3 34,875 3

Federal agencies 107,148 8 92,887 8

Residential and commercial 30,717 3 33,545 3

Total mortgage-backed securities 137,865 11 126,432 11

Other debt and equity securities 55,002 4 49,245 4

Total available-for-sale securities 239,539 19 214,156 18

Held-to-maturity securities 717 - - -

Mortgages held for sale (1) 35,273 3 48,955 4

Loans held for sale (1) 163 - 661 -

Loans:

Commercial:

Commercial and industrial 188,092 15 173,913 15

Real estate mortgage 105,475 8 105,437 9

Real estate construction 16,445 1 17,963 2

Lease financing 12,048 1 12,771 1

Foreign 43,447 3 39,852 4

Total commercial 365,507 28 349,936 31

Consumer:

Real estate 1-4 family first mortgage 254,000 20 234,619 20

Real estate 1-4 family junior lien mortgag 70,227 5 80,840 7

Credit card 24,747 2 22,772 2

Automobile 48,476 4 44,986 4

Other revolving credit and installment 42,035 3 42,071 3

Total consumer 439,485 34 425,288 36

Total loans (1) 804,992 62 775,224 67

Other 4,354 - 4,438 -

Total earning assets $ 1,284,685 100 % $ 1,169,465 100 %

Funding sources

Deposits:

Interest-bearing checking $ 35,570 3 % $ 30,564 3 %

Market rate and other savings 550,394 43 505,310 43

Savings certificates 49,510 4 59,484 5

Other time deposits 28,090 2 13,363 1

Deposits in foreign offices 76,894 6 67,920 6

Total interest-bearing deposits 740,458 58 676,641 58

Short-term borrowings 54,716 4 51,196 4

Long-term debt 134,937 10 127,547 11

Other liabilities 12,471 1 10,032 1

Total interest-bearing liabilities 942,582 73 865,416 74

Portion of noninterest-bearing funding sources 342,103 27 304,049 26

Total funding sources $ 1,284,685 100 % $ 1,169,465 100 %

Noninterest-earning assets

Cash and due from banks $ 16,272 16,303

Goodwill 25,637 25,417

Other 121,711 130,450

Total noninterest-earning assets $ 163,620 172,170

Noninterest-bearing funding sources

Deposits $ 280,229 263,863

Other liabilities 60,500 61,214

Total equity 164,994 151,142

Noninterest-bearing funding sources used to fund earning assets (342,103) (304,049)

Net noninterest-bearing funding sources $ 163,620 172,170

Total assets $ 1,448,305 1,341,635

(1) Nonaccrual loans are included in their respective loan categories.

37