Wells Fargo 2013 Annual Report Download - page 209

Download and view the complete annual report

Please find page 209 of the 2013 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

207

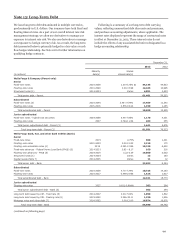

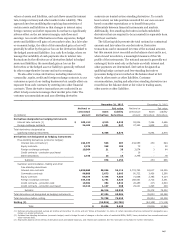

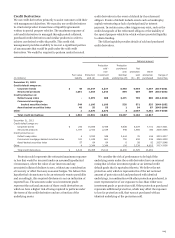

values of assets and liabilities, and cash flows caused by interest

rate, foreign currency and other market value volatility. This

approach involves modifying the repricing characteristics of

certain assets and liabilities so that changes in interest rates,

foreign currency and other exposures do not have a significantly

adverse effect on the net interest margin, cash flows and

earnings. As a result of fluctuations in these exposures, hedged

assets and liabilities will gain or lose market value. In a fair value

or economic hedge, the effect of this unrealized gain or loss will

generally be offset by the gain or loss on the derivatives linked to

the hedged assets and liabilities. In a cash flow hedge, where we

manage the variability of cash payments due to interest rate

fluctuations by the effective use of derivatives linked to hedged

assets and liabilities, the unrealized gain or loss on the

derivatives or the hedged asset or liability is generally reflected

in other comprehensive income and not in earnings.

We also offer various derivatives, including interest rate,

commodity, equity, credit and foreign exchange contracts, to our

customers as part of our trading businesses but usually offset our

exposure from such contracts by entering into other financial

contracts. These derivative transactions are conducted in an

effort to help customers manage their market price risks. The

customer accommodations and any offsetting derivative

contracts are treated as free-standing derivatives. To a much

lesser extent, we take positions executed for our own account

based on market expectations or to benefit from price

differentials between financial instruments and markets.

Additionally, free-standing derivatives include embedded

derivatives that are required to be accounted for separately from

their host contracts.

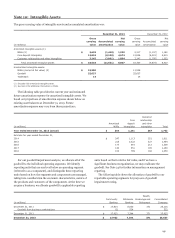

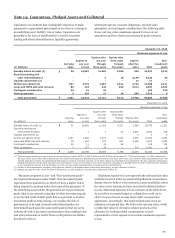

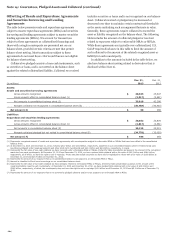

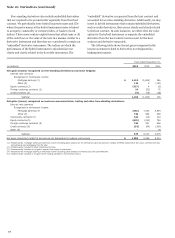

The following table presents the total notional or contractual

amounts and fair values for our derivatives. Derivative

transactions can be measured in terms of the notional amount,

but this amount is not recorded on the balance sheet and is not,

when viewed in isolation, a meaningful measure of the risk

profile of the instruments. The notional amount is generally not

exchanged, but is used only as the basis on which interest and

other payments are determined. Derivatives designated as

qualifying hedge contracts and free-standing derivatives

(economic hedges) are recorded on the balance sheet at fair

value in other assets or other liabilities. Customer

accommodation, trading and other free-standing derivatives are

recorded on the balance sheet at fair value in trading assets,

other assets or other liabilities.

-

- - - - -

-

$

$

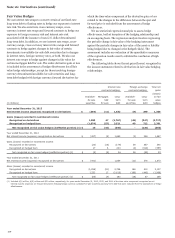

December 31, 2013 December 31, 2012

Fair value Fair value

(in millions)

Notional or

contractual

amount

Asset

derivatives

Liability

derivatives

Notional or

contractual

amount

Asset

derivatives

Liability

derivatives

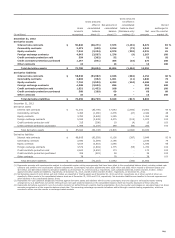

Derivatives designated as hedging instruments

Interest rate contracts (1) 100,412 4,315 2,528 92,004 7,284 2,696

Foreign exchange contracts 26,483 1,091 847 27,382 1,808 274

Total derivatives designated as

qualifying hedging instruments 5,406 3,375 9,092 2,970

Derivatives not designated as hedging instruments

Free-standing derivatives (economic hedges):

Interest rate contracts (2) 220,577 595 897 334,555 450 694

Equity contracts 3,273 349 206 75 50

Foreign exchange contracts 10,064 21 35 3,074 3 64

Credit contracts - protection purchased 16

Other derivatives 2,160 13 16 2,296 78

Subtotal 978 1,154 453 886

Customer accommodation, trading and other

free-standing derivatives:

Interest rate contracts 4,030,068 50,936 53,113 2,774,783 63,617 65,305

Commodity contracts 96,889 2,673 2,603 90,732 3,456 3,590

Equity contracts 96,379 7,475 7,588 71,958 3,783 4,114

Foreign exchange contracts 164,160 3,731 3,626 166,061 3,713 3,241

Credit contracts - protection sold 19,501 354 1,532 26,455 315 2,623

Credit contracts - protection purchased 23,314 1,147 368 29,021 1,495 329

Subtotal 66,316 68,830 76,379 79,202

Total derivatives not designated as hedging instruments 67,294 69,984 76,832 80,088

Total derivatives before netting 72,700 73,359 85,924 83,058

Netting (3) (56,894) (63,739) (62,108) (71,116)

Total 15,806 9,620 23,816 11,942

(1) Notional amounts presented exclude $1.9 billion at December 31, 2013, and $4.7 billion at December 31, 2012, of certain derivatives that are combined for designation as a

hedge on a single instrument.

(2) Includes free-standing derivatives (economic hedges) used to hedge the risk of changes in the fair value of residential MSRs, MHFS, loans, derivative loan commitments and

other interests held.

(3) Represents balance sheet netting of derivative asset and liability balances, and related cash collateral. See the next table in this Note for further information.