Wells Fargo 2013 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2013 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Risk Management – Asset/Liability Management (continued)

On January 6, 2013, the Basel Committee on Bank

Supervision (BCBS) endorsed a revised Basel III liquidity

framework for banks. In October 2013, a Notice of Proposed

Rulemaking (NPR) regarding the U.S. implementation of the

Basel III liquidity coverage ratio (LCR) was issued by the FRB,

OCC and FDIC. The NPR’s public comment period closed on

January 31, 2014, and the agencies will review and take into

consideration the comments filed on the proposal before

adopting a final rule. The FRB recently finalized rules imposing

enhanced liquidity management standards on large BHCs such

as Wells Fargo. We will continue to analyze these proposed and

recently finalized rules and other regulatory proposals that may

affect liquidity risk management to determine the level of

operational or compliance impact to Wells Fargo. For additional

information see the “Capital Management” and “Regulatory

Reform” sections in this Report.

Parent Under SEC rules, our Parent is classified as a “well-

known seasoned issuer,” which allows it to file a registration

statement that does not have a limit on issuance capacity. In

April 2012, the Parent filed a registration statement with the

SEC for the issuance of senior and subordinated notes, preferred

stock and other securities. The Parent’s ability to issue debt and

other securities under this registration statement is limited by

the debt issuance authority granted by the Board. The Parent is

currently authorized by the Board to issue $60 billion in

outstanding short-term debt and $170 billion in outstanding

long-term debt. At December 31, 2013, the Parent had available

$41.9 billion in short-term debt issuance authority and

$82.2 billion in long-term debt issuance authority. The Parent’s

debt issuance authority granted by the Board includes short-

term and long-term debt issued to affiliates. During 2013, the

Parent issued $13.1 billion of senior notes, of which $6.9 billion

were registered with the SEC. In addition, during 2013, the

Parent issued $5.5 billion of subordinated notes, all of which

were registered with the SEC. During fourth quarter 2013, the

Parent exchanged $2.1 billion of subordinated notes issued by

Wells Fargo Bank, N.A. for $2.4 billion of unregistered

subordinated notes issued by the Parent. In addition, during

fourth quarter 2013, the Parent exchanged $672 million of

subordinated notes issued by the Parent for $723 million of

unregistered subordinated notes issued by the Parent. A

registration statement filed by the Parent on December 17, 2013,

was declared effective on January 3, 2014, and provides for these

newly issued unregistered subordinated notes to be exchanged

for registered securities. The offer to exchange these

unregistered subordinated notes for registered notes

commenced on January 6, 2014. In addition, in January 2014,

the Parent issued $1.7 billion of registered senior notes.

The Parent’s proceeds from securities issued in 2013 were

used for general corporate purposes, and, unless otherwise

specified in the applicable prospectus or prospectus supplement,

we expect the proceeds from securities issued in the future will

be used for the same purposes. Depending on market conditions,

we may purchase our outstanding debt securities from time to

time in privately negotiated or open market transactions, by

tender offer, or otherwise.

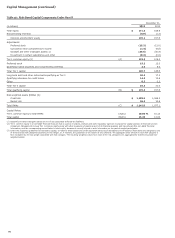

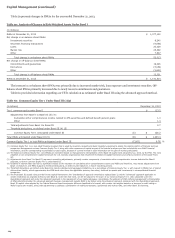

Table 55 provides information regarding the Parent’s

medium-term note (MTN) programs. The Parent may issue

senior and subordinated debt securities under Series L & M, and

the European and Australian programmes. Under Series K, the

Parent may issue senior debt securities linked to one or more

indices or bearing interest at a fixed or floating rate.

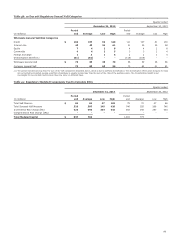

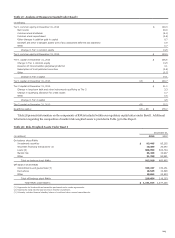

Table 55: Medium-Term Note (MTN) Programs

December 31, 2013

(in billions)

Date

established

Debt

issuance

authority

Available

for

issuance

MTN program:

Series L & M (1) May 2012 $ 25.0 9.4

Series K (1)(3) April 2010 25.0 22.3

European (2)(4) December 2009 25.0 16.7

European (2)(5) August 2013 10.0 10.0

Australian (2)(6) June 2005 AUD 10.0 5.7

(1) SEC registered.

(2) Not registered with the SEC. May not be offered in the United States without

applicable exemptions from registration.

(3) As amended in April 2012.

(4) As amended in April 2012 and April 2013. For securities to be admitted to listing

on the Official List of the United Kingdom Financial Conduct Authority and to trade

on the Regulated Market of the London Stock Exchange.

(5) For securities that will not be admitted to listing, trading and/or quotation by any

stock exchange or quotation system, or will be admitted to listing, trading and/or

quotation by a stock exchange or quotation system that is not considered to be a

regulated market.

(6) As amended in October 2005, March 2010 and September 2013.

Wells Fargo Bank, N.A. Wells Fargo Bank, N.A. is authorized

by its board of directors to issue $100 billion in outstanding

short-term debt and $125 billion in outstanding long-term debt.

At December 31, 2013, Wells Fargo Bank, N.A. had available

$100 billion in short-term debt issuance authority and

$80.1 billion in long-term debt issuance authority. In March

2012, Wells Fargo Bank, N.A. established a $100 billion bank

note program under which, subject to any other debt

outstanding under the limits described above, it may issue

$50 billion in outstanding short-term senior notes and

$50 billion in outstanding long-term senior or subordinated

notes. During 2013, Wells Fargo Bank, N.A. issued $8.9 billion

of senior notes under the bank note program. At

December 31, 2013, Wells Fargo Bank, N.A. had remaining

issuance capacity under the bank note program of $50 billion in

short-term senior notes and $36.6 billion in long-term senior or

subordinated notes. In addition, during 2013, Wells Fargo Bank,

N.A. executed advances of $24.0 billion with the Federal Home

Loan Bank of Des Moines, of which $19.0 billion remained

outstanding at December 31, 2013.

Wells Fargo Canada Corporation In February 2014,

Wells Fargo Canada Corporation (WFCC), an indirect wholly

owned Canadian subsidiary of the Parent, qualified with the

Canadian provincial securities commissions a base shelf

prospectus for the distribution from time to time in Canada of up

to CAD $7.0 billion in medium-term notes. During 2013, WFCC

issued CAD $1.5 billion in medium-term notes using availability

outstanding under its prior base shelf prospectus. In

January 2014, WFCC issued an additional CAD $1.3 billion in

98