Wells Fargo 2013 Annual Report Download - page 203

Download and view the complete annual report

Please find page 203 of the 2013 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

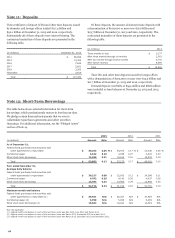

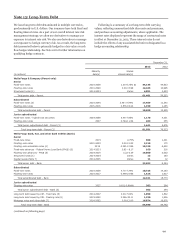

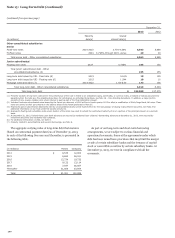

- -

- - - - -

- -

-

- - - -

-

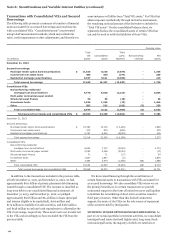

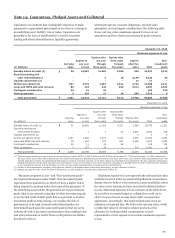

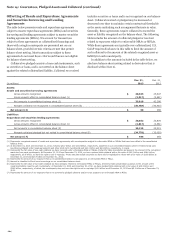

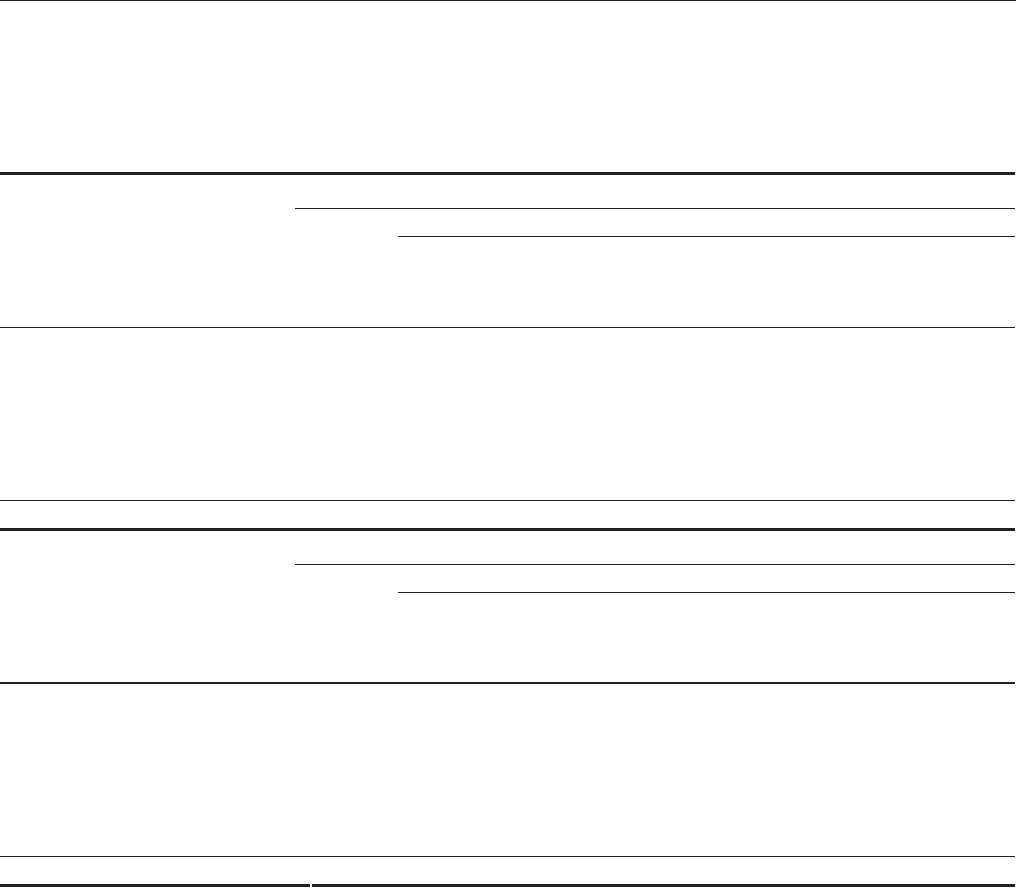

Note 14: Guarantees, Pledged Assets and Collateral

Guarantees are contracts that contingently require us to make

payments to a guaranteed party based on an event or a change in

an underlying asset, liability, rate or index. Guarantees are

generally in the form of standby letters of credit, securities

lending and other indemnifications, liquidity agreements,

written put options, recourse obligations, residual value

guarantees, and contingent consideration. The following table

shows carrying value, maximum exposure to loss on our

guarantees and the related non-investment grade amounts.

