Wells Fargo 2013 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2013 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

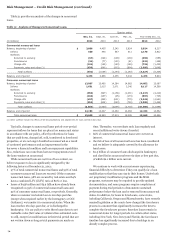

Pick-a-Pay Portfolio The Pick-a-Pay portfolio was one of the

consumer residential first mortgage portfolios we acquired from

Wachovia and a majority of the portfolio was identified as PCI

loans.

The Pick-a-Pay portfolio includes loans that offer payment

options (Pick-a-Pay option payment loans), and also includes

loans that were originated without the option payment feature,

loans that no longer offer the option feature as a result of our

modification efforts since the acquisition, and loans where the

customer voluntarily converted to a fixed-rate product. The Pick-

a-Pay portfolio is included in the consumer real estate 1-4 family

first mortgage class of loans throughout this Report. Real estate

1-4 family junior lien mortgages and lines of credit associated

with Pick-a-Pay loans are reported in the home equity portfolio.

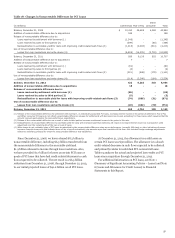

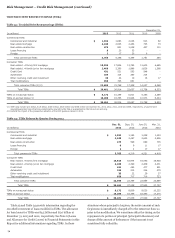

Table 24 provides balances by types of loans as of

December 31, 2013, as a result of modification efforts, compared

to the types of loans included in the portfolio at acquisition.

Total adjusted unpaid principal balance of PCI Pick-a-Pay loans

was $28.8 billion at December 31, 2013, compared with

$61.0 billion at acquisition. Modification efforts have largely

involved option payment PCI loans, which, based on adjusted

unpaid principal balance, have declined to 17% of the total Pick-

a-Pay portfolio at December 31, 2013, compared with 51% at

acquisition.

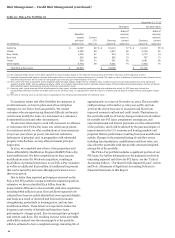

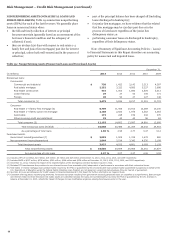

Table 24: Pick-a-Pay Portfolio - Comparison to Acquisition Date

December 31,

2013 2008

(in millions)

Adjusted

unpaid

principal

balance (1) % of total

Adjusted

unpaid

principal

balance (1) % of total

Option payment loans $ 24,420 44 % $ 99,937 86 %

Non-option payment adjustable-rate

and fixed-rate loans (2) 7,892 14 15,763 14

Full-term loan modifications 23,509 42 - -

Total adjusted unpaid principal balance (2) $ 55,821 100 % $ 115,700 100 %

Total carrying value $ 50,971 $ 95,315

(1) Adjusted unpaid principal balance includes write-downs taken on loans where severe delinquency (normally 180 days) or other indications of severe borrower financial stress

exist that indicate there will be a loss of contractually due amounts upon final resolution of the loan.

(2) Includes loans refinanced under the Consumer Relief Refinance Program.

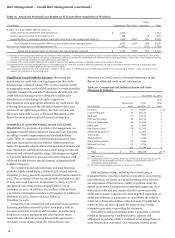

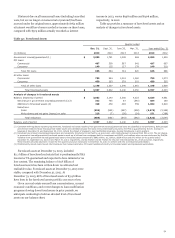

Pick-a-Pay loans may have fixed or adjustable rates with

payment options that include a minimum payment, an interest-

only payment or fully amortizing payment (both 15 and 30 year

options). Total interest deferred due to negative amortization on

Pick-a-Pay loans was $902 million at December 31, 2013, and

$1.4 billion at December 31, 2012. Approximately 93% of the

Pick-a-Pay customers making a minimum payment in

December 2013 did not defer interest, compared with 90% in

December 2012.

Deferral of interest on a Pick-a-Pay loan may continue as

long as the loan balance remains below a pre-defined principal

cap, which is based on the percentage that the current loan

balance represents to the original loan balance. The majority of

the Pick-a-Pay portfolio has a cap of 125% of the original loan

balance. Most of the Pick-a-Pay loans on which there is a

deferred interest balance re-amortize (the monthly payment

amount is reset or “recast”) on the earlier of the date when the

loan balance reaches its principal cap, or generally the 10-year

anniversary of the loan. After a recast, the customers’ new

payment terms are reset to the amount necessary to repay the

balance over the remainder of the original loan term.

Due to the terms of the Pick-a-Pay portfolio, there is little

recast risk in the near term where borrowers will have a payment

change over 7.5%. Based on assumptions of a flat rate

environment, if all eligible customers elect the minimum

payment option 100% of the time and no balances prepay, we

would expect the following balances of loans to recast based on

reaching the principal cap and also experiencing a payment

change over the annual 7.5% reset: $40 million in 2014,

$69 million in 2015 and $45 million in 2016. In addition, in a

flat rate environment, we would expect the following balances of

loans to start fully amortizing due to reaching their recast

anniversary date and also having a payment change over the

annual 7.5% reset: $211 million in 2014, $411 million in 2015

and $470 million in 2016. In 2013, the amount of loans reaching

their recast anniversary date and also having a payment change

over the annual 7.5% reset was $36 million.

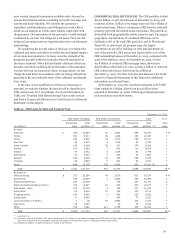

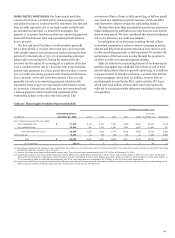

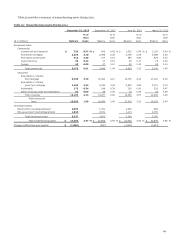

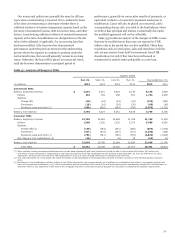

Table 25 reflects the geographic distribution of the Pick-a-

Pay portfolio broken out between PCI loans and all other loans.

The LTV ratio is a useful metric in predicting future real estate

1-4 family first mortgage loan performance, including potential

charge-offs. Because PCI loans were initially recorded at fair

value, including write-downs for expected credit losses, the ratio

of the carrying value to the current collateral value will be lower

compared with the LTV based on the adjusted unpaid principal

balance. For informational purposes, we have included both

ratios for PCI loans in the following table.

63