Wells Fargo 2013 Annual Report Download - page 33

Download and view the complete annual report

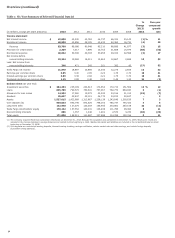

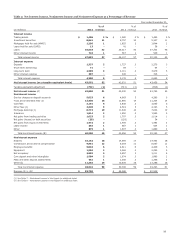

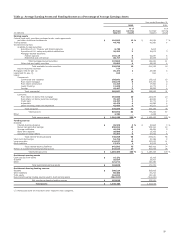

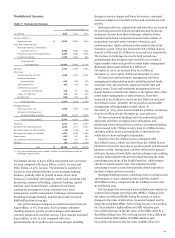

Please find page 33 of the 2013 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.able to grow our loans on a year-over-year basis for 10

consecutive quarters, and for the past seven quarters year-over-

year loan growth has been at least 3%, despite the planned

runoff from our non-strategic/liquidating portfolios. Our non-

strategic/liquidating loan portfolios decreased $13.7 billion

during the year (now less than 10% of total loans) and our core

loan portfolios increased $39.9 billion from the prior year. Our

federal funds sold, securities purchased under resale agreements

and other short-term investments (collectively referred to as

federal funds sold and other short-term investments elsewhere

in this Report) increased by $76.5 billion during the year on

continued strong growth in interest-earning deposits, and we

grew our investment securities portfolio by $29.2 billion in 2013.

While we believe our liquidity position was already strong

with increased regulatory expectations, we have been adding to

our position over the past year. We issued long-term debt and

term-deposits at very low interest rates and most of the proceeds

went into cash and federal funds sold and other short term

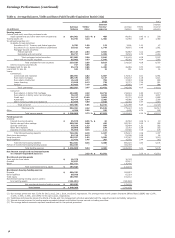

investments. Deposit growth remained strong with period-end

deposits up $76.3 billion from 2012. Average deposits have

grown while deposit costs (down 5 basis points from a year ago

to 11 basis points in fourth quarter 2013) have declined for

13 consecutive quarters. We grew our primary consumer

checking customers by a net 4.7% from a year ago

(November 2013 compared with November 2012). The growth in

these relationship-based customers should benefit our future

results as we remain focused on meeting more of our customers’

financial needs.

Credit Quality

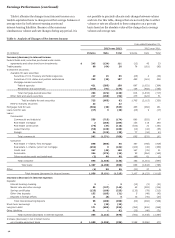

Credit quality continued to improve in 2013, with solid

performance in several of our commercial and consumer loan

portfolios, reflecting our long-term risk focus and the benefit

from the improving housing market. Net charge-offs of

$4.5 billion were 0.56% of average loans, down 61 basis points

from a year ago. Net losses in our commercial portfolio were

only $206 million, or 6 basis points of average loans. Net

consumer losses declined to 98 basis points in 2013 from

184 basis points in 2012. We continued to have strong

improvement in our commercial and residential real estate

portfolios. Our commercial real estate portfolios were in a net

recovery position for each quarter of 2013 and losses on our

consumer real estate portfolios declined $3.5 billion from a year

ago, down 59%. The consumer loss levels reflected the positive

momentum in the residential real estate market, with home

values improving significantly in many markets, as well as lower

default frequency.

Reflecting these improvements in our loan portfolios, our

provision for credit losses in 2013 was $2.3 billion, which was

$4.9 billion less than a year ago. This provision reflected a

release of $2.2 billion from the allowance for credit losses,

compared with a release of $1.8 billion a year ago. Given current

favorable conditions, we continue to expect future allowance

releases, absent a significant deterioration in the economy.

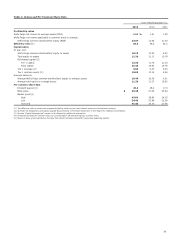

In addition to lower net charge-offs and provision expense,

nonperforming assets (NPAs) also improved and were down

$4.9 billion, or 20%, from 2012. Nonaccrual loans declined

$4.8 billion from the prior year while foreclosed assets were

down slightly from 2012.

Capital

We continued to strengthen our capital levels in 2013 even as we

returned more capital to our shareholders, increasing total

equity to $171.0 billion at December 31, 2013, up $12.1 billion

from the prior year. Our Tier 1 common equity ratio was 10.82%

of risk-weighted assets (RWA) under Basel I. Our estimated

Common Equity Tier 1 ratio under Basel III, using the advanced

approach method, increased to 9.76% in 2013, exceeding our

internal target of 9%, which includes a 100 basis point internal

capital buffer. The increase in the Basel III ratio was the result of

our strong underlying earnings performance and a reduction in

RWA, which was due to our improved credit profile and model

refinements for our commercial portfolios. We gained more

clarity regarding Basel III capital requirements in 2013 and took

a number of actions to further reduce RWA such as disposing of

an asset that had a punitive risk weighting and obtaining more

granular data related to the underlying investments of life

insurance assets.

For 2013 we paid a total dividend of $1.15 per share, an

increase of 31% from the prior year, and we purchased

124 million shares of common stock in the year. We also

executed a $500 million forward purchase contract that is

expected to settle in first quarter 2014 for approximately

11 million shares.

Our other regulatory capital ratios under Basel I remained

strong with a total risk-based capital ratio of 15.43%, Tier 1 risk-

based capital ratio of 12.33% and Tier 1 leverage ratio of 9.60%

at December 31, 2013, compared with 14.63%, 11.75% and 9.47%,

respectively, at December 31, 2012. In July 2013, U.S. banking

regulatory agencies issued a supplementary leverage ratio

proposal for Basel III. Based on our review, our current leverage

levels would exceed the applicable proposed requirements for

the holding company and each of our insured depository

institutions. See the “Capital Management” section in this

Report for more information regarding our capital, including the

calculation of common equity for regulatory purposes. We

remain committed to returning more capital to our shareholders.

31