December 31, 2013

Maximum exposure to loss

$

$

$

$

(in millions)

Carrying

value

Expires in

one year

or less

Expires after

one year

through

three years

Expires after

three years

through

five years

Expires

after five

years Total

Non-

investment

grade

Standby letters of credit (1) 56 16,907 11,628 5,308 994 34,837 9,512

Securities lending and

other indemnifications 3 18 3,199 3,220 25

Liquidity agreements (2) 17 17

Written put options (3) 907 4,775 2,967 3,521 2,725 13,988 4,311

Loans and MHFS sold with recourse 86 116 418 849 5,014 6,397 3,674

Contingent consideration 30 15 94 109 109

Other guarantees 3 329 17 16 954 1,316 4

Total guarantees 1,082 22,142 15,127 9,712 12,903 59,884 17,635

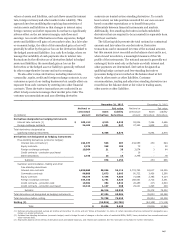

December 31, 2012

Maximum exposure to loss

(in millions)

Carrying

value

Expires in

one year

or less

Expires after

one year

through

three years

Expires after

three years

through

five years

Expires after

five years Total

Non-

investment

grade

Standby letters of credit (1) 42 19,463 11,782 6,531 1,983 39,759 11,331

Securities lending and

other indemnifications 3 7 20 2,511 2,541 118

Liquidity agreements (2) 3 3 3

Written put options (2)(3) 1,427 2,951 3,873 2,475 2,575 11,874 3,953

Loans and MHFS sold with recourse 99 443 357 647 4,426 5,873 3,905

Contingent consideration 35 11 24 94 129 129

Other guarantees 3 677 26 1 717 1,421 4

Total guarantees 1,606 23,548 16,069 9,768 12,215 61,600 19,443

(1) Total maximum exposure to loss includes direct pay letters of credit (DPLCs) of $16.8 billion and $18.5 billion at December 31, 2013 and December 31, 2012, respectively.

We issue DPLCs to provide credit enhancements for certain bond issuances. Beneficiaries (bond trustees) may draw upon these instruments to make scheduled principal and

interest payments, redeem all outstanding bonds because a default event has occurred, or for other reasons as permitted by the agreement. We also originate multipurpose

lending commitments under which borrowers have the option to draw on the facility in one of several forms, including as a standby letter of credit. Total maximum exposure

to loss includes the portion of these facilities for which we have issued standby letters of credit under the commitments.

(2) Certain of these agreements included in this table are related to off-balance sheet entities and, accordingly, are also disclosed in Note 8.

(3) Written put options, which are in the form of derivatives, are also included in the derivative disclosures in Note 16.

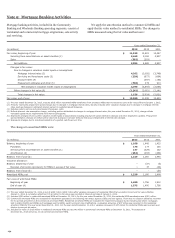

“Maximum exposure to loss” and “Non-investment grade”

are required disclosures under GAAP. Non-investment grade

represents those guarantees on which we have a higher risk of

being required to perform under the terms of the guarantee. If

the underlying assets under the guarantee are non-investment

grade (that is, an external rating that is below investment grade

or an internal credit default grade that is equivalent to a below

investment grade external rating), we consider the risk of

performance to be high. Internal credit default grades are

determined based upon the same credit policies that we use to

evaluate the risk of payment or performance when making loans

and other extensions of credit. These credit policies are further

described in Note 6.

Maximum exposure to loss represents the estimated loss that

would be incurred under an assumed hypothetical circumstance,

despite what we believe is its extremely remote possibility, where

the value of our interests and any associated collateral declines

to zero. Maximum exposure to loss estimates in the table above

do not reflect economic hedges or collateral we could use to

offset or recover losses we may incur under our guarantee

agreements. Accordingly, this required disclosure is not an

indication of expected loss. We believe the carrying value, which

is either fair value for derivative related products or the

allowance for lending related commitments, is more

representative of our exposure to loss than maximum exposure

to loss.

201