Wells Fargo 2013 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2013 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Risk Management – Credit Risk Management (continued)

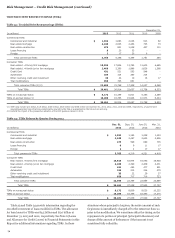

We believe we have a high quality residential mortgage loan

servicing portfolio. Of the $1.8 trillion in the residential

mortgage loan servicing portfolio at December 31, 2013, 94%

was current, less than 2% was subprime at origination, and less

than 1% was related to home equity loan securitizations. Our

combined delinquency and foreclosure rate on this portfolio was

6.40% at December 31, 2013, compared with 7.04% at

December 31, 2012. Three percent of this portfolio is private

label securitizations for which we originated the loans and

therefore have some repurchase risk. We have observed an

increase in outstanding demands, compared with

December 31, 2012, associated with our pre-2009 private label

securitizations due to an increase in new demands received in

fourth quarter 2013, most of which were anticipated and were

covered through mortgage loan repurchase accruals established

in prior periods. Investors continue to review defaulted loans for

potential breaches of our loan sale representations and

warranties, and we continue to believe the risk of repurchase in

our private label securitizations is substantially reduced, relative

to third-party issued private label securitizations, because

approximately one-half of this portfolio of private label

securitizations does not contain representations and warranties

regarding borrower or other third party misrepresentations

related to the mortgage loan, general compliance with

underwriting guidelines, or property valuation, which are

commonly asserted bases for repurchase. For the 3% private

label securitization segment of our residential mortgage loan

servicing portfolio (weighted-average age of 98 months), 57% are

loans from 2005 vintages or earlier; 76% were prime at

origination; and approximately 60% are jumbo loans. The

weighted-average LTV as of December 31, 2013 for this private

securitization segment was 67%. We believe the highest risk

segment of these private label securitizations is the subprime

loans originated in 2006 and 2007. These subprime loans have

seller representations and warranties and currently have LTVs

close to or exceeding 100%, and represent 10% of the private

label securitization portion of the residential mortgage servicing

portfolio. We had $67 million of repurchases related to private

label securitizations in 2013 compared with $180 million in

2012.

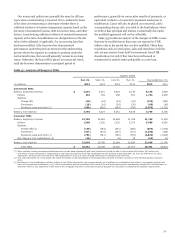

Of the servicing portfolio, 3% is non-agency acquired

servicing and 1% is private whole loan sales. We did not

underwrite and securitize the non-agency acquired servicing and

therefore we have no obligation on that portion of our servicing

portfolio to the investor for any repurchase demands arising

from origination practices. For the private whole loan segment,

while we do have repurchase risk on these loans, less than 2%

were subprime at origination and loans that were sold and

subsequently securitized are included in the private label

securitization segment discussed above.

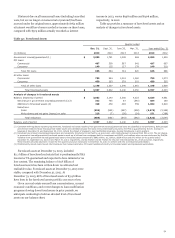

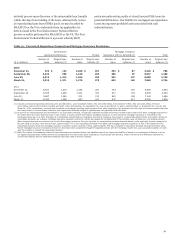

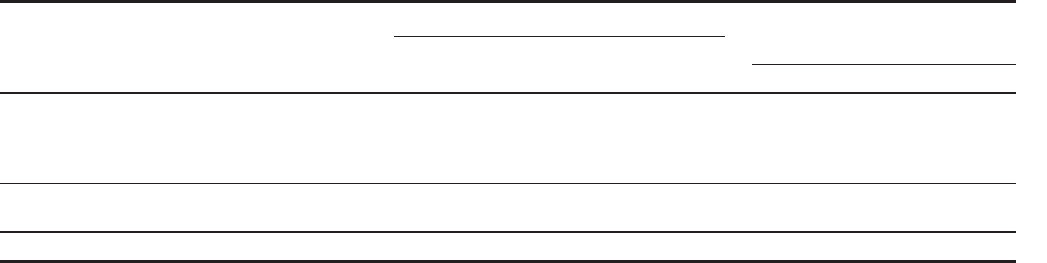

Table 40 summarizes the changes in our mortgage

repurchase liability. We incurred net losses on repurchased

loans and investor reimbursements totalling $481 million on

mortgage loans with original balances of $1.4 billion in 2013,

excluding the $746 million and the $508 million cash payments

for the FHLMC and FNMA settlement agreements, respectively,

compared with net losses of $1.1 billion on mortgage loans with

original balances of $2.5 billion for 2012. Both the FHLMC and

FNMA settlement agreements executed in the third and fourth

quarters of 2013, respectively, were covered through mortgage

loan repurchase accruals established in prior periods.

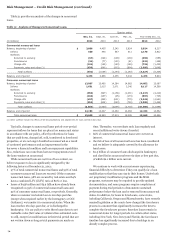

Table 40: Changes in Mortgage Repurchase Liability

Quarter ended

Year ended Dec. 31,

(in millions)

Dec. 31,

2013

Sept. 30,

2013

June 30,

2013

Mar. 31,

2013 2013 2012 2011

Balance, beginning of period $ 1,421 2,222 2,317 2,206 2,206 1,326 1,289

Provision for repurchase losses:

Loan sales 16 28 40 59 143 275 101

Change in estimate (1) 10 - 25 250 285 1,665 1,184

Total additions 26 28 65 309 428 1,940 1,285

Losses (2) (548) (829) (160) (198) (1,735) (1,060) (1,248)

Balance, end of period $ 899 1,421 2,222 2,317 899 2,206 1,326

(1) Results from changes in investor demand and mortgage insurer practices, credit deterioration and changes in the financial stability of correspondent lenders.

(2) Quarter and year ended September 30 and December 31, 2013, respectively, reflect $746 million as a result of the agreement with FHLMC that resolves substantially all

repurchase liabilities related to loans sold to FHLMC prior to January 1, 2009. Quarter and year ended December 31, 2013, reflect $508 million as a result of the agreement

with FNMA that resolves substantially all repurchase liabilities related to loans sold to FNMA that were originated prior to January 1, 2009.

80