Wells Fargo 2013 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2013 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

x

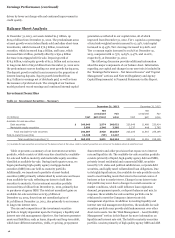

Balance Sheet Analysis (continued)

Loan Portfolio

Total loans were $825.8 billion at December 31, 2013, up

$26.2 billion from December 31, 2012. Table 12 provides a

summary of total outstanding loans by non-strategic/liquidating

and core loan portfolios. The runoff in the non-

strategic/liquidating portfolios was $13.7 billion, while loans in

the core portfolio grew $39.9 billion from December 31, 2012.

Our core loan growth in 2013 included:

a $20.7 billion increase in the commercial segment

predominantly from growth in commercial and industrial

loans and foreign loans, which included $5.2 billion of

commercial real estate portfolio acquisitions, consisting of

$4.0 billion U.K. commercial real estate loans classified

within foreign loans and $1.2 billion within commercial real

estate mortgage; and

x a $19.2 billion increase in consumer loans, predominantly

from growth in first lien mortgages.

Additional information on the non-strategic and liquidating

loan portfolios is included in Table 17 in the “Risk Management

– Credit Risk Management” section in this Report.

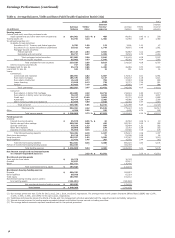

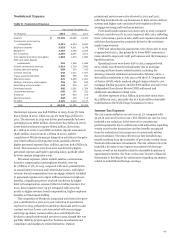

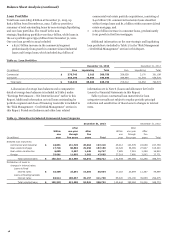

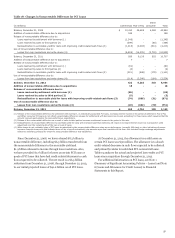

Table 12: Loan Portfolios

December 31, 2013 December 31, 2012

(in millions) Core Liquidating Total Core Liquidating Total

Commercial $ 378,743 2,013 380,756 358,028 3,170 361,198

Consumer 366,190 78,853 445,043 346,984 91,392 438,376

Total loans $ 744,933 80,866 825,799 705,012 94,562 799,574

A discussion of average loan balances and a comparative

detail of average loan balances is included in Table 5 under

“Earnings Performance – Net Interest Income” earlier in this

Report. Additional information on total loans outstanding by

portfolio segment and class of financing receivable is included in

the “Risk Management – Credit Risk Management” section in

this Report. Period-end balances and other loan related

information are in Note 6 (Loans and Allowance for Credit

Losses) to Financial Statements in this Report.

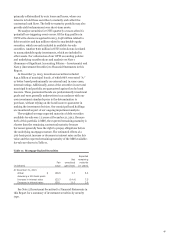

Table 13 shows contractual loan maturities for loan

categories normally not subject to regular periodic principal

reduction and sensitivities of those loans to changes in interest

rates.

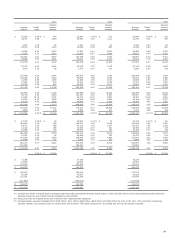

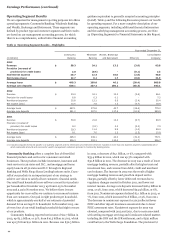

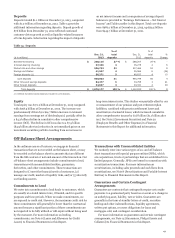

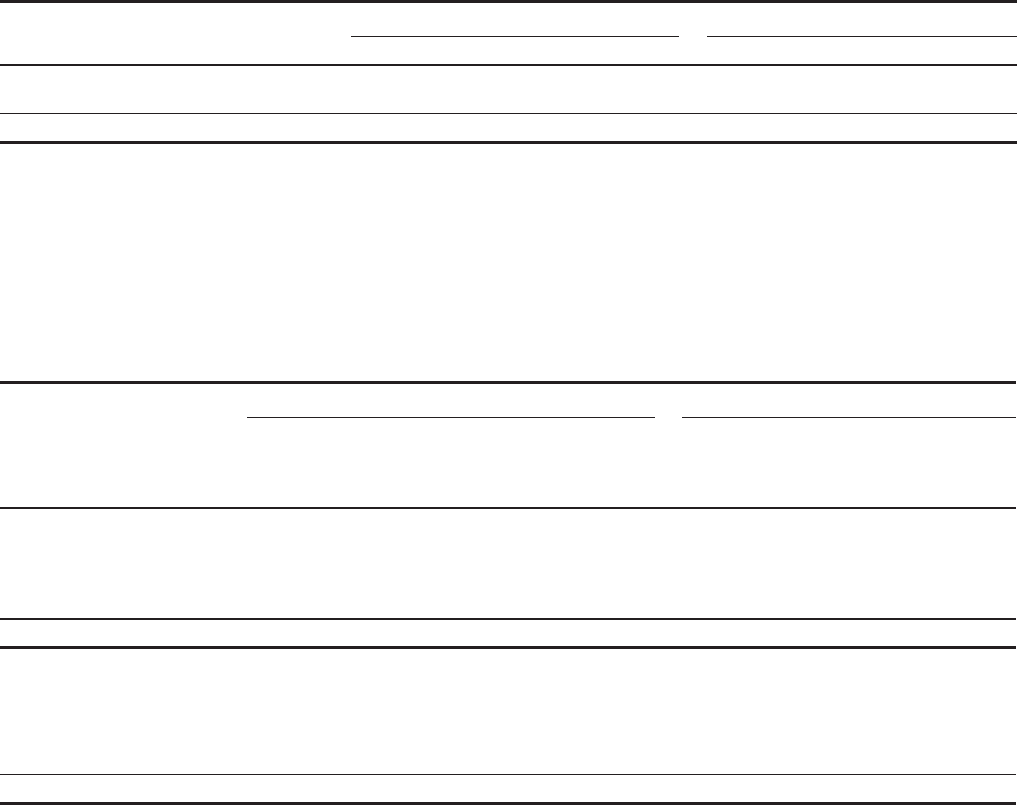

Table 13: Maturities for Selected Commercial Loan Categories

December 31, 2013 December 31, 2012

(in millions)

Within

one

year

After

one year

through

five years

After

five

years Total

Within

one

year

After

one year

through

five years

After

five

years Total

Selected loan maturities:

Commercial and industrial $ 44,801 131,745 20,664 197,210 45,212 123,578 18,969 187,759

Real estate mortgage 17,746 60,004 29,350 107,100 22,328 56,085 27,927 106,340

Real estate construction 6,095 9,207 1,445 16,747 7,685 7,961 1,258 16,904

Foreign 33,681 11,602 2,382 47,665 27,219 7,460 3,092 37,771

Total selected loans $ 102,323 212,558 53,841 368,722 102,444 195,084 51,246 348,774

Distribution of loans to

changes in interest rates:

Loans at fixed

interest rates $ 18,409 23,891 14,684 56,984 17,218 20,894 11,387 49,499

Loans at floating/variable

interest rates 83,914 188,667 39,157 311,738 85,226 174,190 39,859 299,275

Total selected loans $ 102,323 212,558 53,841 368,722 102,444 195,084 51,246 348,774

48