Wells Fargo 2013 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2013 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272

|

|

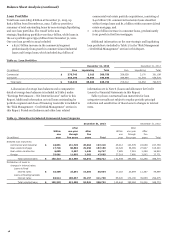

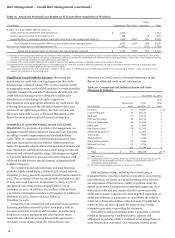

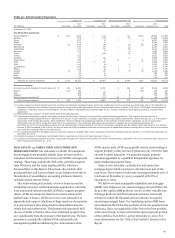

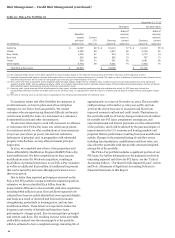

Risk Management – Credit Risk Management (continued)

Credit Risk Management

Loans represent the largest component of assets on our balance

sheet and their related credit risk is a significant risk we

manage. We define credit risk as the risk of loss associated with

a borrower or counterparty default (failure to meet obligations

in accordance with agreed upon terms). Table 16 presents our

total loans outstanding by portfolio segment and class of

financing receivable.

Table 16: Total Loans Outstanding by Portfolio Segment and

Class of Financing Receivable

December 31,

(in millions) 2013 2012

Commercial:

Commercial and industrial $ 197,210 187,759

Real estate mortgage 107,100 106,340

Real estate construction 16,747 16,904

Lease financing 12,034 12,424

Foreign (1) 47,665 37,771

Total commercial 380,756 361,198

Consumer:

Real estate 1-4 family first mortgage 258,497 249,900

Real estate 1-4 family junior lien mortgage 65,914 75,465

Credit card 26,870 24,640

Automobile 50,808 45,998

Other revolving credit and installment 42,954 42,373

Total consumer 445,043 438,376

Total loans $ 825,799 799,574

(1) Substantially all of our foreign loan portfolio is commercial loans. Loans are

classified as foreign primarily based on whether the borrower’s primary address is

outside of the United States.

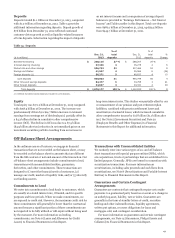

We manage our credit risk by establishing what we believe

are sound credit policies for underwriting new business, while

monitoring and reviewing the performance of our existing loan

portfolios. We employ various credit risk management and

monitoring activities to mitigate risks associated with multiple

risk factors affecting loans we hold, could acquire or originate

including:

x Loan concentrations and related credit quality

x Counterparty credit risk

x Economic and market conditions

x Legislative or regulatory mandates

x Changes in interest rates

x Merger and acquisition activities

x Reputation risk

Our credit risk management oversight process is governed

centrally, but provides for decentralized management and

accountability by our lines of business. Our overall credit

process includes comprehensive credit policies, disciplined

credit underwriting, frequent and detailed risk measurement

and modeling, extensive credit training programs, and a

continual loan review and audit process.

A key to our credit risk management is adherence to a well-

controlled underwriting process, which we believe is

appropriate for the needs of our customers as well as investors

who purchase the loans or securities collateralized by the loans.

54