Wells Fargo 2013 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2013 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

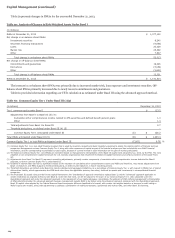

Current Accounting Developments

The following accounting pronouncements have been issued by

the FASB but are not yet effective:

x

x

x

x

Accounting Standards Update (ASU or Update) 2014-04,

Receivables – Troubled Debt Restructurings by Creditors

(Subtopic 310-40) – Reclassification of Residential Real

Estate Collateralized Consumer Mortgage Loans upon

Foreclosure

ASU 2014-01, Investments – Equity Method and Joint

Ventures (Topic 323): Accounting for Investments in

Qualified Affordable Housing Projects

ASU 2013-11, Income Taxes (Topic 740): Presentation of an

Unrecognized Tax Benefit When a Net Operating Loss

Carryforward, a Similar Tax Loss, or a Tax Credit

Carryforward Exists; and

ASU 2013-08, Financial Services – Investment Companies

(Topic 946): Amendments to the Scope, Measurement and

Disclosure Requirements.

ASU 2014-04 clarifies the timing of when a creditor is

considered to have taken physical possession of residential real

estate collateral for a consumer mortgage loan, resulting in the

reclassification of the loan receivable to real estate owned. A

creditor has taken physical possession of the property when

either (1) the creditor obtains legal title through foreclosure, or

(2) the borrower transfers all interests in the property to the

creditor via a deed in lieu of foreclosure or a similar legal

agreement. The Update also requires disclosure of the amount of

foreclosed residential real estate property held by the creditor

and the recorded investment in residential real estate mortgage

loans that are in process of foreclosure. These changes are

effective for us in first quarter 2015 with prospective application.

Early adoption is permitted. Our adoption of this guidance will

not have a material effect on our consolidated financial

statements.

ASU 2014-01 amends the criteria a company must meet to elect

to account for investments in qualified affordable housing

projects using a method other than the cost or equity methods. If

the criteria are met, a company is permitted to amortize the

initial investment cost in proportion to and over the same period

as the total tax benefits the company expects to receive. The

amortization of the initial investment cost and tax benefits are to

be recorded in the income tax expense line. The Update also

requires new disclosures about all investments in qualified

affordable housing projects regardless of the accounting method

used. These changes are effective for us in first quarter 2015 with

retrospective application. Early adoption is permitted. We are

evaluating the impact this Update will have on our consolidated

financial statements.

ASU 2013-11 is expected to eliminate diversity in practice as it

provides guidance on financial statement presentation of an

unrecognized tax benefit when a net operating loss (NOL)

carryforward, a similar tax loss, or a tax credit carryforward

exists. These changes are effective for us in first quarter 2014

with prospective application applied to all unrecognized tax

benefits that exist at the effective date. Early adoption and

retrospective application are permitted. This Update will not

have a material effect on our consolidated financial statements.

ASU 2013-08 amends the scope, measurement and disclosure

requirements for investment companies. The Update changes

criteria companies use to assess whether an entity is an

investment company. In addition, investment companies must

measure noncontrolling ownership interests in other investment

companies at fair value rather than using the equity method of

accounting. This Update also requires new disclosures, including

information about changes, if any, in an entity’s status as an

investment company and information about financial support

provided or contractually required to be provided by an

investment company to any of its investees. These changes are

effective for us in first quarter 2014 with prospective application.

Early adoption is not permitted. The Update will not have a

material effect on our consolidated financial statements.

114