Wells Fargo 2013 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2013 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

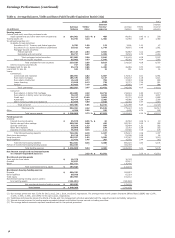

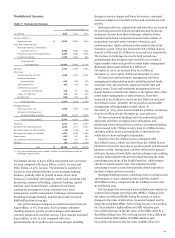

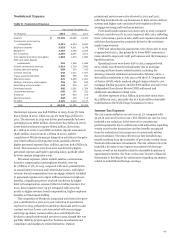

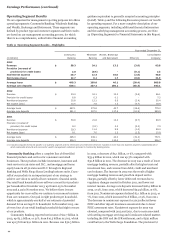

Earnings Performance (continued)

driven by lower net charge-offs and continued improvement in

credit quality.

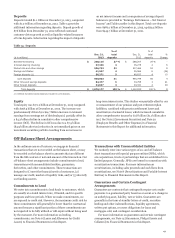

Balance Sheet Analysis

At December 31, 2013, our assets totaled $1.5 trillion, up

$104.0 billion from December 31, 2012. The predominant areas

of asset growth were in federal funds sold and other short-term

investments, which increased $76.5 billion, investment

securities, which increased $29.2 billion, and loans, which

increased $26.2 billion, partially offset by a $30.4 billion

decrease in mortgages held for sale. Deposit growth of

$76.3 billion, total equity growth of $12.1 billion and an increase

in long-term debt of $25.6 billion from December 31, 2012 were

the predominant sources funding our asset growth during 2013.

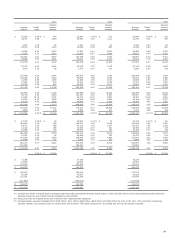

The deposit growth resulted in an increase in the proportion of

interest-bearing deposits. Equity growth benefited from

$14.7 billion in earnings net of dividends paid, as well as from

the issuance of preferred stock. The strength of our business

model produced record earnings and continued internal capital

generation as reflected in our capital ratios, all of which

improved from December 31, 2012. Tier 1 capital as a percentage

of total risk-weighted assets increased to 12.33%, total capital

increased to 15.43%, Tier 1 leverage increased to 9.60%, and

Tier 1 common equity increased to 10.82% at December 31,

2013, compared with 11.75%, 14.63%, 9.47%, and 10.12%,

respectively, at December 31, 2012.

The following discussion provides additional information

about the major components of our balance sheet. Information

regarding our capital and changes in our asset mix is included in

the “Earnings Performance – Net Interest Income” and “Capital

Management” sections and Note 26 (Regulatory and Agency

Capital Requirements) to Financial Statements in this Report.

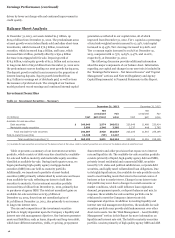

Investment Securities

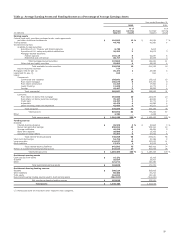

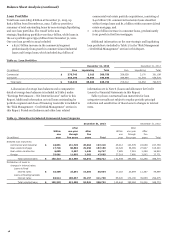

Table 10: Investment Securities – Summary

December 31, 2013 December 31, 2012

(in millions) Cost

Net

unrealized

gain (loss)

Fair

value Cost

Net

unrealized

gain

Fair

value

Available-for-sale securities:

Debt securities $ 246,048 2,574 248,622 220,946 11,468 232,414

Marketable equity securities 2,039 1,346 3,385 2,337 448 2,785

Total available-for-sale securities 248,087 3,920 252,007 223,283 11,916 235,199

Held-to-maturity securities 12,346 (99) 12,247 - - -

Total investment securities (1) $ 260,433 3,821 264,254 223,283 11,916 235,199

(1) Available-for-sale securities are carried on the balance sheet at fair value. Held-to-maturity securities are carried on the balance sheet at amortized cost.

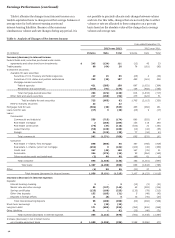

Table 10 presents a summary of our investment securities

portfolio, which consists of debt securities classified as available-

for-sale and held-to-maturity and marketable equity securities

classified as available-for-sale. During fourth quarter 2013, we

began purchasing high-quality agency mortgage-backed

securities (MBS) into our held-to-maturity portfolio.

Additionally, we transferred a portfolio of asset-backed

securities (ABS) primarily collateralized by auto loans and leases

from available-for-sale, reflecting our intent to hold these

securities to maturity. Our investment securities portfolio

increased $29.2 billion from December 31, 2012, primarily due

to purchases of agency MBS. The total net unrealized gains on

available-for-sale securities were $3.9 billion at

December 31, 2013, down from net unrealized gains of

$11.9 billion at December 31, 2012, due primarily to an increase

in long-term interest rates.

The size and composition of the investment securities

portfolio is largely dependent upon the Company’s liquidity and

interest rate risk management objectives. Our business generates

assets and liabilities, such as loans, deposits and long-term debt,

which have different maturities, yields, re-pricing, prepayment

characteristics and other provisions that expose us to interest

rate and liquidity risk. The available-for-sale securities portfolio

consists primarily of liquid, high quality agency debt and MBS,

privately issued residential and commercial MBS, securities

issued by U.S. states and political subdivisions, corporate debt

securities, and highly rated collateralized loan obligations. Due

to its highly liquid nature, the available-for-sale portfolio can be

used to meet funding needs that arise in the normal course of

business or due to market stress. Changes in our interest rate

risk profile may occur due to changes in overall economic or

market conditions, which could influence loan origination

demand, prepayment speeds, or deposit balances and mix. In

response, the available-for-sale securities portfolio can be

rebalanced to meet the Company’s interest rate risk

management objectives. In addition to meeting liquidity and

interest rate risk management objectives, the available-for-sale

securities portfolio may provide yield enhancement over other

short-term assets. See the “Risk Management – Asset/Liability

Management” section in this Report for more information on

liquidity and interest rate risk. The held-to-maturity securities

portfolio consists primarily of high quality agency MBS and ABS

46