Wells Fargo 2013 Annual Report Download - page 206

Download and view the complete annual report

Please find page 206 of the 2013 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

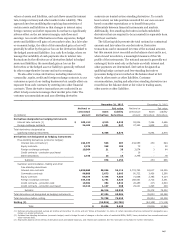

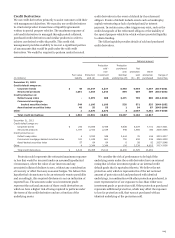

Note 14: Guarantees, Pledged Assets and Collateral (continued)

Offsetting of Resale and Repurchase Agreements

and Securities Borrowing and Lending

Agreements

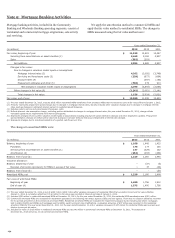

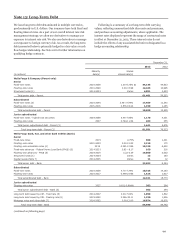

The table below presents resale and repurchase agreements

subject to master repurchase agreements (MRA) and securities

borrowing and lending agreements subject to master securities

lending agreements (MSLA). We account for transactions

subject to these agreements as collateralized financings and

those with a single counterparty are presented net on our

balance sheet, provided certain criteria are met that permit

balance sheet netting. Most transactions subject to these

agreements do not meet those criteria and thus are not eligible

for balance sheet netting.

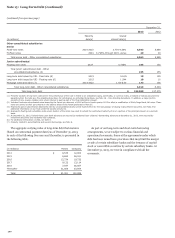

Collateral we pledged consists of non-cash instruments, such

as securities or loans, and is not netted on the balance sheet

against the related collateralized liability. Collateral we received

includes securities or loans and is not recognized on our balance

sheet. Collateral received or pledged may be increased or

decreased over time to maintain certain contractual thresholds

as the assets underlying each arrangement fluctuate in value.

Generally, these agreements require collateral to exceed the

asset or liability recognized on the balance sheet. The following

table includes the amount of collateral pledged or received

related to exposures subject to enforceable MRAs or MSLAs.

While these agreements are typically over-collateralized, U.S.

GAAP requires disclosure in this table to limit the amount of

such collateral to the amount of the related recognized asset or

liability for each counterparty.

In addition to the amounts included in the table below, we

also have balance sheet netting related to derivatives that is

disclosed within Note 16.

$

$

$

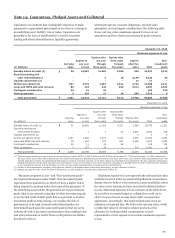

(in millions)

Dec. 31,

2013

Dec. 31,

2012

Assets:

Resale and securities borrowing agreements

Gross amounts recognized 38,635 45,847

Gross amounts offset in consolidated balance sheet (1) (2,817) (2,561)

Net amounts in consolidated balance sheet (2) 35,818 43,286

Noncash collateral not recognized in consolidated balance sheet (3) (35,768) (42,920)

Net amount (4) $ 50 366

Liabilities:

Repurchase and securities lending agreements

Gross amounts recognized 38,032 35,876

Gross amounts offset in consolidated balance sheet (1) (2,817) (2,561)

Net amounts in consolidated balance sheet (5) 35,215 33,315

Noncash collateral pledged but not netted in consolidated balance sheet (6) (34,770) (33,050)

Net amount (7) 445 265

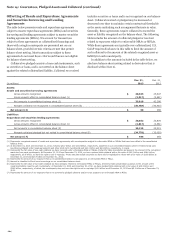

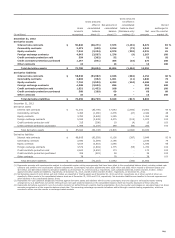

(1) Represents recognized amount of resale and repurchase agreements with counterparties subject to enforceable MRAs or MSLAs that have been offset in the consolidated

balance sheet.

(2) At December 31, 2013 and December 31, 2012, includes $25.7 billion and $33.8 billion, respectively, classified on our consolidated balance sheet in Federal funds sold,

securities purchased under resale agreements and other short-term investments and $10.1 billion and $9.5 billion, respectively, in Loans.

(3) Represents the fair value of non-cash collateral we have received under enforceable MRAs or MSLAs, limited for table presentation purposes to the amount of the recognized

asset due from each counterparty. At December 31, 2013 and December 31, 2012, we have received total collateral with a fair value of $43.3 billion and $46.6 billion,

respectively, all of which, we have the right to sell or repledge. These amounts include securities we have sold or repledged to others with a fair value of $23.8 billion at

December 31, 2013 and $29.7 billion at December 31, 2012.

(4) Represents the amount of our exposure that is not collateralized and/or is not subject to an enforceable MRA or MSLA.

(5) Amount is classified in Short-term borrowings on our consolidated balance sheet.

(6) Represents the fair value of non-cash collateral we have pledged, related to enforceable MRAs or MSLAs, limited for table presentation purposes to the amount of the

recognized liability owed to each counterparty. At December 31, 2013 and December 31, 2012, we have pledged total collateral with a fair value of $39.0 billion and

$36.4 billion, respectively, of which, the counterparty does not have the right to sell or repledge $10.0 billion as of December 31, 2013 and $9.1 billion as of December 31,

2012.

(7) Represents the amount of our exposure that is not covered by pledged collateral and/or is not subject to an enforceable MRA or MSLA.

204