Singapore Airlines 2002 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2002 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Financial Statements

31 March 2002

SIA Annual Report 01/02 99

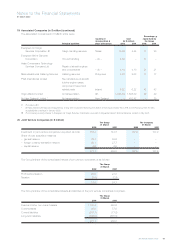

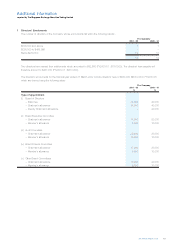

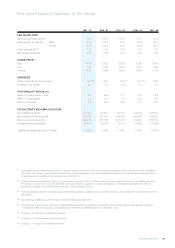

33 Related Party Transactions (in $ million)

The followings are transactions entered into by the Group with related parties:-

The Group

2001 - 02 2000 - 01

Purchases of services from associated companies 296.4 440.9

Services rendered to associated companies (1.1) –

Purchases of services from joint venture companies 12.7 12.6

Commission received from a joint venture company (1.7) (5.9)

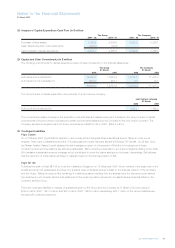

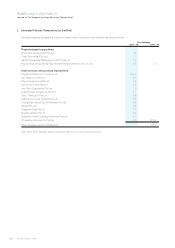

34 Subsequent Events

(a) On 3 April 2002, one A310-300 passenger aircraft was traded-in to Rolls Royce Aircraft Management.

(b) On 2 May 2002, it was announced that Singapore Airlines (SIA) and Virgin Investments SA have agreed to subscribe for additional

shares in Virgin Atlantic Limited (VAL), amounting to GBP25.0 million (S$65.7 million). In line with SIA’s 49.0% stake in VAL, SIA’s

portion of this subscription amounts to GBP12.3 million (S$32.2 million). The additional capital is for the purpose of increasing VAL’s

working capital and funding future capital expenditure requirements.

(c) Corporate tax rate, as announced on 3 May 2002, is reduced to 22.0% with effect from Year of Assessment 2003. In accordance with

SAS 12 (2001) Income Taxes, and SAS 10 (2000) Events After The Balance Sheet Date, this is a non-adjusting subsequent event and

the financial effect of the reduced tax rate will be reflected in the 31 March 2003 financial year.

The current period taxation charge of $233.8 million and $173.5 million for the Group and the Company respectively, are computed

based on the year end prevailing tax rate of 24.5%. Applying the reduced tax rate of 22.0%, the taxation charge for the year, including

write-back of deferred tax balances provided in the prior years, would be $138.7 million and $99.5 million for the Group and the

Company respectively.

In compliance with SAS 12 (2001) Income Taxes, the Group has with effect from this financial year provided for full deferred taxation.

Thus, the deferred tax liability as at 31 March 2002 is computed based on the taxable temporary differences at year end using the

prevailing tax rate of 24.5%. Applying the reduced tax rate of 22.0%, the deferred tax liability at 31 March 2002 would be $2,392.6

million and $1,980.8 million for the Group and the Company respectively.

The aggregate adjustments in the next financial year of the current and deferred taxation charges are estimated to be $277.8 million

and $225.1 million for the Group and the Company respectively.