Wells Fargo 2013 Annual Report Download - page 102

Download and view the complete annual report

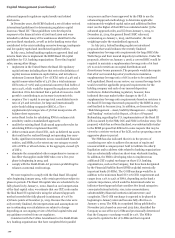

Please find page 102 of the 2013 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Capital Management (continued)

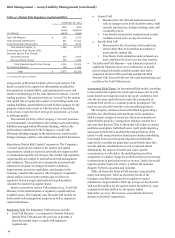

advanced approach regulatory capital results and related

disclosures.

In December 2010, the BCBS finalized a set of further revised

international guidelines for determining regulatory capital

known as “Basel III.” These guidelines were developed in

response to the financial crisis of 2008 and 2009 and were

intended to address many of the weaknesses identified in the

previous Basel standards, as well as in the banking sector that

contributed to the crisis including excessive leverage, inadequate

and low quality capital and insufficient liquidity buffers.

In July 2013, federal banking regulators approved final and

interim final rules to implement the BCBS Basel III capital

guidelines for U.S. banking organizations. These final capital

rules, among other things:

x

x

x

x

x

x

x

implement in the United States the Basel III regulatory

capital reforms including those that revise the definition of

capital, increase minimum capital ratios, and introduce a

minimum Common Equity Tier 1 (CET1) ratio of 4.5% and a

capital conservation buffer of 2.5% (for a total minimum

CET1 ratio of 7.0%) and a potential countercyclical buffer of

up to 2.5%, which would be imposed by regulators at their

discretion if it is determined that a period of excessive credit

growth is contributing to an increase in systemic risk;

require a Tier 1 capital to average total consolidated assets

ratio of 4% and introduce, for large and internationally

active bank holding companies (BHCs), a Tier 1

supplementary leverage ratio of 3% that incorporates off-

balance sheet exposures;

revise Basel I rules for calculating RWA to enhance risk

sensitivity under a standardized approach;

modify the existing Basel II advanced approaches rules for

calculating RWA to implement Basel III;

deduct certain assets from CET1, such as deferred tax assets

that could not be realized through net operating loss carry-

backs, significant investments in non-consolidated financial

entities, and MSRs, to the extent any one category exceeds

10% of CET1 or all such items, in the aggregate, exceed 15%

of CET1;

eliminate the accumulated other comprehensive income or

loss filter that applies under RBC rules over a five-year

phase in beginning in 2014; and

comply with the Dodd-Frank Act provision prohibiting the

reliance on external credit ratings.

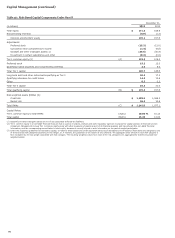

We were required to comply with the final Basel III capital

rules beginning January 2014, with certain provisions subject to

phase-in periods. The Basel III capital rules are scheduled to be

fully phased in by January 1, 2022. Based on our interpretation

of the final capital rules, we estimate that our CET1 ratio under

the final Basel III capital rules using the advanced approach

method exceeded the fully phased-in minimum of 7.0% by

276 basis points at December 31, 2013. Because the rules were

only recently finalized, the interpretations and assumptions we

use in estimating our calculations are subject to change

depending on our ongoing review of the final capital rules and

any guidance received from our regulators.

Consistent with the Collins Amendment to the Dodd-Frank

Act, banking organizations that have completed their parallel

run process and have been approved by the FRB to use the

advanced approach methodology to determine applicable

minimum risk-weighted capital ratios and additional buffers

must use the higher of their RWA as calculated under (i) the

advanced approach rules, and (ii) from January 1, 2014, to

December 31, 2014, the general Basel I RBC rules and,

commencing on January 1, 2015, and thereafter, the risk

weightings under the standardized approach.

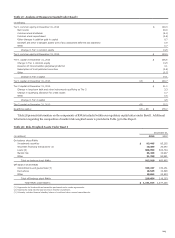

In July 2013, federal banking regulators introduced

proposals that would enhance the recently finalized

supplementary leverage ratio requirements for large BHCs like

Wells Fargo and their insured depository institutions. Under the

proposals, effective on January 1, 2018, a covered BHC would be

required to maintain a supplementary leverage ratio of at least

5% to avoid restrictions on capital distributions and

discretionary bonus payments. The proposals would also require

that all of our insured depository institutions maintain a

supplementary leverage ratio of 6% in order to be considered

well capitalized. Based on our review, our current leverage levels

would exceed the applicable proposed requirements for the

holding company and each of our insured depository

institutions. Federal banking regulators, however, have

indicated they may make further changes to the U.S.

supplementary leverage ratio requirements based on revisions to

the Basel III leverage framework proposed by the BCBS in 2013

and finalized in January 2014. In addition, as discussed in the

“Risk Management – Asset/Liability Management – Liquidity

and Funding” section in this Report, a Notice of Proposed

Rulemaking regarding the U.S. implementation of the Basel III

LCR was issued by the FRB, OCC and FDIC in October 2013. The

proposal, which has not been finalized, was substantially similar

to the BCBS proposal but differed in some respects that may be

viewed as a stricter version of the LCR, such as proposing a more

aggressive phase-in period.

The FRB has also indicated that it is in the process of

considering new rules to address the amount of equity and

unsecured debt a company must hold to facilitate its orderly

liquidation and to address risks related to banking organizations

that are substantially reliant on short-term wholesale funding.

In addition, the FRB is developing rules to implement an

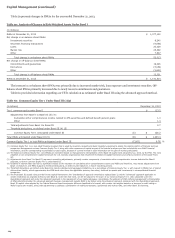

additional CET1 capital surcharge on those U.S. banking

organizations, such as the Company, that have been designated

by the Financial Stability Board (FSB) as global systemically

important banks (G-SIBs). The G-SIB surcharge would be in

addition to the minimum Basel III 7.0% CET1 requirement and

ranges from 1.0% to 3.5% of RWA, depending on the bank’s

systemic importance, which would be determined under an

indicator-based approach that considers five broad categories:

cross-jurisdictional activity; size; inter-connectedness;

substitutability/financial institution infrastructure; and

complexity. The G-SIB surcharge is expected to be phased in

beginning in January 2016 and become fully effective on

January 1, 2019. The FSB, in an updated listing published in

November 2013 based on year-end 2012 data, identified the

Company as one of the 29 G-SIBs and provisionally determined

that the Company’s surcharge would be 1.0%. The FSB is

expected to update the list of G-SIBs and their required

100