Wells Fargo 2013 Annual Report Download - page 6

Download and view the complete annual report

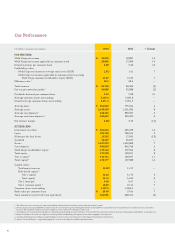

Please find page 6 of the 2013 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Our capital also grew and remained well above

regulatory minimum levels. Our Tier1 common equity

at the end of 2013 was $123.5billion, up 13percent

from 2012, resulting in a Tier1 common equity ratio

of 10.82percent under BaselI. Under BaselIII capital

rules, our estimated Common Equity Tier1 ratio was

9.76percent.1

We also increased returns for our shareholders. Our

full-year return on assets rose to 1.51percent, up 10basis

points from 2012, and our full-year return on equity was

13.87percent, up 92basis points from 2012. In2013, we

returned $11.4billion to shareholders through dividends

and share repurchases. We increased our regular

quarterly dividend by 36percent, to 30cents per share,

and purchased 124million shares of our common stock

in2013. We are further pleased that the market rewarded

our shareholders, as our common stock price increased

33percent in2013.

We are proud of what we accomplished in2013

because the results reflect how we are helping our

customers. And we know the road ahead will continue to

require a strong commitment to our customers and the

communities we serve.

Helping individuals and businesses

in the real economy

We recognize the struggles many are experiencing in this

economy and remain committed to doing all that we can to

help individuals and businesses prosper and succeed. We

support the real economy in many ways, including enabling

people to buy new homes, providing needed capital for

business investment and expansion, and helping consumers

plan for retirement.

Creating new homeowners and helping keep people

intheir homes

Housing is a cornerstone of the economy, and

homeownership is the foundation of neighborhoods

large and small. For most people, their home is their

largest and most important asset. We are proud to be the

nation’s largest home lender, and every day get to see

the dierence that a home can make in people’s lives and

intheir communities.

In2013, we provided financing to 1.5million consumers

to purchase homes or refinance existing mortgages.

Buying a home typically fuels additional spending—

newfurniture, appliances, or renovations— that benefits

local businesses and creates jobs. Because of this

multiplier eect, a housing recovery has led every

economic recovery in recent history.

Just as important, we are helping people stay in their

homes. WellsFargo is a leader in preventing foreclosures—

since 2009, we have completed more than 904,000 home

loan modifications and provided $7.7billion in principal

1 For more information regarding our regulatory capital and related ratios determined

under Basel I and Basel III, please see the “Financial Review – Capital Management”

section in this Report.

forgiveness. We also have participated in nearly 1,200

home preservation events, including hosting 107 of our

own workshops where we have met one-on-one with

nearly 45,000 customers facing financial hardships.

Inaddition, through WellsFargo LIFT programs, we

oer down payment assistance and education to potential

homeowners in communities most deeply impacted by

the recession. We have committed $190million to our

LIFT programs, and since early 2012, we have provided

down payment assistance to help more than 5,000 people

buy homes in 24markets. In2013, we expanded our

assistance through UrbanLIFT,SM a program that awarded

$11.4million in grants to local nonprofits to accelerate

economic recovery and neighborhood improvement

projects in 25communities across the U.S.

Meeting the needs of businesses – small and large

We know for our economy to fully recover, we need

businesses to grow and add jobs. Small businesses are

the growth engines in every community, and as the

nation’s largest lender to small businesses, we are helping

business owners every day get the capital and financial

services they need.

In2013, WellsFargo extended $18.9billion in new loan

commitments to small businesses (primarily those with

annual revenues of less than $20million), up 18percent

from 2012. We were the nation’s largest provider of

Small Business Administration (SBA) loans based on

dollar volume for the fifth consecutive year. WellsFargo

approved a record $1.47billion in SBA7(a) loans during

federal fiscal year 2013 (October2012 – September2013),

up 18percent from the prior year.

We also fund mid-sized and large companies, helping

them grow both domestically and internationally.

In2013, our average commercial and industrial loans

rose to $188billion, up 8percent from 2012. We work

side by side with these businesses through our extensive

network of commercial banking oces in all 50states,

providing our commercial customers with financial

services like treasury management, insurance, capital

finance, asset-based lending, commercial real estate, and

foreign exchange. We also operate oces in international

locations— including Hong Kong, London, Sydney, and

Toronto— tomeet the global needs of our corporate

customers and provide services to financial institutions

around the world.

Helping people plan and prepare for retirement

As a leading retirement services provider— weadminister

about $341billion in IRA assets and $298billion in 401(k)

and institutional retirement plan assets— WellsFargo

understands the importance of investing and saving for

the future.

About 10,000 people retire every day, and most are

expected to live longer in retirement than their parents and

grandparents. Yet study after study shows that too many

Americans are not adequately prepared for retirement and